Back in August 2012, we created a growth portfolio for readers of my Internet Wealth Builder who were prepared to accept a greater degree of risk in exchange for the potential for higher returns.

The original portfolio was valued at $10,000, distributed among eight stocks. Three were U.S. companies while the rest were Canadian. There are no bond positions in this portfolio.

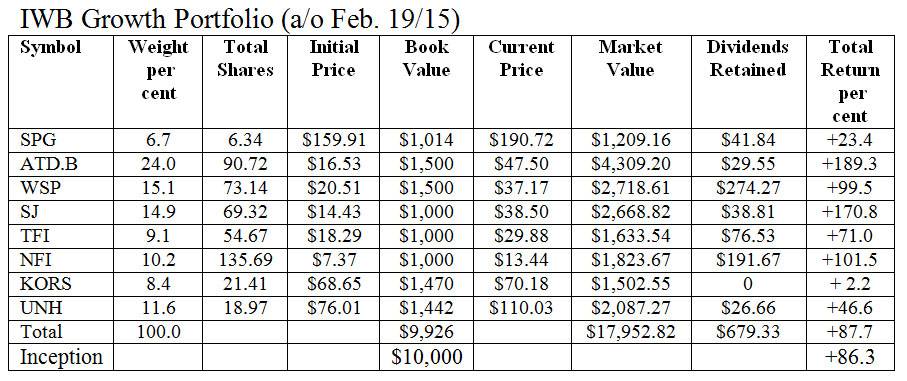

Here are the securities that make up the portfolio, with an update on how they have performed since our last review in early August.

Simon Property Group Inc.

This is the largest retail property group in the United States, with interests in shopping malls across the country. It's a huge business, with funds from operations (FFO) of $3.235-billion (U.S.) ($8.90 per share, fully diluted) in 2014. Net profit for the year was just over $1.4-billion ($4.52 per share) up from $1.3-billion ($1.24 per share) the year before.

On Jan. 30, The Indianapolis-based company announced a 12 per cent dividend increase, bringing the quarterly payment to $1.40 per share. The next distribution is scheduled for Feb. 27 to shareholders of record as of Feb. 13, so it is included in the calculations in this issue.

At the time of the last review in August, the shares were at $167.67. The mid-day price on Feb. 19 was $190.72 plus we have received $4 per share in dividends for a total return of 16.1 per cent since the last update. The total return since the inception of the portfolio is 23.4 per cent.

Alimentation Couche-Tard

There's no stopping this juggernaut. When we originally added it to the portfolio the shares were trading at a split-adjusted $16.53. At the time of the August review, they were at $30.36. Now they are trading at $47.50, a gain of 56 per cent in just six months. The dividend isn't much, just $0.045 per quarter, but with growth like this, who cares? Our total return since inception is almost 190 per cent making this stock the top performer in the portfolio.

WSP Global Inc.

WSP is one of the world's leading professional services companies, employing some 32,000 specialists in 39 countries on five continents. The recent acquisition of Colombian firm Dessau CEI strengthened its expertise in the oil and gas sector and provides a foothold for South American expansion. Although the company's expertise ranges far beyond the energy sector, the share price movement appears to have been affected at least in part by the decline in the price of oil. The stock is only up $1.54 (4.3 per cent) since August. We have also received two dividends totalling $0.75 per share.

Stella-Jones

This company is a leading North American manufacturer of pressure treated wood products. Its core product categories are railway ties and utility poles – not exciting, perhaps, but critical to the country's infrastructure. The company has a network of 28 wood treating facilities spread across 17 U.S. states and five Canadian provinces. It serves many of North America's largest railroads, telecom providers, and electrical transmission utilities. The stock has been hot recently, gaining $10 a share since the August update. The dividend is small, only $0.07 a quarter, so like Alimentation Couche-Tard this is primarily a growth story. Total return since inception is 171 per cent.

TransForce Inc.

TransForce is in the trucking and courier business (among others) so the company is one of the beneficiaries of the fall in oil prices. Therefore, we might have expected more of a gain than the 7.8 per cent upward move in the share price since last August. However, even strong third-quarter results did not provide much momentum. (Fourth-quarter and year-end figures will be announced March 2.) Still, we have a total return of 71 per cent to date, which is a decent performance.

New Flyer Industries

We saw a small uptick in the price of this Winnipeg-based heavy-duty bus manufacturer but that, combined with a monthly dividend of $0.0487 per share, was enough to give us a double in terms of total return since the portfolio's inception.

Michael Kors

The brand is still hot, based on what I observed in department stores over the holidays. But the stock is definitely not. It's off more than $11 a share since our last review in August and with no dividend to provide support we risk seeing it fall below our purchase level of $68.65 (U.S.). That's in spite of third-quarter 2015 results (to Dec. 27) that showed a gain of almost 30 per cent in revenue and net income of $303.7-million ($1.48 per share, fully diluted). Investors were more concerned with future prospects and when the company issued a soft outlook for the current quarter in early February the share price plunged more than 12 per cent. It has since recovered slightly but the long-term trend line is down, not exactly what we want to see in a growth stock.

UnitedHealth Group

In contrast to Michael Kors, this stock is moving in the opposite direction – straight up. The shares have gained $28.54 (U.S.) since August and show no sign of slowing down. The health insurance provider, which has benefitted from the introduction of Obamacare, reported 2014 revenue of $130.5-billion, up from $122.5-billion in 2013. Earnings from operations were $10.3-billion, compared to $9.6-billion in the previous year. The company continues to buy back shares in the open market, repurchasing $4-billion worth of stock in 2014. The annualized dividend is $1.50 per share.

Here is how the portfolio stood as of mid-day on Feb. 19. Commissions are not taken into account and the U.S. and Canadian dollars are treated as being at par but obviously gains (or losses) on the American securities are increased due to the current exchange rate differential.

Comments

With the exception of Michael Kors, the portfolio has done very well, with a total return since inception of 86.3 per cent. That works out to a compound annual growth rate of 28.26 per cent, well ahead of expectations. That's very satisfying but don't expect this portfolio to keep churning out profits at that rate. On a portfolio such as this, an average annual return in the 12 per cent range over the long term would be more in line. Still, we'll take the profits where we find them.

Changes

I am concerned about the performance of Michael Kors, particularly the downward trend pattern. Therefore, I am selling the entire position, giving us $1,502.55 to reinvest. We'll use the money to buy 11 shares of Apple. It was trading at $128.80 at the time of writing for a total cost of $1,416.80. That leaves $85.75 in cash.

I would like to eliminate all the fractional shares in this portfolio so we will make the following small trades. These are not recommended for individual investors because the commissions would be prohibitive; the best way to acquire small additional amounts of stock is through dividend reinvestment plans (DRIPs).

Alimentation Couche-Tard

We'll buy .28 of a share for $13.30, bringing the total to 91 and leaving $16.25 in retained dividends.

WSP Global

We have $274.27 in retained dividends, giving us enough to buy 6.86 shares for $254.99. We now own 80 shares and have $19.28 in cash.

Stella Jones

We'll make a small purchase of .68 of a share, which brings our total to 70. The cost is $26.18, leaving us with $12.63.

Transforce

We have enough cash to buy 2.33 shares for a cost of $69.62. That gives us a total of 57 shares and leaves cash of $6.91.

New Flyer

We will purchase 14.31 shares for $192.33. Our total is now 150 shares. This will wipe out our retained dividends in NFI and we'll draw $0.66 from the cash left from the KORS sale to make up the difference.

United Health

This one is really tiny. We only need 0.03 of a share to bring our total to an even 19, so we'll spend $3.30 to do that. We still have cash of $23.36.

This leaves us with only SPG showing fractional shares. We need .66 of a share to fix that, which will cost $125.88. We can just manage that by using the retained dividends of $41.84 plus $84.04 from the cash generated by the KORS sale. We're left with cash of $1.05.

Here's a look at the revised portfolio. I'll revisit it again in August.