A humorous look at the companies that caught our eye, for better or worse, this week

DOLLARAMA (STAR)

Inflation-orama? It’ll-cost-you-another-dollar-ama? Dollarama might want to consider changing its name now that it plans to hike its top prices to $4 from $3 to offset rising costs. Customers may not like Dollarama’s ever-increasing prices, but investors aren’t complaining: The retailer posted a 31.6-per-cent gain in earnings per share for the fiscal fourth quarter and raised its dividend – triggering an inflationary spike in its stock price.

DOL (TSX), $92.13, up $12.69 or 16% over week

DRAGONWAVE (STAR)

Why did DragonWave’s stock jump this week? Simple: The “leading provider of high-capacity packet microwave solutions” announced a joint venture with Mitel, a “world leader in network function virtualization (NFV) mobile solutions,” in which DragonWave “will contribute all outdoor networking expertise combined with small cell-focused and high-capacity, spectrally-efficient packet wireless backhaul solutions.” Any questions?

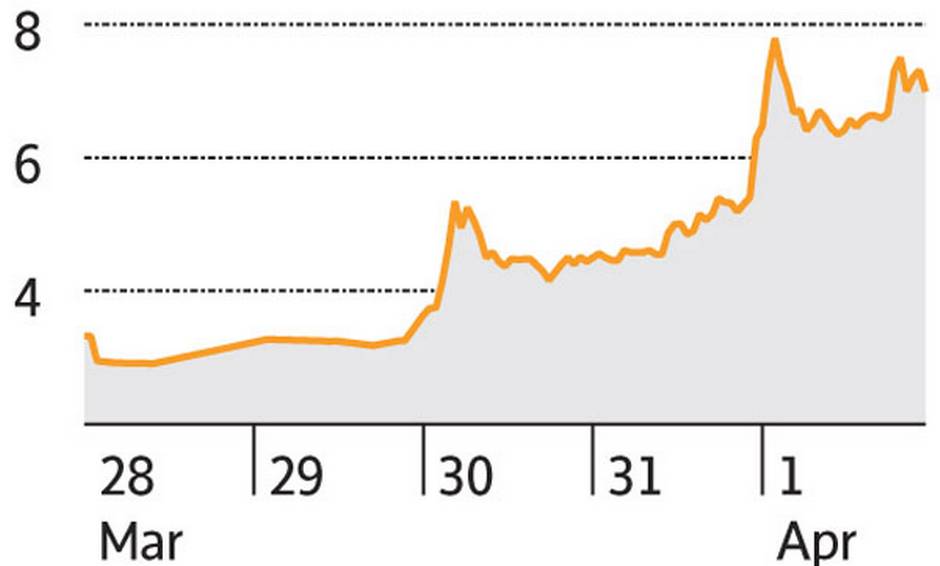

DWI (TSX), $6.99, up $4.09 or 141% over week

LULULEMON ATHLETICA (STAR)

Well, it looks like Lululemon might finally be putting its problems, er, behind it. Since the see-through yoga pants debacle of 2013 caused a massive rip in its share price, the retailer has been revamping its image by rolling out more elaborate designs and expanding its men’s and children’s lines. With fourth-quarter earnings per share rising a better-than-expected 9 per cent, the stock extended its recent gains – no ifs, ands, or butts.

LULU (Nasdaq), $68.69 (U.S.), up $7.80 or 12.8% over week

SUNEDISON (DOG)

For SunEdison, the outlook keeps getting darker. Once described by CNBC’s Jim Cramer as the “Valeant of solar” – that was meant as a compliment when both stocks were soaring last year – SunEdison is being investigated by the SEC over allegations it vastly overstated its cash position. With SunEdison’s stock plunging 98 per cent since July and the company facing a possible Chapter 11 bankruptcy filing, Valeant’s situation is looking positively bright by comparison.

SUNE (NYSE), 43¢ (U.S.), down 78¢ or 64.5% over week

PANDORA MEDIA (DOG)

Pandora’s Internet radio service plays all styles of music, but investors are particularly fond of the blues. Weeks after the company reported disappointing fourth-quarter results and a drop in listeners – hit by competition from rivals such as Spotify and Apple Music – Pandora announced that co-founder Tim Westergren is returning as CEO, replacing Brian McAndrews, who departed after less than three years.

“My CEO left me (duh-da-duh-dun) and my stock’s a goin’ down … ”

P (NYSE), $8.98 (U.S.), down $1.95 or 17.8% over week