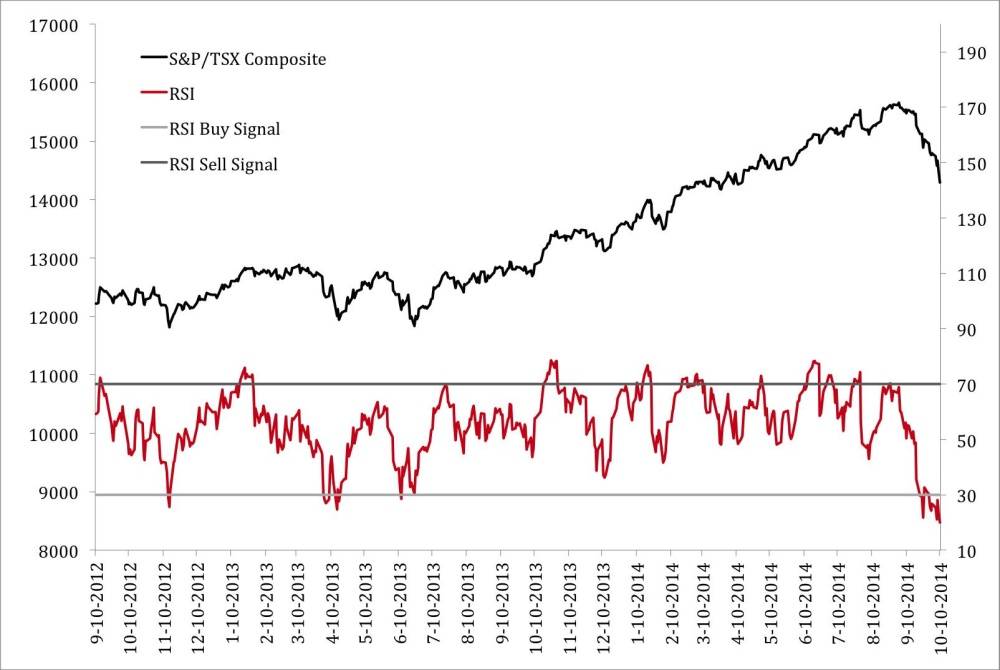

The S&P/TSX Composite fell exactly two per cent Thursday to Thursday, while the energy sector got poleaxed. The entire domestic benchmark is now oversold, or below the buy signal of 30 from my favoured technical indicator, the Relative Strength Index.

There are currently 94 TSX constituents trading at technically oversold levels, and this includes the majority of the S&P/TSX Energy Index. Energy stocks have been broadly oversold for a couple of weeks and this week's further bludgeoning highlights why I have been cautioning investors against going fishing in the sector.

Short-term energy stock performance is usually swamped by movements in the commodity price when things get volatile. No matter how oversold an energy stock gets, it can go lower if the commodity price doesn't co-operate.

You'd think, with over a third of the index oversold, that there would be a bunch of promising-looking domestic equities. But in truth, I'm struggling. Suncor Energy Inc. (full disclosure: I own the stock already in my RRSP), a historically stable, well-run company, might be tempting for longer-term investors since bitumen prices haven't fallen near as much as crude prices. I'd rather see the energy price flatten out for a few days first, however.

Finning International Inc., wholesalers of Caterpillar Inc. heavy equipment, is also worth further study, but analysts – who are usually optimistic about the stocks they cover – seem ambivalent about the company's outlook.

The S&P/TSX Composite is the focus chart for the week, largely because I think that investors looking to dip their toe in volatile market waters should probably just buy the index.

The domestic benchmark is much more oversold now than at any point in the past two years with an RSI of 20. The RSI buy signal was effective in November 2012, April 2013, and June of 2013.

Investors with longer-term time horizons should consider adding broad market exposure at these levels but I wouldn't be aggressive about it. There are post-crisis market trends – weak U.S. dollar and strong commodity demand notably – that may have helped the domestic market, but may have run their course.

As always, technical analysis should be accompanied by fundamental research, especially in volatile markets.

Follow Scott Barlow on Twitter @SBarlow_ROB.