Seasonal strength by the U.S. home building sector has returned again this year. The period runs from Oct. 15 to Feb. 6. Average return per period during the past 20 periods was 20.0 per cent.

Seasonal strength is related to the U.S. housing start cycle. Builders increase their housing starts into October with the intention of completing construction prior to the spring home purchase period.

What is happening this year?

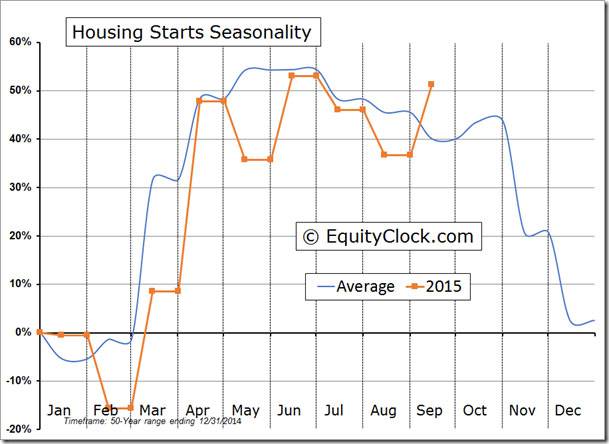

September housing starts released on Tuesday were greater than expected and nicely above seasonal trends at this time of year. Consensus was an increase to 1,150,000 units. Actual was a 6.5-per-cent increase from August to 1,206,000 units.

The easiest way to invest in the sector is to own either SPDR Homebuilder Index ETF (XHB-N) or iShares U.S. Home Construction ETF (ITB-N). The former is a modified equally weighted ETF that includes retail stocks such as Home Depot Inc. (HD-N) and Lowe's Companies Inc. (LOW-N) related to the home building sector. The later focuses more on home builder stocks and building material stocks, including D.R. Horton Inc (DHI-N), Lennar Corp (LEN-N), PulteGroup Inc (PHM-N) and Toll Brothers Inc (TOL-N)

On the charts, the sector and its related Exchange Traded Fund responded positively to the September report. The sector bottomed on Aug. 25 with the U.S. equity market. Intermediate trends for XHB and ITB currently are neutral. Both show improving strength relative to the S&P 500 Index and recently have moved above their 20, 50 and 200 day moving averages.

Accumulation of ETFs and individual equities related to the home building sector for a seasonal trade between now and early February makes sense again this year.

Disclaimer: Don and Jon Vialoux are authors of free daily reports on equity markets, sectors, commodities and Exchange Traded Funds available at www.timingthemarket.ca. and www.equityclock.com The enclosed report is for information only. It should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.