Come this afternoon, the market will once again turn its attention to the fortunes of the world's most profitable technology company. There's little doubt Apple's quarterly earnings for the quarter ended December 31 will include some eye-popping numbers. But beyond the headlines – revenue, profit, iPhones and iPads sold – there are four areas of concern that will largely determine how investors react to Apple's latest numbers.

Reuters

China

A big part of Apple’s stock-price jump since July of last year has come from a suite of new products, such as the high-end iPhone 5S. But much of the investor optimism is also due to the company’s new deal with telecom giant China mobile. The deal allows Apple to claim a much larger share of the smartphone pie in what is perhaps the most potentially lucrative market in the world.

There’s only one problem – expectations are sky-high, and now it’s time to find out if Apple can deliver. Even after making its new devices available through China Mobile, Apple has a long and difficult battle to catch up to Chinese market leaders, such as rival Samsung. If the company doesn’t have good news from China in its earnings results Monday, much of the investor optimism may quickly burn away.

AP

Margins

A serious cause of worry among analysts for some time, Apple’s shrinking margins will probably not be helped by its expanded China presence, as the company continues to make lower-priced phones a bigger part of its product mix. Even as it continues to sell an astounding number of products, Apple has seen its gross margins drop or remain unchanged for seven straight quarters. In the second fiscal quarter of 2012, the company reported margins of 47.4 per cent. But that number has declined gradually, coming in at 37 per cent last quarter, and expected to be about the same when Apple reports on Monday. The shrinking margins are in part due to an industry-wide trend that’s seeing more and more consumers opt for low-price, commodity smartphones instead of high-end devices such as some of the latest iPhones. But for years, as lower-priced competitors have eaten away at its market share, Apple has remained by far the most profitable smartphone-maker – investors will want some insight on how long that profitability is likely to last.

Apple's gross margins

SOURCE: Company filings

AP

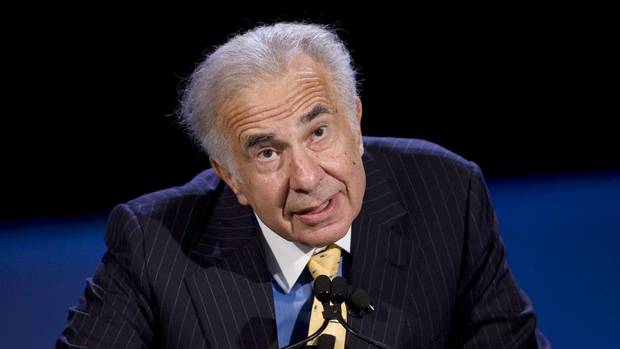

The Icahn Effect

Earlier this month, big-name investor Carl Icahn announced that he boosted his stake in Apple, as he continues to push for the company to give some of its cash back to investors.

Mr. Icahn now owns about 0.7 per cent of Apple, an investment of about $3.7-billion. The investor has been very publicly urging the company to use some of its money for a share buyback or increased dividend. Mr. Icahn points out that Apple is currently sitting on about $140-billion in cash, and is currently, in his opinion, undervalued. However others argue that sitting on a mountain of cash is not an especially unusual thing for a major tech company today, and that much of Apple’s cash is tucked away overseas, and as such subject to a heavy tax hit should the company move it to the U.S.

On Apple’s conference call on Monday, analysts will be listening closely to see if Mr. Icahn’s influence has had an impact on management’s thinking, and whether the company plans to give some of its investors’ cash back to them.

AP

Phablets

It may be the silliest product name in an industry full of silly product names, but phablets have become the latest craze among hardware-makers looking to squeeze a bit more profit out what is quickly becoming a commodity market. In recent years, companies such as Samsung have sought to blur the lines between what some consumers may consider a small tablet and others a large smartphone. In all, Samsung and others now offer dozens of screen sizes, from traditional 4-inch smartphones to 12-inch behemoth tablets. Apple, on the other hand, has largely resisted the lure of such in-between devices. But that may change as pressure mounts on the company to continue making incremental improvements to its hallmark iPhone and iPad lines. While it continues to build better screens, batteries and processors, the company may also start looking at capitalizing on the growing phablet market. Normally, Apple’s management says exactly nothing about upcoming products during its conference calls, but CEO Tim Cook might give a few hints as to whether the company has changed its mind on multiple screen sizes.