Hi Lou,

Not sure whether you limit yourself to Canadian equities but if you do not I would like your opinion on NLS. You are a great fan of the RSI metric and NLS seems an excellent example to this amateur.

Cheers,

Jim

Hey Jim,

Thanks for the assignment. The goal that I set out when I invite investors to send in their requests is to provide a feedback loop for those seeking a second opinion. I don't limit myself to Canadian equities but the majority of the inquiries that I receive are focused on stocks trading north of the border. I gladly examine stocks trading on markets in the United States when asked, so let's examine the case for Nautilus Inc. (NLS NYSE).

NLS is a leader in the home fitness space with brands such as Nautilus, Bowflex, Universal, and Schwinn. Bowflex will be familiar to anyone who watches television. It seems that the company has a never-ending stream of innovative new machines to help clients achieve their fitness goals. The Schwinn unit does not represent bicycles for use on streets or trails but rather stationary bicycles for indoor use.

The company has been successful in growing its revenue and net income over the last number of years providing investors with a rationale to hit the buy button. A survey of the charts will help form my opinion of this stock.

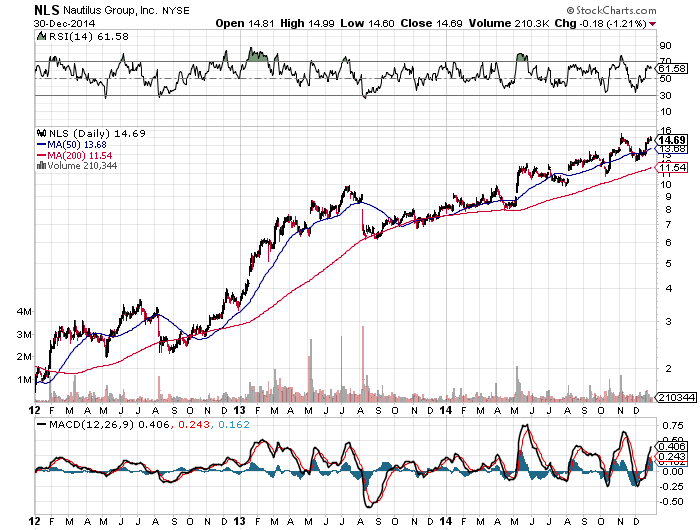

The three-year chart illustrates how generous NLS has been since January of 2012 when it traded below $2.00. The ascent however was not without its pullbacks but over the course of the last three years support along the 200-day moving average has held. Clearly investors were sufficiently confident to buy on the dips. As you mentioned the RSI has generated a number of buy-and-sell signals along the advance.

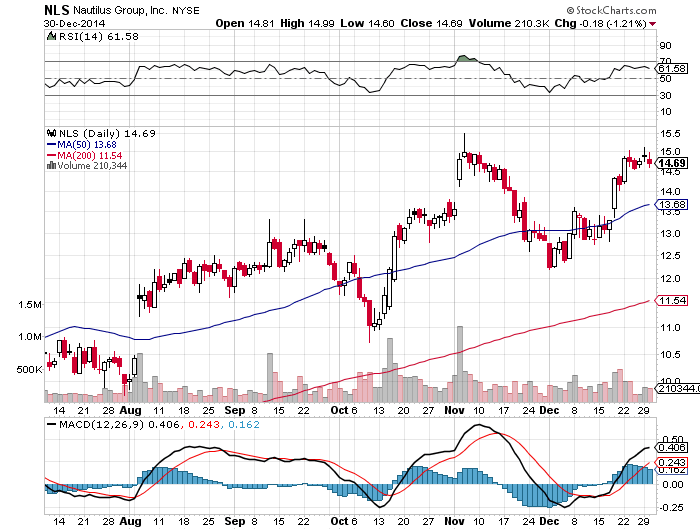

The six-month chart provides a close up of the buy-and-sell signals generated by the RSI since July. Most notably the buy in October and the sell in November. currently the RSI is neutral at best and the MACD looks to be turning lower. Also worth mentioning is the resistance that has formed at $15. Until there are better indications that NLS is ready to move through $15 it would be prudent to look for a better entry point.

Make it a profitable day and happy capitalism!

Have your own question for Lou? Send it in to lou@happycapitalism.com.