I realize this is not the time of year when people are thinking about their RRSPs, but it should be. In fact, you should be glancing at your RRSP portfolio at least once a quarter. It's not a case of invest-it-and-forget-it; like any other portfolio, managing an RRSP is a year-round responsibility. After all, it's your retirement money at stake.

So I make no apologies about revisiting my RRSP Portfolio this week to see how it's doing and, if necessary, make some tweaks.

This portfolio, which was launched in February 2012, has two objectives. The first is capital preservation – as with any pension plan, you don't want to lose money. The second is to earn a higher rate of return than you could get from a GIC.

As a result, the portfolio has a heavy weighting in bonds and defensive securities in order to minimize risk. But it also contains some growth-oriented mutual funds covering the Canadian, U.S., and international equity markets.

The securities were chosen from the Recommended Lists of my three newsletters: the Internet Wealth Builder, The Income Investor, and Mutual Funds/ETFs Update. The initial value was $25,031.92. The portfolio contains a mix of ETFs, mutual funds, common stocks, limited partnerships, and REITs. This means that readers who wish to replicate it must have a self-directed RRSP with a brokerage firm.

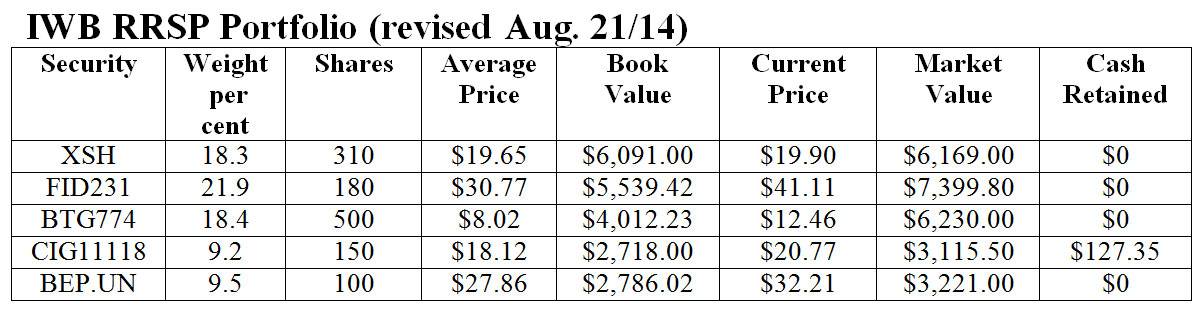

These are the securities currently in the RRSP Portfolio with some comments on how they have performed since the last review in February.

iShares DEX Short Term Corporate Universe + Maple Bond Index Fund (XSH-T)

This exchange-traded fund invests primarily in bonds that mature in five years or less, although there are a few longer-term issues in the mix. The bonds may be issued by Canadian companies or by foreign corporations in Canadian currency (the Maple Bonds). Short-term bond funds are essentially defensive positions so expect returns to be minimal. The share price has not budged since my last review in February, however we received monthly distributions totalling about $0.31 per unit. This brought the total return in the approximately one year since this ETF was added to 4.2 per cent. That's a very acceptable result for such a low-risk position.

Fidelity Canadian Large Cap Fund B units (FID231)

This Fidelity entry has "Canadian" as part of its name but less than half the portfolio is in this country and most of the top ten holdings are American or overseas firms such as IBM, Imperial Tobacco, and BP. The fund continues to perform well with a gain of 8.7 per cent since the time of my last update.

Beutel Goodman American Equity Fund D units (BTG774)

The U.S. stock markets have not been as strong as the TSX this year but you'd never know it from this fund. It's ahead 14.5 per cent since February, thereby retaining its position as the strongest performing mutual fund in the RRSP Portfolio. It would have done even better had it not had such a large position in retailer Target Inc., which has lost hundreds of millions in its move into Canada.

Black Creek International Equity Fund A units (CIG11118)

This fund was added in September 2013. It invests in countries around the world except the U.S. and Canada. Manager Richard Jenkins got the fund off to a strong start for us with a total return of 16.4 per cent in the first six months. But it has treaded water since, gaining just 2.6 per cent since February.

Brookfield Renewable Energy Partners LP (BEP.UN-T)

After a slow start, this limited partnership that owns a range of renewable power installations in North America and Brazil has gained some momentum. The shares are up 11.3 per cent since February plus we received distributions of $1.03 (U.S.) per unit. That brings our total return to date to 28.9 per cent.

Brookfield Infrastructure Partners LP (BIP.UN-T)

This limited partnership invests in infrastructure projects around the world. It's been our star performer since the portfolio was launched, narrowly edging the Beutel Goodman American Fund for the honour. Since my last review the shares have gained 13.6 per cent and we have received payments of $1.44 (U.S.) per unit.

Capital Power Corporation (CPX-T)

We added 60 shares of this stock in February as a replacement for Firm Capital, which was not performing to my satisfaction. It has turned out to be a good move so far. The shares are up almost $5 since February, for a gain of 21.8 per cent. Including dividends, our total return in the past six months has been 24.5 per cent.

Boardwalk REIT (BEI.UN-T)

This REIT, which focuses on Western Canada, was the biggest dollar gainer in the past six months, with the shares rising $10. Distributions are $0.17 a month.

Interest

We invested cash holdings and the accumulated distributions of $1,858.28 in a Tangerine high interest savings account paying 1.35 per cent. That provided $12.54 in interest since February.

Here is how the RRSP Portfolio stood as of mid-day on Aug. 21 (mutual fund prices are as of the close of trading on Aug. 20). Commissions have not been factored in and Canadian and U.S. currencies are treated at par.

Comments:

Since inception, this portfolio has generated a total return of 36.6 per cent. That translates into a compound average annual rate of return of 13.3 per cent. That's much higher than our target and probably not sustainable. However, we have a nice cushion for when the inevitable correction finally comes.

Changes:

We will reinvest some of our accumulated cash to add to various positions, as follows.

XSH – We will buy 10 more shares for a total cost of $199. Of this, $169.32 will come from our cumulative distributions. We'll draw $29.68 from our unallocated cash reserve for the balance. This will bring our total position to 310 shares.

FID231 – We'll add 13 units to this Fidelity fund to bring the total to 180. The cost will be $534.43. That will use all the accumulated distributions. We'll take the remaining $4.32 from the general reserve.

BTG774 – Another 21 units will round up our total to 500. The cost will be $261.66. We will use the $251.67 in accumulated distributions plus $9.99 from the general reserve.

BEP.UN – We'll add nine shares at $32.21, which will bring our total to 100. The cost will be $289.89. We'll use all the accumulated distributions plus $4.30 from the reserve.

BIP.UN – Five more shares will bring our total to 90 at a cost of $225.25. We have more than enough in accumulated distributions to cover this.

There are no changes to the Black Creek fund, CPX, or BEI.UN.

Note that adding small amounts of mutual fund units should not be expensive or difficult if you have followed my advice to buy front-end load units at zero commission. Stock commissions are another matter. Do not make small purchases unless you can do so very cheaply. Dividend reinvestment plans, where available, are a better option.

Here's a look at the revised portfolio.

After all these changes, we are left with accumulated distributions and a cash reserve totalling $731.16. We will continue to hold this money in a high-interest savings account paying 1.35 per cent.

I'll review this portfolio again in February.