A humorous look at the companies that caught our eye, for better or worse, this week.

Micex Index

MICEX (Russia)

March 7, 2014 close: 1,339.36

down 105.35 or 7.3% over week

Hullo, Vladimir Putin here. You have seen my photos, da? I like to hunt and fish without shirt. Now Russian investors lose their shirts, too, ha ha. Sorry, I make bad joke. Seriously, though, this is not the fault of Vladimir Putin. I host greatest Olympic Games ever! I come to aid of Russian peoples of Crimea! You want a piece of Vlady? Obama, take off shirt. We wrestle now.

Nickel

Nickel (LME, 3-month futures)

March 6, 2014 close: $15,470 (U.S./tonne)

up $750 or 5.1% over week

There once was a metal called nickel

The price of which used to be fickle

But as worries arise

About Russia’s supplies

The sellers have slowed to a trickle

Constellation Software

CSU (TSX)

March 7, 2014 close: $265.48

up $20.56 or 8.4% over week

Constellation: A group of stars forming a particular shape or pattern.

Constellation Software: A company whose stock is shooting to the stars. Boosted by a string of acquisitions, the provider of software to businesses and governments in more than 30 countries posted a 20-per-cent jump in adjusted net income for 2013. Investors need a new software program to keep track of all the money they are making.

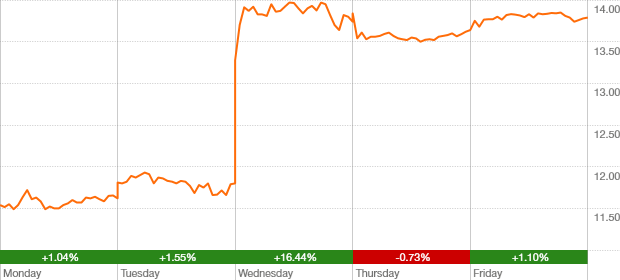

Smith & Wesson

SWHC (Nasdaq)

March 7, 2014 close: $13.79 (U.S.)

up $2.29 or 19.9% over week

Guns don’t kill people, or so the firearms lobby says. But there’s no debating that guns make people rich.

Case in point: Smith & Wesson. Lifted by 30-per-cent growth in handgun sales, the firearms maker posted better-than-expected quarterly earnings. Seems people worried about potentially tighter gun laws after a spate of mass shootings have been stocking up on weapons, making America not only wealthier – but, er, safer too.

Staples

SPLS (Nasdaq)

March 7, 2014 close: $11.48 (U.S.)

down $2.11 or 15.5% over week

You know when the office practical joker “accidentally” puts your 50-page presentation into the shredder? Welcome to the world of the Staples investor. Shares of the office products retailer, which is struggling amid intense competition from online players, got ripped to pieces after the chain reported a 7-per-cent drop in quarterly same-store sales. With 225 stores slated to close by the end of 2015, investors are shopping elsewhere.