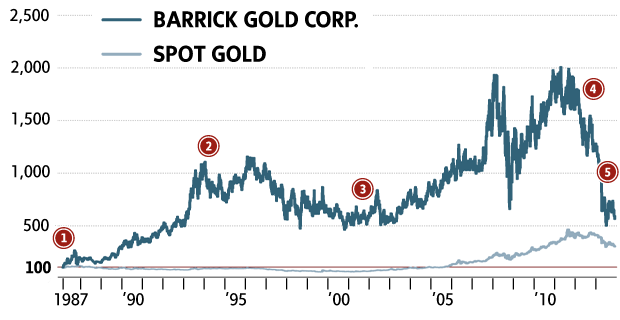

Barrick vs. Spot Gold

1. The beginning

May 1983: Barrick Resources goes public. Controlled by Peter Munk and his partner David Gilmour, the firm holds mainly oil and gas exploration assets, with a few gold interests.

July 1984: Barrick buys Camflo Mines, a Toronto company that has gold mining operations in Quebec; its first substantial gold asset.

Dec. 1986: Barrick buys the Goldstrike mine in Nevada, which proves to be an enormous gold resource. The company now owns six North American gold mines.

2. Early success

August 1994: Barrick buys Lac Minerals for $2.3-billion, after winning a bidding war with rival Royal Oak Mines. This makes it the world’s third-largest gold producer

3. Mergers and acquisitions

June 2001: Barrick merges with Homestake Mining in a $2.2-billion deal, creating the world’s second largest gold producer.

Oct. 2005: Barrick launches a hostile bid to buy Placer Dome. When the $12.1-billion deal closes in early 2006, Barrick is the largest gold company in the world.

May 2007: The company eliminates the last of its hedge contracts, allowing it to take full advantage of gold price increases (and exposing it to falling prices).

4. Trouble on the horizon

April 2011: Barrick launches $7.3-billion takeover of copper producer Equinox Minerals, only to write down half of that value two years later when copper prices slump.

June 2012: CEO Aaron Regent is fired after four years on the job, a period when the Barrick share price stagnated despite a big jump in the price of gold.

5. The decline

Oct. 2013: Barrick halts construction on its Pascua Lama gold and silver project that straddles the border between Argentina and Chile, and launches a $3-billion stock sale.

Dec. 2013: Barrick announces that Peter Munk will step down as chairman at the next annual meeting, in 2014.

Chart shows daily closes. Index: Feb 25, 1987 = 100

Graphic by Richard Blackwell and John Sopinski

Source: Bloomberg