Plodding but profitable stocks like Fortis Inc and Empire Co. rarely make appearances in the oversold list, but that's the situation we have this week. The trees continue to rocket higher – the forestry sector now dominates the top of the overbought list by Relative Strength Index.

Fortis announced plans to acquire U.S.-based utility UNS Energy Corp and the market clearly hated this idea, taking the stock lower by 6.5 per cent in the aftermath. Standard and Poor's immediately downgraded the company's credit outlook on the news, which was also unhelpful.

Investors were also distressed by Empire Co.'s earnings report on December 12. Sales and operating profit margins showed quarter over quarter declines, as the company's Sobeys grocery chain struggles with an increasingly competitive business climate. Empire stock is down by about 10 per cent from the November highs.

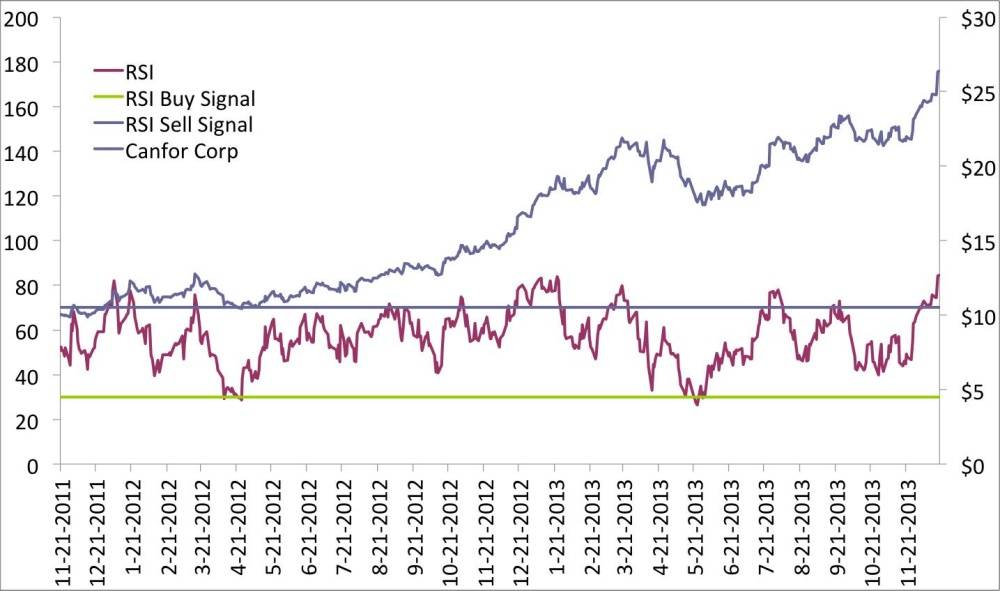

Canfor Corp is now the most overbought TSX stock according to RSI at 84.5 (the RSI sell signal is 70), and is our focus chart for the week. West Fraser Timber is close behind at 77.9.

Energy stocks are also a big part of the overbought list as Husky Energy Inc., Pembina Pipeline and Gibson Energy are all well above the short term warning signal of 70.

Fortis would be a candidate for further study but the proposed deal is so mired in legal issues that it's probably best to stay away.

Which leaves auto parts manufacturer Martinrea International Inc. The stock has taken a 20 per cent beating since a disappoinitng earnings report. Canaccord Genuity analyst David Tyerman recently upgraded the company to a buy, with a price target of $10.25 per share. Trading Martinrea at this point is not for the faint of heart, or risk averse, but it is interesting.

Investors with big gains in forestry stocks should consider taking some profits but, other than that, I'm not sure there's much to do here. Big investors are drifting off for the holidays, liquidity is declining and more volatility than usual is to be expected until year end. It might not mean much.

Overbought and oversold stocks for week ending Dec. 20/2013

| Ticker | RSI | 1W Return % | P/E ratio TTM | P/E Ratio Fwd | |

|---|---|---|---|---|---|

| **Oversold** | |||||

| Westport Innovations Inc | WPT | 20.75 | -3.98 | N/A | N/A |

| Thompson Creek Metals Co Inc | TCM | 23.81 | -11.45 | N/A | N/A |

| Empire Co Ltd 'A' | EMP/A | 26.30 | -0.63 | 13.83 | 12.15 |

| Iamgold Corp | IMG | 26.80 | -4.67 | 8.78 | 12.73 |

| Rubicon Minerals Corp | RMX | 27.38 | -6.25 | N/A | N/A |

| Fortuna Silver Mines Inc | FVI | 29.78 | -6.10 | 19.94 | 13.71 |

| Alaris Royalty Corp | AD | 29.94 | -10.10 | 20.62 | 20.24 |

| Silvercorp Metals Inc | SVM | 30.14 | -2.83 | 9.81 | 6.24 |

| Martinrea International Inc | MRE | 30.50 | -13.92 | 6.74 | 6.48 |

| Endeavour Silver Corp | EDR | 31.46 | -3.41 | 9.36 | #N/A N/A |

| Transcontinental Inc-Cl A | TCL.A | 32.16 | -0.88 | 7.26 | 7.21 |

| Fortis Inc | FTS | 32.37 | -0.03 | 19.30 | 16.93 |

| **Overbought** | |||||

| Canfor Corp | CFP | 84.46 | 6.32 | 18.08 | 13.13 |

| Cae Inc | CAE | 78.92 | 7.09 | 19.49 | 17.31 |

| West Fraser Timber Co Ltd | WFT | 77.87 | 7.22 | 17.97 | 11.63 |

| Husky Energy Inc | HSE | 76.74 | 4.93 | 15.38 | 14.48 |

| Pembina Pipeline Corp | PPL | 74.07 | 7.46 | 34.53 | 33.03 |

| Gibson Energy Inc | GEI | 73.85 | 3.89 | 21.48 | 27.15 |

| Open Text Corp | OTC | 73.20 | 3.48 | 31.15 | 14.96 |

| Granite Real Estate Investme | GRT.UN | 72.73 | 4.98 | 10.75 | N/A |

| Superior Plus Corp | SPB | 71.74 | 4.08 | 32.21 | 17.00 |

| Canadian Western Bank | CWB | 71.50 | -1.00 | 16.07 | 13.95 |

| Constellation Software Inc | CSU | 71.39 | 10.26 | 48.16 | 18.26 |

| Davis & Henderson Corp | DH | 70.88 | 2.59 | 19.91 | 13.00 |

| Tourmaline Oil Corp | TOU | 70.53 | 1.85 | 104.77 | 39.52 |

| Paramount Resources Ltd -A | POU | 69.71 | 3.72 | N/A | N/A |

| Igm Financial Inc | IGM | 68.72 | 5.35 | 18.69 | 16.92 |