Are we finally seeing the bottom of the latest downturn in the mining cycle?

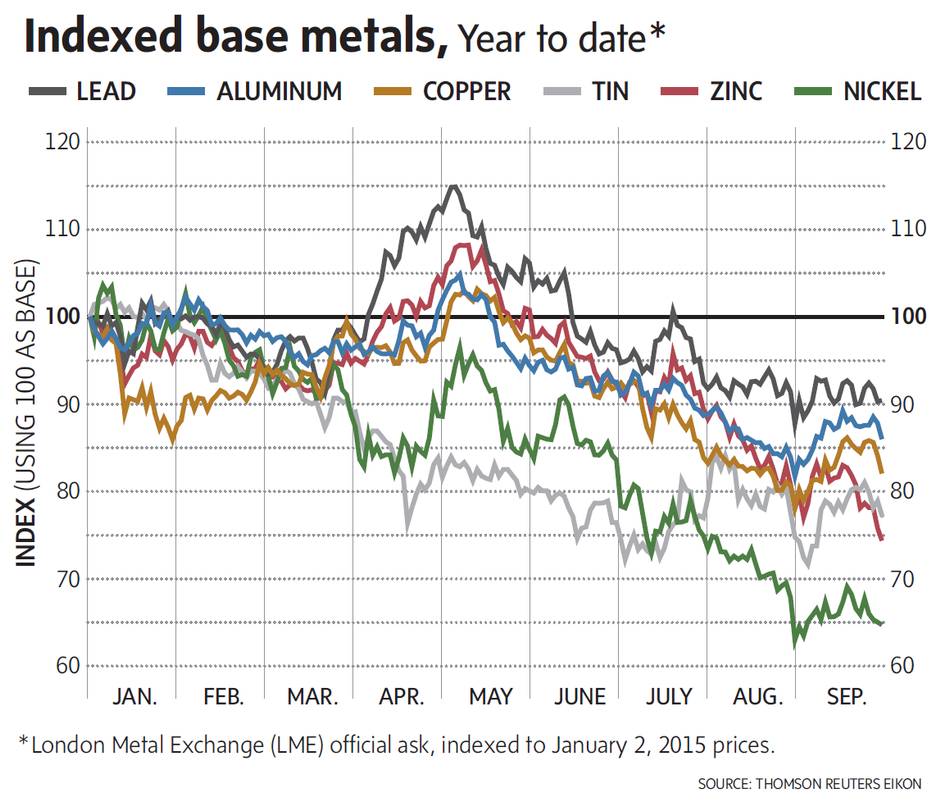

Investors would be forgiven for rolling their eyes at such a prediction, given how many times it has been made since prices of commodities such as coal, copper, nickel and zinc started to slide from record or near-records in 2011.

While many experts believe industrial metal prices will remain volatile in the months ahead due to uncertainty in the Chinese economy, a growing number are forecasting better days are (finally) ahead.

“While further downside is likely in store for several commodities, we suspect that prices for most will find a bottom by the end of this year, and begin to trend up thereafter,” TD Bank economist Dina Ignjatovic said recently.

JP Morgan put a “buy” on the mining sector recently, saying it expects commodity prices to recover in the next year or so as China’s economy stabilizes. Mining companies have been slashing costs and capital spending to cope with lower commodity prices. Some have also been forced to take massive write-offs as a result of lower valuations. JP Morgan believes many of these earnings downgrades are done, at least for now.

Some big name investors are also now putting money into the sector. Carl Icahn recently bought an 8.5-per-cent stake in base metal producer Freeport-McMoRan Inc., becoming one of its largest shareholders. George Soros has taken notable positions in companies like Barrick Gold and coal miners Peabody Energy and Arch Coal. The growing interest from these activist investors suggests a belief there is money to be made if and eventually when prices climb higher.

The renewed interest in the downtrodden mining sector comes as commodities have once again been plagued by concerns about economic growth in China, the world’s largest consumer of metals such as copper, nickel and coal.

Some believe the latest sell-off, while an opportunity for some investors, may have been overblown.

“Fresh evidence of the Chinese malaise has put raw material prices under further pressure as we have experienced classic knee-jerk reactions in the marketplace – even though the bear markets in this sector have been heralding this economic development,” said Rhona O’Connell, head of metals at GFMS, a division of Thomson Reuters, in a recent market commentary.

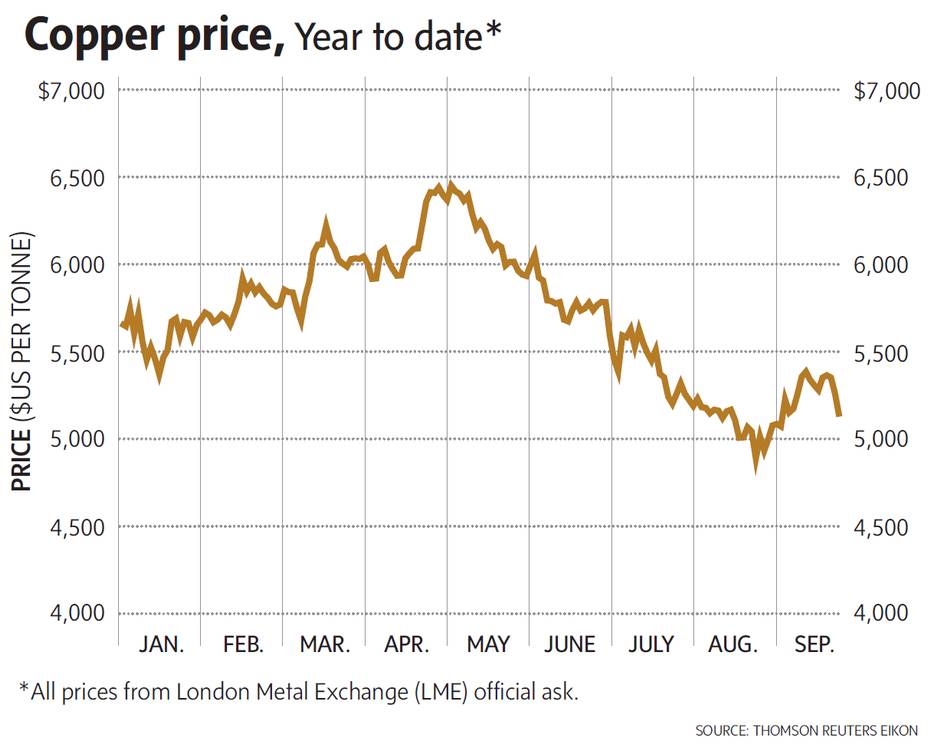

Copper is especially vulnerable to economic growth concerns in China, given the country accounts for more than 40 per cent of the world’s supply.

“Although the next few months and are likely to be painful for the copper market (and that of other industrial metals), this recent spike downwards has been driven by a degree of panic,” O’Connell said. “The current may prove to be short-lived and there may well be more pain to come, but we believe that these markets are slowly starting to come out of the woods.”

Bruce Alway, manager of base metals mining at GFMS, said the industry has been struggling in part due to the production from newer, larger mines being built in recent years.

“On the back of the mining boom there is quite a lot of new supply coming on and not enough discipline,” around cutbacks, Alway said.

However, he believes supply is starting to better match demand. That’s due in part to a dramatic drop in investment in the sector, which has put some projects on the sidelines and slowed the timing of others.

Production of certain metals, such as a copper, has also slowed around the world due to unforeseen factors such as strikes, flooding and geopolitical tensions. Alway points to examples in recent months such as power disruptions in Zambia, labour unrest in Chile and Indonesia’s export bank. There is also Glencore Plc’s recent decision to suspend production at units in the Democratic Republic of the Congo and Zambia so it can build new, cheaper processing facilities.

This combined loss of production could help to put a floor under copper prices in the months to come, Alway said.

Still, concerns remain that China’s growth rate will continue to slow, especially after the U.S. Federal Reserve cited China’s stumbling economy as a reason not to raise interest rates in September.

It’s speculation that analysts at Capital Economics call describe as “wide of the mark.”

“In fact, a range of measures covering imports, output and spending suggest that conditions have stabilized and, in many cases, improved since the start of the year,” economists Mark Williams, Chang Liu and Julian Evans-Prtichard said in a recent a note.

While it’s a “risk worth considering … given the evidence of stabilization in recent data, and the fact that further monetary and fiscal support are in the pipeline, a more likely outturn is that China’s economy strengthens over the quarters ahead,” they said.

With copper, for example, Capital Economics is calling on price to increase to $6,250 per tonne from about $5,400 by the end of the year, “with more gains to come in 2016.”

Thomson Reuters Know 360 App – Your mobile thought leadership library. Published by professionals for professionals, Thomson Reuters publications provide exclusive insights, ideas and information for the financial, risk, legal and scientific markets. Thomson Reuters Know 360 invites you to learn more and download the app for free to your tablet device or iPhone at thomsonreuters.com/know360app

This content was produced by The Globe and Mail's advertising department, in consultation with Thomson Reuters. The Globe's editorial department was not involved in its creation.