Andrew Hallam is the index investor for Globe Investor's Strategy Lab. Follow his contributions here and view his model portfolio here.

Each year, the Dalbar Research and Communications Group dishes out artillery. Financial advisers who claim investors can't effectively build their own portfolios receive it with open arms. They use that artillery on clients who plan to jump ship – those itching to manage their own money.

Dalbar says the typical investor underperforms the market, long term, by more than 4 per cent per year. The S&P 500 averaged 9.22 per cent between 1994 and 2014. But according to Dalbar, the typical U.S. investor in equity funds averaged just 5.02 per cent.

Canadians' investment patterns are likely similar.

Such a gap between how the market performs and how investors perform isn't explained by fees alone. The typical U.S. actively managed mutual fund costs about 1.3 per cent a year. So why the yawning 4.2-per-cent gap between what the market earned and what the typical investor made?

Dalbar says most investors perform poorly because of bad choices such as market timing, speculating on scorching sectors or gambling on funds with red hot managers. Such behaviour leads people to buy high and sell low.

DIY investors are usually concerned about fees – and for good reason. Actively managed Canadian mutual funds cost more than 2 per cent per year. Cost conscious investors prefer cheaper index funds. According to the SPIVA Canada scorecard, over the past five years, just 19.57 per cent of actively managed Canadian equity funds outperformed the S&P/TSX composite index.

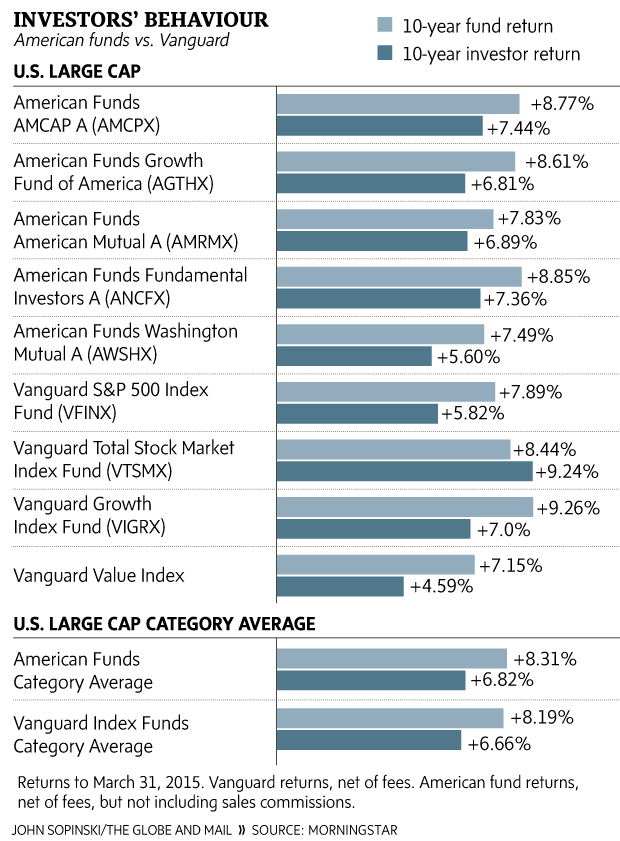

But do the steady hands of financial advisers improve investment performance? I wanted to see if investors guided by professionals could equal the returns of the funds they owned. For example, if a fund averaged 10 per cent annually over a 10-year period, did its investors average 10 per cent? I also wanted to see if investors guided by financial advisers behaved more rationally than Vanguard's investors – most of whom invest on their own.

To find out, I looked at the American Funds from Capital Group, the third-largest fund company. I chose it because you can only buy their funds through a financial adviser. And Morningstar doesn't provide investment return data for Canadian fund companies.

When measuring U.S. large-cap equity funds with 10-year returns, investors in the American Funds underperformed their investments by 1.49 per cent per year. Investors in Vanguard's large-cap indexes were just as silly. They underperformed their funds by 1.53 per cent per year.

Advisers did worse in the American Funds emerging market category. Their clients underperformed their investments by 2.77 per cent per year for the decade ending March 31, 2015. Vanguard's index fund investors beat their emerging market benchmark by 0.13 per cent per year.

In the small-cap category, the American Funds advisers really missed the mark. Their investors underperformed their funds by 1.57 per cent per year. Vanguard's emerging markets index investors underperformed by 1.13 per cent.

On average, the adviser-guided equity investors with American Funds underperformed their fund returns by 1.70 per cent annually. Investors with Vanguard – most likely DIY investors – underperformed their funds by 0.90 per cent per year.

So what's the trick to decent performance? Whether you build your own portfolio of ETFs or an adviser selects funds for you, a buy-and-hold approach works best. Ensure that your money is diversified. Invest equal sums each month. Rebalance once a year. And don't speculate that one fund or category will outperform another.

Too many of us, it seems, are wired to be knuckleheads with money – whether we're financial advisers or not.