In September 2011 I launched a balanced portfolio for investors looking for a combination of above-average cash flow and reasonable risk. The initial portfolio valuation was $25,027.75.

The objective is to generate a return that is at least two percentage points more than that offered by the highest-paying GIC. Right now, the best five-year rate is 3.05 per cent so my current target is at least 5.05 per cent per year, including distributions and capital gains.

I make no distinction between registered and non-registered accounts, so keep in mind that the tax advantages of dividend-paying securities will be lost if they are held in an RRSP, RRIF, TFSA, RESP, etc.

Here's a summary of how the securities we currently hold performed over the seven months since I last reviewed this portfolio in late March.

iShares 1-5 Year Laddered Corporate Bond Fund (CBO)

This is a defensive short-term ETF. It's a low-risk way to own bonds but it will never provide much of a return. Since my last review in March, the units have dropped $0.20 in market value. But we received $0.54 in distributions so we have a net gain of 1.7 per cent over the seven-month period. That's not much but it's what we should expect in the current interest rate environment.

CIBC Global Bond Fund (A units) (CIB490)

I added this fund to the portfolio in March to increase our bond exposure. We've seen a small gain of $0.21 per unit in the net asset value plus we have received distributions of $0.11 for a total return of 2.7 per cent over the period.

Cineplex Inc. (CGX)

It wasn't a blockbuster summer at the movies but Cineplex still managed to add $0.41 to its share price since my last review in March. The cinema giant also raised its monthly dividend by 4.2 per cent to $0.125 per share in the spring. I added this stock to the portfolio in September 2013 and it has given us a total return of almost 11 per cent since then.

Freehold Royalties (FRU)

It has been a rough time for oil producers and this royalty company hasn't escaped. The shares are down $1.36 since my last update. We received $1.12 per unit in monthly dividends but that wasn't enough to offset the price drop. As a result, we're down 1.2 per cent since I added Freehold to the portfolio in September 2013.

Inter Pipeline (IPL)

Talk about an outstanding investment! This one is like the Energizer Bunny – it just keeps going and going and going. It's hard to believe that a small pipeline company added $6.70 a share since last March in a lacklustre market, but that's what happened. Plus we received monthly dividends of $0.1075 per share for a total return of almost 26 per cent in seven months.

Brookfield Renewable Energy Limited Partnership (BEP.UN)

This renewable energy partnership also fared well over the summer, adding $3.34 per share. We also received two quarterly dividends of $0.3875 (U.S.), which boosted our seven-month advance to 12.9 per cent.

Brookfield Infrastructure Limited Partnership (BIP.UN)

This is a companion limited partnership to Renewable Energy but in this case the assets are infrastructure – everything from coal terminals and railways to power transmission lines. It has performed well for us and the shares are up $1.02 since March. We also received two dividends of $0.48 each.

BCE Inc. (BCE)

BCE's share price appears to be stuck in neutral. The stock is up only $0.70 since March and many analysts feel it is unlikely to move much higher for now. But the dividend is a juicy $0.6175 per quarter, which bulks the total return.

Cash

We invested $2,245.21in a high interest savings account paying 1.35 per cent. Total interest over the latest seven-month period was $17.68.

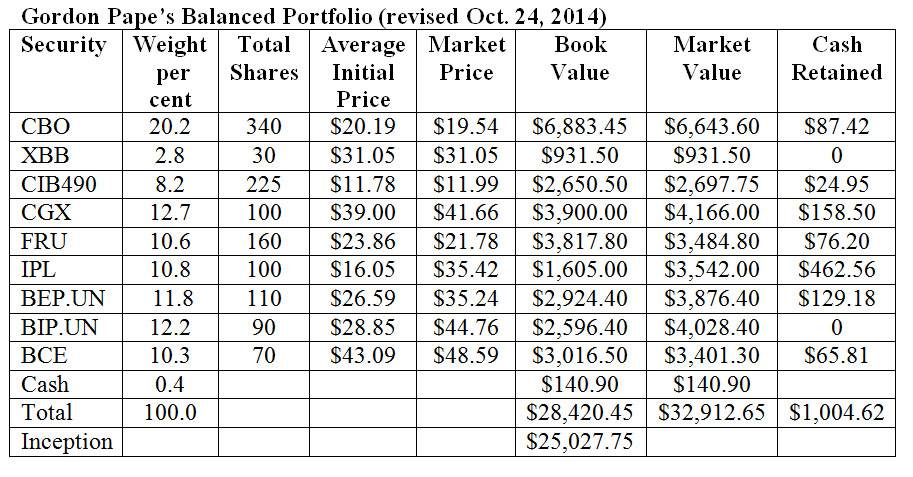

Here's how the portfolio stood after the close of trading on Oct. 24. Commissions have not been factored in. Canadian and U.S. dollars are treated as being at par for purposes of the calculations.

Comments

Thanks in large part to Inter Pipeline, the portfolio gained 6 per cent in the seven months since the last review in March. Cash flow during the period was $614.72. The total value, including retained cash, stands at $33,917.27. Since inception, we have a total return of 35.5 per cent. Our average annual compound rate of return is 10.3 per cent so we continue to run well ahead of target.

Changes

It's time to deploy some of the large cash reserves we have built up in this portfolio. Here's what we'll do.

CBO – We will buy 30 shares at a cost of $19.54, for a total outlay of $586.20. That will leave us with $87.42 in cash retained.

FRU – We'll take advantage of the price retreat to add 10 shares at $21.78, for an expense of $217.80. We will have $76.20 left over.

BEP.UN – We'll add 10 shares to bring our total to 110. At the current price of $35.24, that will require $352.40, leaving cash of $129.18.

BIP.UN – We'll also buy 10 shares here to increase the total to 90. The cost is $447.60. We're a little short in our retained cash so we'll take the extra $12.59 from the general cash fund.

BCE – We will add five shares at a cost of $242.95. We will now own 70 shares and have $65.81 in our retained cash reserve.

Also, we will sell 25 shares of Inter Pipeline for $885.50. Yes, it has been an outstanding performer but the portfolio weighting has become too high and the stock looks a little pricey at this level. We should add more bonds to the portfolio so we will spend $931.50 to buy 30 units of the iShares Canadian Universe Bond Fund (XBB). We'll draw the extra $46 from cash.

Here is the revised portfolio.

Through these changes, we have increased the bond component of the portfolio by three percentage points, thus reducing overall market risk. We have also restored better balance among the equity positions, reducing the spread between the lowest and the highest weightings to 2.4 percentage points compared to four points previously. Our cash reserves, including retained dividends/distributions, have been reduced to $1,145.52. We'll keep that in our high-interest account, which now pays 1.3 per cent.

Readers are reminded not to make small trades unless they have a rock-bottom discount brokerage service or a fee-based account. Small quantities of five or ten shares are better accumulated through DRIP programs.

I will review this portfolio again in six months.