The strategy of "sell in May and go Away" for North American equity markets is off to a rough start.

Traditionally, the strategy calls for liquidation of equities that track the equity markets on May 5 and a return to equity markets on Oct. 28. The intention is to avoid equity markets during a time of greater-than-average volatility that inevitably occurs for varying unexpected reasons during the May to October period.

Investors, who followed a static strategy of liquidating equities on May 5, missed two opportunities: North American equity markets rallied from short-term oversold levels and continued to advance into the traditionally profitable Memorial Day trade.

Since May 5, the Dow Jones Industrial Average gained 1.20 per cent, the S&P 500 Index added 2.36 per cent, the TSX Composite Index advanced 3.47 per cent and the NASDAQ Composite Index jumped 4.59 per cent.

The best-performing sector was the S&P Technology sector, up 5.77 per cent. Strength accelerated into the Memorial Day trade, lasting from five trading days prior to the U.S. Memorial Day holiday until the first two trading day after Memorial Day. This year, the trade ends at the close on June 1.

The average optimal day for the S&P 500 Index and the TSX Composite Index to reach their seasonal summer peak has changed slightly during the past 20 years.

The average peak date for the S&P 500 Index has shifted to June 8. The average peak date for the TSX Composite has adjusted to June 4.

Both indexes have a history of reaching an average seasonal low in mid-October.

A short-term peak by North American equity markets during the next two weeks makes sense.

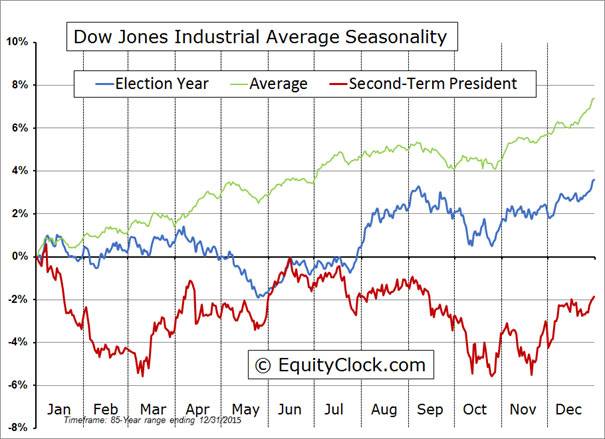

Short-term momentum indicators (like Stochastics, Relative Strength Index, Moving Average Convergence Divergence) are approaching overbought levels. In addition, the Dow Jones Industrial Average during a U.S. presidential election year following a second-term president has a history of peaking on average in mid-June.

The strategy of caution in equity markets between mid-June and presidential election day during a U.S. presidential election year following a second-term president makes sense.

Equity market corrections from the end of August to Election Day triggered by nasty political battles frequently happen. A Supreme Court ruling announced after the last presidential election allows unrestricted election spending by Super PACs. Pre-election political battles could be uglier than usual this fall. Investors will want to avoid the uncertainties.

Disclaimer: Don Vialoux is author of free daily reports on equity markets, sectors, commodities and Exchange Traded Funds available at www.timingthemarket.ca. The enclosed report is for information only. It should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.