The S&P/TSX Composite fell 0.7 per cent for the trading week ending with Thursday's close, but the damage in resource and precious metals stocks was far more severe. The list of oversold, technically attractive stocks by Relative Strength Index (RSI) is huge this week at 44 members.

In technical terms, the benchmark's RSI reading of 40 puts it closer to the buy signal of 30 than the overbought RSI sell signal of 70.

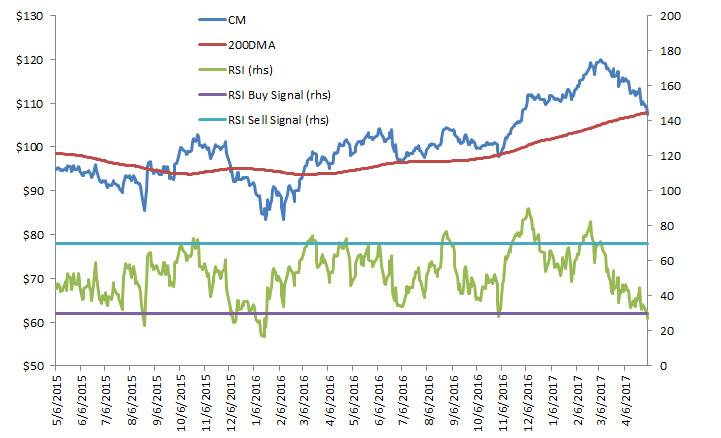

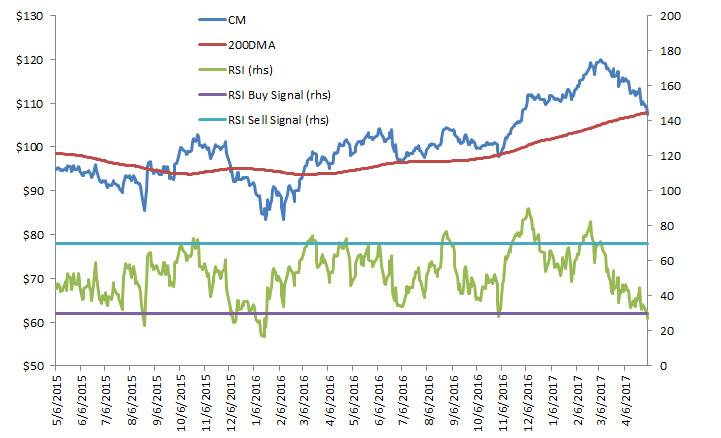

I picked Canadian Imperial Bank of Commerce as the focus stock this week primarily because the major banks are rarely oversold. We all know why bank stocks have been weaker – I covered that in a Thursday column that was skeptical (but not bearish) on the banks – but I'm hoping a purely technical perspective on CIBC will provide more perspective.

Two important things are evident from the chart: RSI buy signals have worked extremely well for CIBC stock and the 200 day-moving average has also been extremely important to stock movements in the past two years.

RSI buy signals have been almost uniformly successful. An oversold signal in August 2015 predicted a 19-per-cent rally to Oct. 23 and another on Nov. 2, 2016 was followed by a 23-per-cent jump to March 7, 2017.

The stock is right at its 200-day moving average and that's cause for a bit of concern. Generally, RSI buy signals have been less effective when stocks are trading below this trend line. A sustained drop below the 200=day should give investors caution.

The list of overbought, technically vulnerable S&P/TSX Composite stocks has 20 members this week led by TMX Group Ltd. The list includes a who's who of lower volatility defensive names including Loblaw Co Ltd., Metro Inc., Dollarama Inc., and Waste Connections Inc.

Fundamental research should always accompany technical analysis before any market transactions.

Follow Scott Barlow on Twitter @SBarlow_ROB.

| NAME | RSI 14d | PX Last | MOV_AVG_200D | LAST_CLOSE_TRR_1WK | LAST_CLOSE_TRR_YTD | PE_RATIO | BEST_PE_RATIO |

|---|

| BNE-T | BONTERRA ENERGY CORP | 19.12881 | 17.6 | 24.80335 | -9.184721 | -38.47145 | #N/A N/A | 23.15789474 |

|---|

| HCG-T | HOME CAPITAL GROUP INC | 19.29305 | 6.01 | 27.00565 | -25.06235 | -80.63781 | 1.521881985 | 2.994519183 |

|---|

| SMF-T | SEMAFO INC | 21.47536 | 2.84 | 4.88215 | -9.841275 | -35.74661 | 28.6055248 | 62.55768427 |

|---|

| CWB-T | CANADIAN WESTERN BANK | 21.49348 | 25.51 | 27.9393 | -5.096723 | -15.27518 | 11.87174247 | 10.3910387 |

|---|

| PD-T | PRECISION DRILLING CORP | 21.632 | 4.93 | 6.33855 | -10.84992 | -32.65028 | #N/A N/A | #N/A N/A |

|---|

| ASR-T | ALACER GOLD CORP | 21.65188 | 1.98 | 2.75145 | -6.603768 | -11.60714 | #N/A N/A | 7.496728807 |

|---|

| BNP-T | BONAVISTA ENERGY CORP | 21.8927 | 2.59 | 4.0561 | -8.802817 | -46 | #N/A N/A | #N/A N/A |

|---|

| SSL-T | SANDSTORM GOLD LTD | 22.15156 | 4.43 | 6.1453 | -7.127886 | -15.93928 | 44.3813649 | 64.40825913 |

|---|

| SPE-T | SPARTAN ENERGY CORP | 22.57986 | 2.09 | 3.0521 | -7.929518 | -37.23724 | #N/A N/A | 41.8 |

|---|

| CVE-T | CENOVUS ENERGY INC | 22.94567 | 12.67 | 18.3431 | -6.494466 | -37.39249 | #N/A N/A | 46.07272727 |

|---|

| TOU-T | TOURMALINE OIL CORP | 23.19337 | 26.06 | 33.1132 | -4.366974 | -27.42969 | 59.80946226 | 15.79393939 |

|---|

| BTO-T | B2GOLD CORP | 23.48283 | 2.99 | 3.70265 | -11.0119 | -6.269594 | 34.66409862 | 36.22398302 |

|---|

| AGI-T | ALAMOS GOLD INC-CLASS A | 23.61765 | 8.48 | 10.27135 | -11.66667 | -8.313885 | #N/A N/A | 48.5364932 |

|---|

| KDX-T | KLONDEX MINES LTD | 23.98134 | 4.36 | 6.46855 | -8.786613 | -30.24 | 32.32721729 | 15.68958237 |

|---|

| GEI-T | GIBSON ENERGY INC | 24.10795 | 17.75 | 18.04655 | -3.689638 | -4.8723 | #N/A N/A | 845.2380952 |

|---|

| TOG-T | TORC OIL & GAS LTD | 24.59109 | 5.58 | 7.5157 | -6.532661 | -31.73256 | #N/A N/A | 60 |

|---|

| ERF-T | ENERPLUS CORP | 24.74638 | 8.98 | 10.36015 | -10.02004 | -29.25337 | #N/A N/A | 17.4368932 |

|---|

| ARX-T | ARC RESOURCES LTD | 24.95066 | 16.86 | 21.71165 | -6.385339 | -26.29329 | 48.26119614 | 21.75483871 |

|---|

| UNS-T | UNI-SELECT INC | 25.12206 | 32.04 | 31.83825 | -11.4183 | 8.91086 | 16.86577252 | 15.69404415 |

|---|

| FM-T | FIRST QUANTUM MINERALS LTD | 25.19087 | 11.59 | 13.3679 | -9.59438 | -13.153 | 46.51220404 | 16.29555501 |

|---|

| CR-T | CREW ENERGY INC | 25.69991 | 3.93 | 6.1563 | -6.650831 | -47.66977 | #N/A N/A | 21.01604278 |

|---|

| AD-T | ALARIS ROYALTY CORP | 25.72285 | 20.72 | 22.55875 | -3.94066 | -11.3612 | 13.41785502 | 12.4295141 |

|---|

| TXG-T | TOREX GOLD RESOURCES INC | 25.85327 | 20.97 | 26.0194 | -8.905305 | 0.8657931 | 23.37691078 | 17.70400578 |

|---|

| BIR-T | BIRCHCLIFF ENERGY LTD | 26.05155 | 6.43 | 8.4164 | -8.794332 | -31.12555 | #N/A N/A | 14.7816092 |

|---|

| MTL-T | MULLEN GROUP LTD | 26.20978 | 14.6 | 17.33005 | -2.796272 | -25.85065 | 32.97676354 | 21.85628743 |

|---|

| RRX-T | RAGING RIVER EXPLORATION INC | 26.23269 | 7.57 | 10.01025 | -5.256566 | -28.3144 | 95.07661607 | 18.19711538 |

|---|

| CM-T | CAN IMPERIAL BK OF COMMERCE | 26.94764 | 107.37 | 107.8576 | -2.132893 | -0.9264193 | 10.93108385 | 10.16183986 |

|---|

| ABX-T | BARRICK GOLD CORP | 27.34045 | 22.01 | 23.7154 | -3.124996 | 2.577024 | 22.13125641 | 18.47474336 |

|---|

| TRQ-T | TURQUOISE HILL RESOURCES LTD | 27.46169 | 3.52 | 4.2525 | -4.607048 | -18.32947 | 25.46677061 | #N/A N/A |

|---|

| EDV-T | ENDEAVOUR MINING CORP | 27.74 | 20.16 | 23.31865 | -8.321964 | 0.4985064 | 86.8288036 | 14.9993427 |

|---|

| AKG-T | ASANKO GOLD INC | 27.74128 | 2.87 | 4.54425 | -11.41976 | -30.33981 | 107.2988002 | 17.68103682 |

|---|

| NA-T | NATIONAL BANK OF CANADA | 27.76968 | 52.22 | 51.5725 | -1.360025 | -3.272708 | 11.57784141 | 9.988523336 |

|---|

| GUY-T | GUYANA GOLDFIELDS INC | 27.97783 | 5.75 | 7.22195 | -12.21374 | -6.04575 | 22.79524395 | 17.63582426 |

|---|

| TFII-T | TFI INTERNATIONAL INC | 28.17464 | 28.11 | 30.5965 | -3.864566 | -18.94406 | 17.99331387 | 13.16011236 |

|---|

| TECK.B-T | TECK RESOURCES LTD-CLS B | 28.35985 | 24.95 | 27.28165 | -11.33617 | -7.145515 | 8.574947189 | 5.775462963 |

|---|

| CUF.UN-T | COMINAR REAL ESTATE INV-TR U | 28.58161 | 13.86 | 15.1008 | -2.394367 | -2.624245 | 8.315189895 | #N/A N/A |

|---|

| CEU-T | CANADIAN ENERGY SERVICES & T | 28.69961 | 6.15 | 6.29255 | -2.070065 | -19.60367 | #N/A N/A | 90.44117647 |

|---|

| SPB-T | SUPERIOR PLUS CORP | 28.9747 | 12.45 | 12.2495 | -4.597704 | -0.5155571 | 13.87450958 | #N/A N/A |

|---|

| PVG-T | PRETIUM RESOURCES INC | 29.27743 | 11.94 | 13.3881 | -9.613933 | 7.374098 | #N/A N/A | 35.11764706 |

|---|

| SRU.UN-T | SMART REAL ESTATE INVESTMENT | 29.60762 | 31.49 | 33.4711 | -2.9584 | -0.7680598 | 18.82367837 | #N/A N/A |

|---|

| MEG-T | MEG ENERGY CORP | 29.63825 | 5.73 | 6.563375 | -6.219315 | -37.91982 | #N/A N/A | #N/A N/A |

|---|

| LB-T | LAURENTIAN BANK OF CANADA | 29.72813 | 54.34 | 54.2067 | -2.860205 | -4.889315 | 9.47310436 | 9.199255121 |

|---|

| SCL-T | SHAWCOR LTD | 29.84709 | 34.06 | 34.15035 | -1.132074 | -4.588898 | #N/A N/A | 20.39520958 |

|---|

| FVI-T | FORTUNA SILVER MINES INC | 29.9476 | 5.73 | 8.6519 | -5.60132 | -24.50593 | 46.8452566 | 17.42741546 |

|---|

| | | | | | | | |

|---|

| | | | | | | | |

|---|

| | | | | | | | |

|---|

| | | | | | | | |

|---|

| NAME | RSI 14d | PX Last | MOV_AVG_200D | LAST_CLOSE_TRR_1WK | LAST_CLOSE_TRR_YTD | PE_RATIO | BEST_PE_RATIO |

|---|

| X-T | TMX GROUP LTD | 82.67136 | 79.74 | 66.1252 | 3.895763 | 12.20748 | 19.95952973 | 16.48883375 |

|---|

| VSN-T | VERESEN INC | 80.95373 | 18.41 | 13.25245 | 22.16324 | 43.73745 | 72.02096803 | 36.24015748 |

|---|

| WPK-T | WINPAK LTD | 80.14561 | 58.4 | 47.49455 | 5.244188 | 28.65051 | 25.88482738 | 23.87576822 |

|---|

| L-T | LOBLAW COMPANIES LTD | 78.31587 | 77.56 | 69.97745 | 2.187083 | 9.885248 | 29.65997248 | 17.23172628 |

|---|

| BB-T | BLACKBERRY LTD | 77.38791 | 12.72 | 10.00215 | 0.3946345 | 37.66234 | #N/A N/A | 616.4134636 |

|---|

| MRU-T | METRO INC | 76.58786 | 46.26 | 42.12345 | -1.174969 | 15.65872 | 18.956483 | 16.7366136 |

|---|

| DOL-T | DOLLARAMA INC | 75.22787 | 121.06 | 101.9764 | 0.5064347 | 23.2923 | 32.56121637 | 28.23227612 |

|---|

| WCN-T | WASTE CONNECTIONS INC | 74.83819 | 127.03 | 105.9665 | 0.66566 | 20.83829 | 38.37272831 | 29.16564943 |

|---|

| NFI-T | NEW FLYER INDUSTRIES INC | 74.40163 | 51.77 | 42.7648 | 3.747493 | 27.37902 | 18.01451791 | 16.43307912 |

|---|

| WN-T | WESTON (GEORGE) LTD | 74.12613 | 122.98 | 112.5558 | 1.259783 | 8.689721 | 23.9080048 | 17.43160879 |

|---|

| CCA-T | COGECO COMMUNICATIONS INC | 73.89819 | 79.06 | 67.378 | 1.099745 | 20.75594 | 13.79970211 | 13.29633367 |

|---|

| GIL-T | GILDAN ACTIVEWEAR INC | 73.43421 | 39.24 | 35.8542 | 2.481067 | 15.52675 | 17.65465922 | 16.57388771 |

|---|

| CAE-T | CAE INC | 73.32857 | 21.49 | 19.07965 | 3.916825 | 14.88478 | 21.15532257 | 20.66346154 |

|---|

| CCL.B-T | CCL INDUSTRIES INC - CL B | 71.98479 | 312.41 | 258.1892 | -0.02879883 | 18.65432 | 29.87792463 | 24.29504627 |

|---|

| OTEX-T | OPEN TEXT CORP | 70.99115 | 47.48 | 42.75153 | 0.7212562 | 14.91657 | 32.33454002 | 15.22423412 |

|---|

| MFI-T | MAPLE LEAF FOODS INC | 70.98038 | 34.19 | 29.9037 | 4.174281 | 22.01916 | 22.31226511 | 22.97715054 |

|---|

| CSU-T | CONSTELLATION SOFTWARE INC | 70.62536 | 686.39 | 601.2663 | 11.97776 | 12.73228 | 42.91483531 | 22.13766631 |

|---|

| KXS-T | KINAXIS INC | 70.61526 | 85.4 | 66.363 | 6.923749 | 36.64 | 151.4085096 | 62.7045333 |

|---|

| CIGI-T | COLLIERS INTERNATIONAL GROUP | 70.37699 | 71.54 | 55.1364 | 7.417421 | 44.55445 | 24.65961604 | 18.73968179 |

|---|

| BBU.UN-T | BROOKFIELD BUSINESS PT.UNNIT | 70.25368 | 36.18 | 32.12312 | 1.486673 | 12.42497 | #N/A N/A | 21.20914401 |

|---|

|

|---|

Source: Bloomberg/Scott Barlow