Last week I introduced some myths around borrowing money to invest. This week, I want to talk about the potential rewards of the idea.

Reward 1: Leveraged investing is a forced investment plan.

Maybe you've heard that if your income is less than your outflow, then your upkeep will be your downfall. Why? Because there will be nothing left at the end of the day to invest for the future. Leveraged investing creates a pool of invested capital that you're required to pay for through regular loan payments. It's really a forced savings or investment plan, and this can be a good thing.

Reward 2: You can build wealth using another's resources.

There are really two ways to build wealth: Through properly utilizing (1) your time and energy, and (2) your assets. For many, their time and energy represent their greatest opportunity for building wealth. It should be the other way around. Your assets should work for you to increase your net worth, and it's helpful to start with a significant amount of capital in your investment account. Borrowing to invest allows you to make use of someone else's money to get that financial ball rolling more quickly.

Reward 3: Leveraged investing can boost your effective returns.

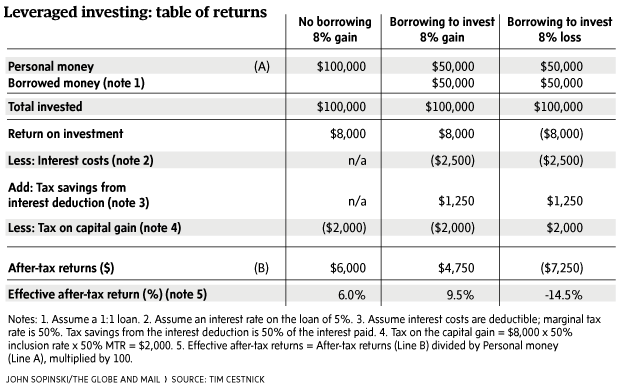

Leveraged investing can increase your effective rate of return. Consider Sarah. Her story is reflected in the accompanying table. Sarah had $50,000 of her own to invest and borrowed another $50,000 for a total portfolio of $100,000. Let's assume her portfolio grew by 8 per cent, or $8,000, over the last year. Assume also that she paid 5 per cent on her loan, for total interest costs of $2,500, which she can deduct for tax purposes. This deduction will save her $1,250 in taxes at a marginal tax rate of, say, 50 per cent.

If Sarah were to sell her investments today, she'd pay taxes of $2,000 on her capital gain ($8,000 capital gain times 50-per-cent inclusion rate times 50-per-cent marginal tax rate). In the end, she'd have $4,750 in her pocket after tax ($8,000 gain, less $2,500 in interest, plus $1,250 in tax savings, less $2,000 in taxes on the capital gain). This represents a 9.5-per-cent aftertax return on her investment ($4,750 divided by $50,000 of her own money invested times 100).

Did you catch that? She earned 8-per-cent pretax on her portfolio but her effective return was 9.5 per cent after taxes because she borrowed to invest. If she had not borrowed, her aftertax return would have been 6 per cent. You'll see from the table that leverage will magnify your gains – but will also magnify your losses.

Reward 4: You may reach your financial goals faster.

Since leveraged investing gets more money working for you sooner, you could reach your financial goals faster. Suppose you plan to retire as soon as you can accumulate $1-million before taxes. Let's assume you can afford to set aside $5,000 annually in a balanced portfolio, and that you've already got $200,000 invested. You can use that $5,000 to add to your portfolio every year, or consider using the $5,000 to cover interest on a $100,000 interest-only loan today. Assuming an 8-per-cent annual return on your portfolio and a 5-per-cent interest cost on the loan, you'd reach the $1-million mark in 22 years without leverage, and 19 years with leverage – three years sooner.

Reward 5: Leveraged investing can create a tax deduction for interest costs.

If you borrow for the purpose of earning income, the interest costs on your loan can be deductible for tax purposes. For every dollar of interest paid, you can expect to save the interest costs multiplied by your marginal tax rate. For example, $5,000 in interest costs would save $2,500 in taxes at a 50-per-cent marginal tax rate.

More on the risks of leveraged investing next time.

Tim Cestnick is managing director of Advanced Wealth Planning, Scotiabank Global Wealth Management, and founder of WaterStreet Family Offices.