The U.S. dollar is climbing, despite rising inflation fears. This is pushing the gold price lower, at a time when a rally in bullion would usually occur.

The pattern is best visualized using the Treasury Inflation Protected Securities (TIPS) ten-year bond issued by the U.S. Federal reserve. The price of the bond is designed to rise with the Consumer Price Index.

Since price and yield move in opposite directions, the yield on the ten-year TIPS falls with rising inflation fears. Even if monthly CPI hasn't been officially announced at lower levels, TIPS investors will be willing to bid more for TIPS in expectation of falling yields.

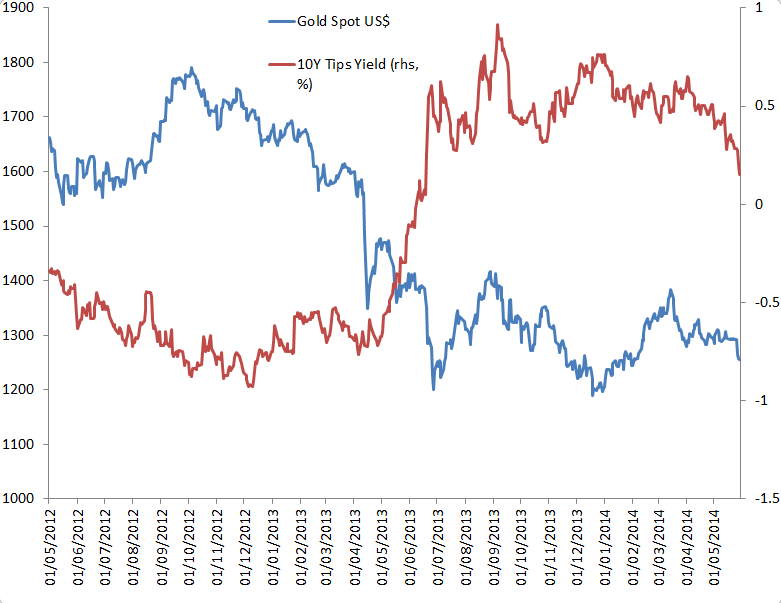

The chart below shows how the gold price and TIPS yields move in opposite directions (the correlation for the past two years is -0.92, which makes the r-squared a highly statistically significant 0.85.)

From October 2013 to March 2014, things moved as they should. When TIPS yield rose, gold fell, and the reverse case also held.

Beginning in late April, however, the gold price seemed less affected by inflation expectations than before, as measured by the ten-year TIPS yield. The yield moved lower, signalling rising inflation pressure, which should have resulted in bullion moving higher. Instead, it stayed flat before moving sharply lower.

The U.S. dollar rally that started in early May is likely the reason gold failed to rally. Gold is frequently called the “anti-currency” because it usually moves in the opposite direction of the world’s reserve currency, the greenback. The U.S. trade-weighted dollar index has climbed 1.9 per cent in the past four weeks.

So, we have cross currents. U.S. inflation fears have been rising since April and, while this would usually cause the U.S. dollar to fall and gold to rise – inflation erodes spending power and the value of national currencies – the opposite has happened. The greenback has actually climbed and gold has been under pressure.

Where to from here? In the past two years, the relationship between the gold price and the TIPS yield (ie. inflation fears) has been a lot stronger than the gold/trade weighted U.S dollar. For that reason, I suspect the influence of the trade-weighted dollar on the bullion price to be fleeting, allowing the gold price to climb, and to reflect inflation fears.