Now we're talking. Volatile market conditions have left a bunch of household equity names trading at significantly oversold, technically attractive levels. The S&P/TSX Composite declined almost half a per cent in Thursday to Thursday time frame and remains in technically neutral territory according to Relative Strength Index.

The list of oversold stocks has ballooned to 36 while the overbought, technically vulnerable list of TSX stocks has fallen to 15 members.

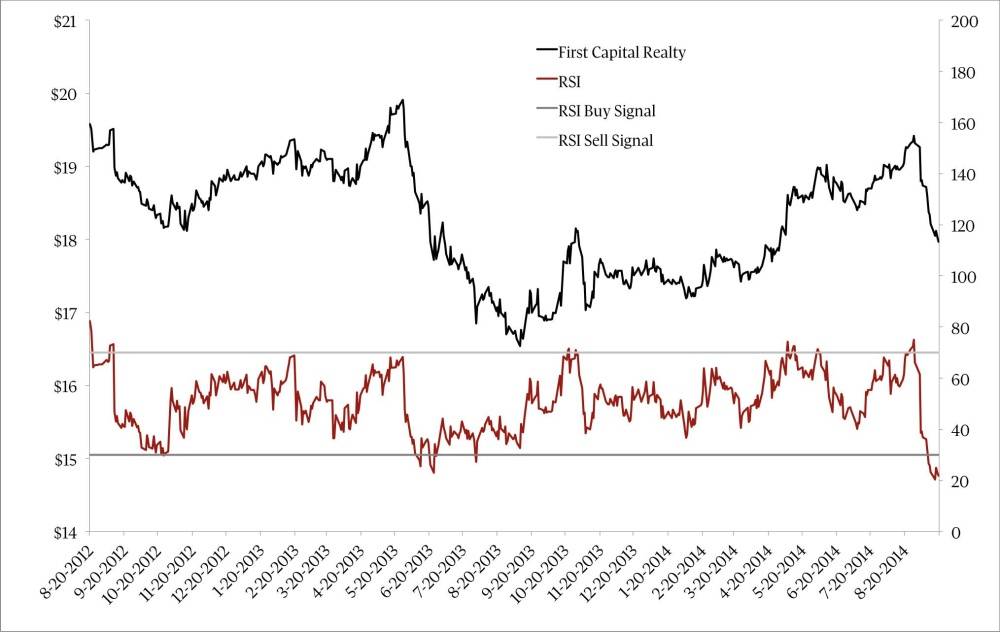

Precious metals and smaller-cap energy stocks still dominate the list of oversold stocks that are due for a bounce. But I'm not going to deal with them this week because I almost fell off my chair when I saw an oversold Canadian real estate company, First Capital Realty. This happens so rarely that First Capital has to be the focus stock of the week.

RSI has worked extremely well in uncovering successful buy and sell signals for the stock. An RSI overbought signal in May 2013 effectively warned of a 16 per cent decline. More recently, a late August 2014 sell signal forecast the ongoing 7.1 per cent correction.

RSI buy signals worked in October 2012 and, although patience was required, in July 2013. First Capital stock is now more oversold than at any time in the past 24 months.

A recent large debt issue was the reason for weakness but analysts remain positive on First Capital. The average analyst target price, combined with a dividend yield of 4.7 per cent, implies a 16 per cent total return in the next 12 months.

As for overbought stocks, the recent trend is that these poised-for-a-pullback stocks have managed to tread water at extended levels. This is likely to continue as investors attempt to hide out from volatility in the commodity sectors. Loblaws Companies Ltd., Westjet Airlines Ltd (a major beneficiary of weaker oil prices) and National Bank of Canada are the three most overbought stocks in the benchmark.

Technical analysis should always be accompanied by fundamental research, otherwise traders and investors could get blindsided by corporate news that everyone else already knows.

Follow Scott Barlow on Twitter @SBarlow_ROB.