A humorous look at the companies that caught our eye, for better or worse, this week

NU SKIN ENTERPRISES - DOG

Nu Skin’s products are supposed to give users a youthful glow, but investors have developed some unsightly worry lines. Hit by unfavourable exchange rates and a slowdown in China – its biggest market – the multilevel marketer of skin-care products and nutritional supplements slashed its third-quarter sales outlook to between $570-million (U.S.) to $573-million, well below the $606-million analysts were expecting. That’ll put a few years on your face.

NUS (NYSE), $36.64 (U.S.), down $7.48 or 17% over week

CONTAINER STORE - DOG

Fun prank: Walk into the Container Store and ask if they “happen to have anything big enough to fit a human body.” The retailer of shelving units, closet organizers and storage bins was dead money this week after it posted second-quarter results slightly below estimates, hurt by a minuscule increase in same-store sales. When your stock has a price-to-earnings multiple of more than 50, any mistakes get severely punished, see?

TCS (NYSE), $11.90 (U.S.), down $3.24 or 21.4% over week

CANADIAN OIL SANDS - STAR

Good news, Canadian Oil Sands investors: Your shares are up about 60 per cent since Suncor made a $4.3-billion takeover offer. Unfortunately, the shares are still down about 50 per cent from a year ago before oil collapsed. But don’t despair: With COS’s board rejecting Suncor’s advance and implementing a “poison pill,” there’s still hope that a better offer will emerge. Or that oil prices will rise. Or that you will win the 50-50 draw at your kid’s hockey game.

COS (TSX), $9.83, up $3.64 or 58.9% over week

YUM BRANDS - DOG

Yum? More like Yuck! The owner of KFC, Pizza Hut and Taco Bell left a terrible taste in investors’ mouths after reporting third-quarter results well below expectations and cutting its full-year earnings guidance, causing the stock to tank. With Yum’s troubled operations in China posting same-store sales growth of just 2 per cent – far less than the 9.6 per cent analysts were looking for – investors are having trouble digesting the news.

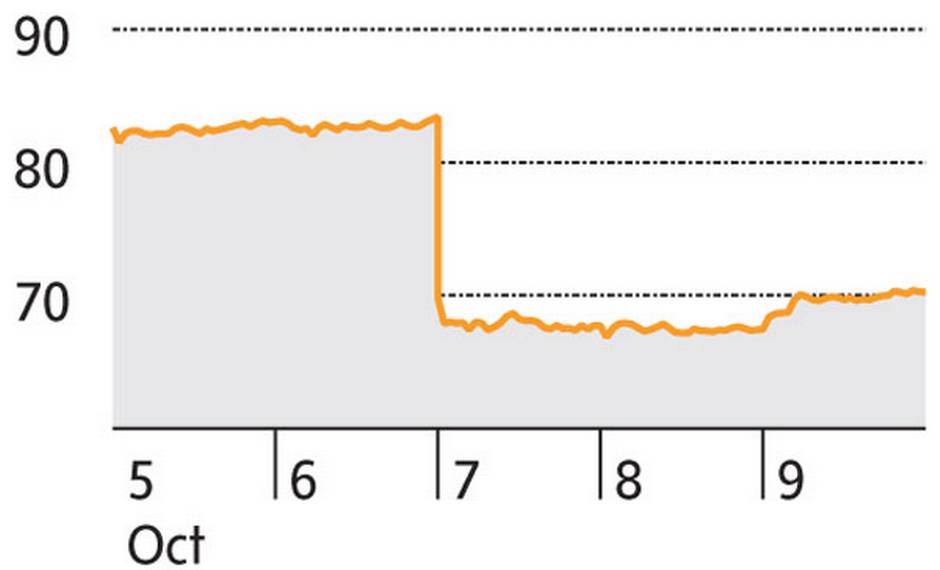

YUM (NYSE), $70.25 (U.S.), down $11.35 or 13.9% over week

RADWARE - DOG

Business quiz: Radware is:

a) a retailer of skateboarding and snowboarding apparel;

b) a company that makes decorative covers for radiators;

c) a “global leader of application delivery and application security solutions for virtual, cloud and software-defined data centres.”

Answer: c.

Well, duh! Too bad Radware’s stock suffered some radical losses when the company warned that third-quarter earnings will be less than half of previous guidance.

RDWR (Nasdaq), $14.34 (U.S.), down $2.33 or 14% over week