In August of 2012, we created a Growth Portfolio for my Internet Wealth Builder newsletter. It was designed for readers who were prepared to accept a greater degree of risk in exchange for potential higher returns.

The original portfolio was valued at $10,000, distributed among eight stocks. Three were U.S. companies while the rest were Canadian. There were no bond positions in this portfolio. The target average annual compound rate of return is in the 12% range.

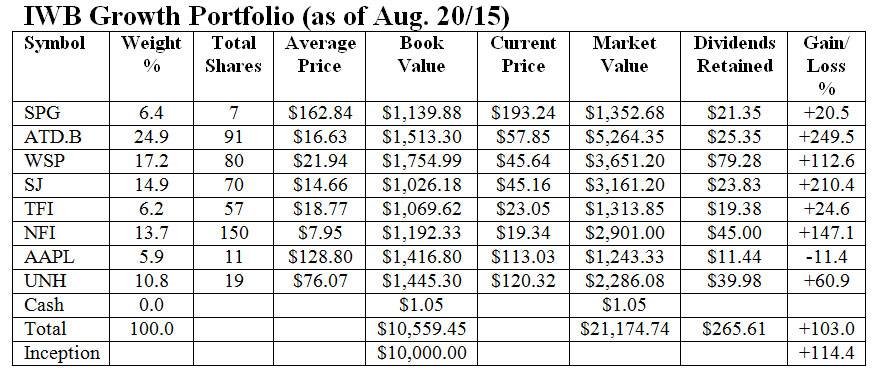

Here are the securities that make up the portfolio, with an update on how they have performed since our last review in mid-February. Prices are as of the afternoon of Aug. 20.

Simon Property Group (SPG-N). Here's a nice success story to help offset the current market gloom. Shares of Simon Property Group are up $2.52 (U.S.) since our last review in February plus the dividend has been raised three times this year. It currently stands at $1.55 per quarter, which is 19% higher than at this time last year. SPG is the largest retail property group in the United States, with interests in shopping malls across the country.

Alimentation Couche-Tard (ATD.B-T, OTC: ANCUF). Despite a recent pullback, Couch-Tard is still up more than $10 a share since February. When the stock was added to the portfolio the shares were trading at a split-adjusted $16.53. As of Aug. 20 they were trading at $57.85. Add in some modest dividends and we have a total return of almost 250 per cent on this one making it the best performer in the portfolio.

WSP Global Inc. (WSP-T, OTC: WSPOF). The TSX is having a bad year but a few stocks are bucking the trend. WSP Global is among them. It is one of the world's leading professional services companies, employing some 32,000 specialists in 39 countries on five continents. The share price is up $8.47 (22.8 per cent) in the past six months plus we received two dividends totalling 75 cents per share.

Stella-Jones Inc. (SJ-T, OTC: STLJF). The slowdown in the rail sector has hit this industry supplier, which is a leading North American manufacturer of railway ties and utility poles. The shares are down about $2 from their 52-week high reached in May, however they are still ahead by 17.3 per cent from our last review. The dividend is small, only 8 cents per quarter, so like Alimentation Couche-Tard this is primarily a growth story. Total return since inception is 171 per cent.

TransForce Inc. (TFI-T, OTC: TFIFF). Trucking and courier company TransForce reported very good second-quarter results with adjusted net income per share up 25% from the same period a year ago. However, investors reacted negatively to the company's reduced outlook for full-year revenue and earnings per share due to weakness in the Canadian economy, particularly in the West. The stock is down almost 23% since February, although we still have a respectable profit since the creation of the portfolio. I'll monitor this one closely over the next few months.

New Flyer Industries (NFI-T, OTC: NFYEF). This Winnipeg-based heavy-duty bus manufacturer is one of the beneficiaries of a lower Canadian dollar since much of its production is sold in the U.S. That was reflected in strong second-quarter earnings, with bottom line profit coming in at $12.4 million (22 cents per share, figures in U.S. dollars). That compared to $3.6-million (8 cents per share) in the same period a year ago. The share price is up $5.80 (43 per cent) since the February review and the company increased its dividend by 6 per cent in May.

Apple Inc. (AAPL-Q). Investors have temporarily fallen out of love with Apple, in part because of the disappointing sales of its supposed big new product, the Apple watch. We added this stock to the portfolio in February as a replacement for Michael Kors (KORS-N). Even though Apple hasn't made a profit for us so far, it has performed far better than KORS, which dropped from $70.18 at the time we sold it to around $42 now. Apple's price will bounce back so be patient.

UnitedHealth Group Inc. (UNH-N). This U.S. health insurance provider, which has benefitted from the introduction of Obamacare, continues to generate strong returns. The shares are up more than $10 in the past six months and the company raised its dividend by one-third in June to 50 cents (U.S.) per quarter ($2 annualized).

Here is how the portfolio stood on the afternoon of Aug. 20. Commissions are not taken into account and the U.S. and Canadian dollars are treated as being at par but obviously gains (or losses) on the American securities are increased due to the significant exchange rate differential.

Comments: The total value of the portfolio, including retained distributions, now stands at $21,440.35. That's up $2,828.50 from the February review, for a six-month gain of 15.2 per cent. That's quite remarkable, given the generally negative stock market tone we experienced over that time.

Based on the initial cost of $10,000, the portfolio has more than doubled in value in its first three years with a total gain of 114.4 per cent. That works out to a compound annual growth rate of almost 29 per cent. It would be unrealistic to expect results to continue at the current torrid pace so let's enjoy it while we can.

Changes: The allocations in the portfolio are getting out of whack. Couch-Tard's strong performance has pushed up its market value to the point where it represents almost one-quarter of the total assets. This is a great stock but that's assigning too much of our assets to one company. Therefore, we will sell 21 shares of ATD.B for proceeds of $1,214.85. That will reduce our position to 70 shares.

We will use $1,017.27 of that money to buy another nine shares of Apple, bring our total to 20. This will reduce our average price for the stock to $121.70. The balance of $197.58 will be added to our cash reserve.

We won't make any other changes for now. Here is the revised portfolio. We'll look at it again in February.