A humorous look at the companies that caught our eye, for better or worse, this week.

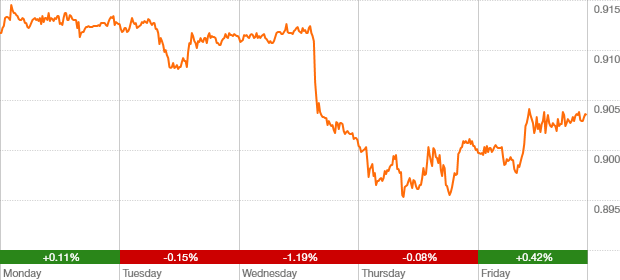

Canadian Dollar

CAD/USD

Jan. 24, 2014 close: 90.31 cents (U.S.)

down 0.8 cents or 0.9% over week

Signs the Canadian dollar is getting pummelled:

1) When you toss a loonie to a panhandler in Buffalo, he throws it back;

2) Washrooms at U.S. hotels are replacing toilet paper with stacks of Canadian bills;

3) The Royal Canadian Mint is planning a limited-edition “drowning loonie” coin.

With the Bank of Canada in no hurry to stop the slide, the currency plunged to its lowest in more than four years.

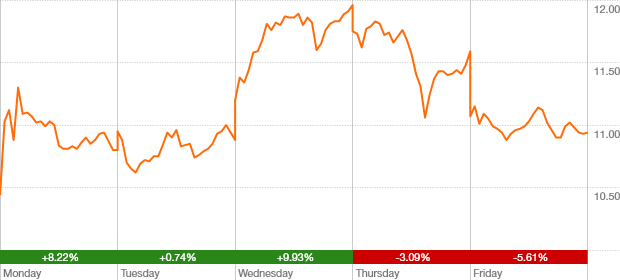

BlackBerry

BB (TSX)

Jan. 24, 2014 close: $10.94

up 96 cents or 9.6% over week

Great news!

BlackBerry shares have rallied about 38 per cent in 2014. Too bad they’re only back to where they were in September. Well, it’s a start. The gloom surrounding the troubled smartphone maker partially lifted this week when the company said it plans to sell most of its Canadian real estate to raise cash. Unfortunately, a separate story about the Pentagon ordering 80,000 BlackBerrys turned out to be untrue.

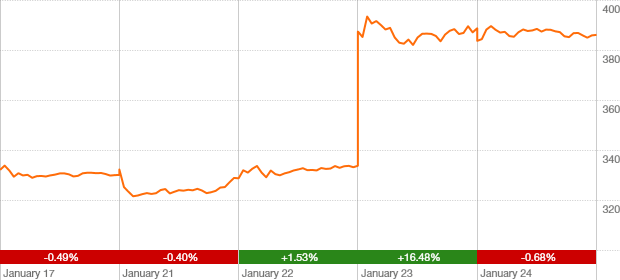

Netflix

NFLX (Nasdaq)

Jan. 24, 2014 close: $386.08 (U.S.)

up $56.04 or 17% over week

Netflix offers an extensive selection of TV shows and movies. But if you want real entertainment, check out the stock: The shares – the biggest gainer on the S&P 500 last year – surged to a record after fourth-quarter earnings topped estimates and the company added four million subscribers worldwide, for a total of 44 million. Given the stock’s forward P/E of 100, investors had better hope the growth continues – or else.

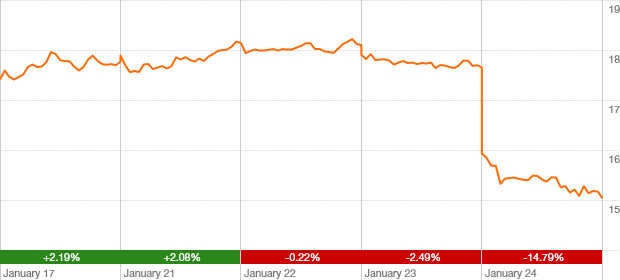

Int’l Game Technology

IGT (NYSE)

Jan. 24, 2014 close: $15.04 (U.S.)

down $2.73 or 15.4% over week

International Game Technology makes a wide variety of video terminals designed to empty the pockets of casino gamblers. Lately, it’s been emptying investors’ pockets, too. Citing “declining gross gaming revenue trends,” the company missed first-quarter estimates and warned that 2014 earnings will be at the low end of its guidance range, with “potential further downside risk.” You win some, you lose some.

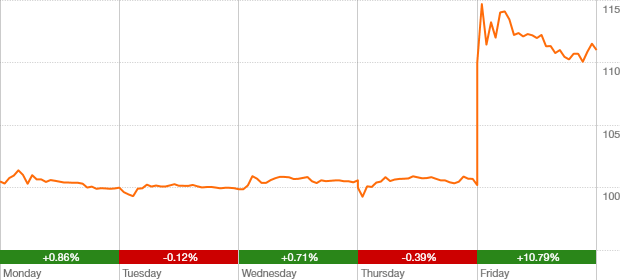

Open Text

OTC (TSX)

Jan. 24, 2014 close: $111

up $11.86 or 12% over week

Multiple choice quiz! Over the past 20 years, business software maker Open Text has completed ____ acquisitions:

a) Zero;

b) 24;

c) 48;

d) None of your business.

Answer: c. And it’s not done yet.

The company, which just snapped up U.S.-based GXS Group for about $1.1-billion (U.S.), plans to spend at least $3-billion on deals over the next five years. That, plus better-than-expected earnings, sent the shares to a record.