Rogers Communications Inc. is radically overhauling its magazine strategy, the latest signal of the publishing industry's retreat from print amid a steady erosion of advertising revenues.

Rogers announced Friday it will reduce the print schedules of Maclean's, Chatelaine and Today's Parent and cease publishing print editions for Canadian Business, Flare, MoneySense and Sportsnet magazines. Rogers is also seeking a buyer for its trade publications and French-language magazines.

That Canada's largest English-language magazine publisher is taking such drastic steps signals a long-expected tipping point has arrived for the industry. Declining print revenue is now commonplace among magazines and newspapers, mostly because advertisers are moving in droves to buy cheaper digital ads that more accurately measure the audience they reach. Even so, Rogers stands out: Its print revenue plunged more than 30 per cent, year over year.

"This isn't something that we're trying to drive. It's the market driving us," Rick Brace, president of Rogers Media, said in an interview. "We can't remain status quo."

Where Rogers has been pouring millions of dollars into holding the line with print subscribers, it is now willing to walk away from significant revenue to shed the accompanying costs of printing and distributing magazines, and to spend more of its energy trying to tap an emerging audience of digital natives.

Come January, Canadian Business, Flare, MoneySense and Sportsnet magazine will continue as "content brands," publishing daily to websites and dedicated apps, but will no longer craft separate issues.

Maclean's, Canada's only weekly news magazine, will shift to monthly print editions, while maintaining a weekly digital edition. Chatelaine and Today's Parent will halve their publishing schedule to six issues a year, in print and online. Hello! Canada, which Rogers publishes under licence from the magazine's Spanish parent Hola!, will still be printed weekly.

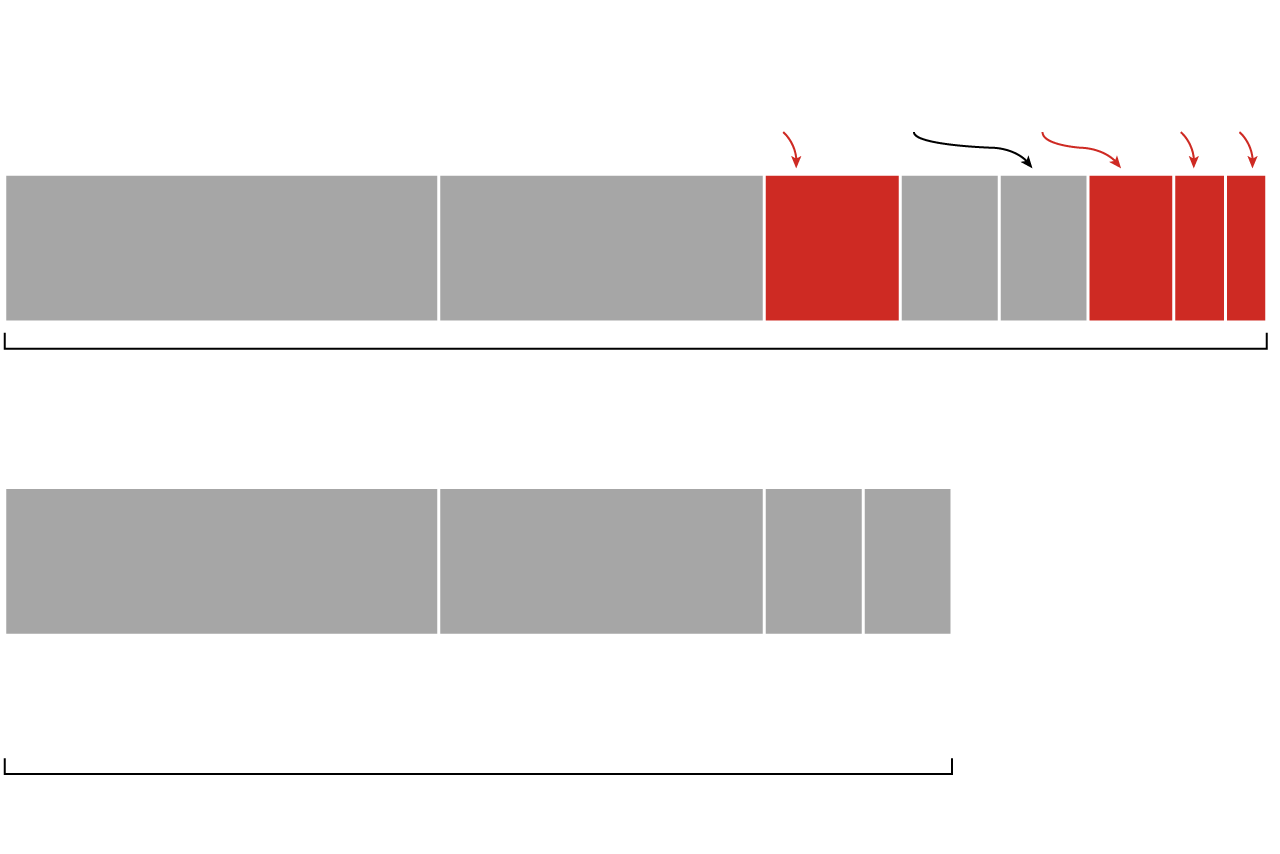

Average circulation for paid print subscriptions

Flare

Canadian Business

Sportsnet Magazine

Today’s Parent

monthly to

once every

two months

Today’s Parent

Hello! Canada

MoneySense

Hello! Canada

no change

Maclean’s

moves from

weekly to

monthly

Maclean’s

Chatelaine

moves from

monthly print

editions to

one edition

every two

months

Chatelaine

Before cuts

700,208

paid print

subscriptions

After cuts

525,548 paid print

subscriptions, likely less

after changes noted above

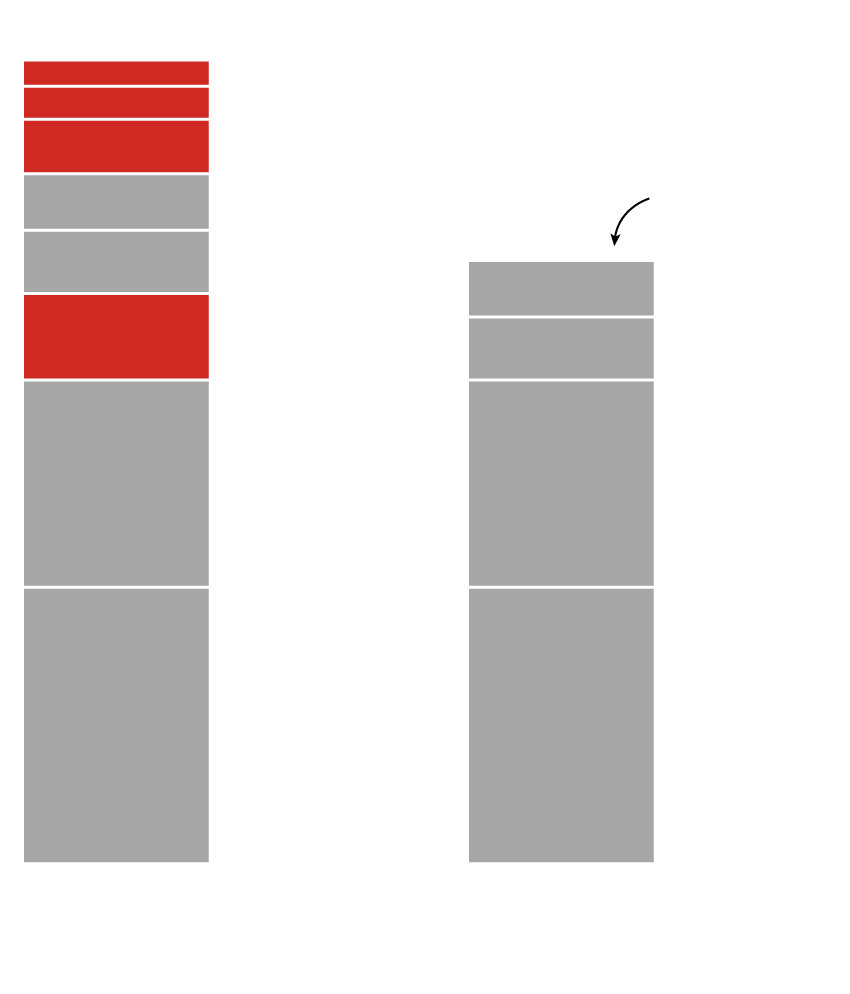

Average circulation for paid print subscriptions

Sportsnet

Magazine

Today’s

Parent

Canadian

Business

Flare

MoneySense

Before cuts

Hello!

Canada

Maclean’s

Chatelaine

700,208 paid print subscriptions

After cuts

Today’s Parent

monthly to

once every

two months

Chatelaine

moves from monthly print editions

to one edition every two months

Maclean’s

moves from weekly

to monthly

Hello!

Canada

no change

525,548 paid print subscriptions after cuts,

likely less after changes noted above

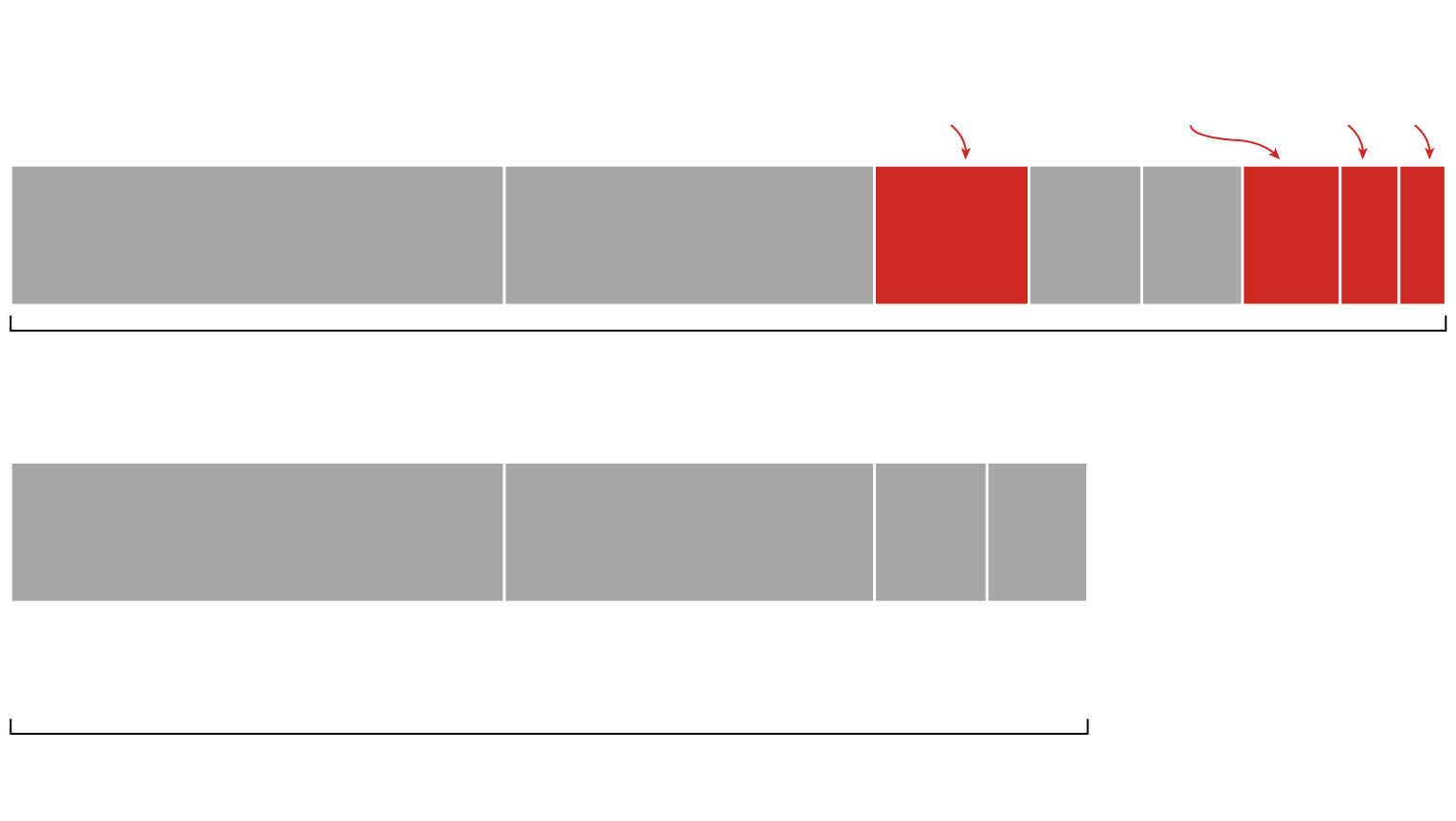

Average circulation for paid print subscriptions

Flare

Canadian Business

Sportsnet Magazine

Today’s Parent

monthly to

once every

two months

Today’s Parent

Hello! Canada

MoneySense

Hello! Canada

no change

Maclean’s

moves from

weekly to

monthly

Maclean’s

Chatelaine

moves from

monthly print

editions to

one edition every

two months

Chatelaine

Before cuts

700,208

paid print

subscriptions

After cuts

525,548 paid print

subscriptions, likely less

after changes noted above

Average circulation for paid print subscriptions

Sportsnet

Magazine

Canadian

Business

Flare

MoneySense

Before cuts

Hello!

Canada

Today’s

Parent

Maclean’s

Chatelaine

700,208 paid print subscriptions

After cuts

Today’s Parent

monthly to

once every

two months

Chatelaine

moves from monthly print editions

to one edition every two months

Maclean’s

moves from weekly

to monthly

Hello!

Canada

no change

525,548 paid print subscriptions after cuts,

likely less after changes noted above

For months, Rogers has also been quietly shopping its 34 trade publications, such as Advisor's Edge and Marketing, as well as its French-language magazines – the French edition of Châtelaine, L'actualité and Lou Lou. They're now openly for sale, and Rogers expects to seal deals before the end of the year.

The short-term pain of the changes could be considerable. Some 55 per cent of Canadian magazine readers choose only print editions, compared with 8 per cent who read solely digitally, according to audience measurement firm Vividata. But as subscribers change their habits, they are driving an inevitable shift.

Canadian Business, for example, circulated 63,198 paid print copies and only 1,605 digital replica editions as of mid-2013, according to the Alliance for Audited Media. Three years later, it circulated only 28,692 paid print copies while digital replica editions increased to 25,918. An average issue had a total online readership of about 537,000 people for the year ended March 31, according to figures from Vividata.

There is name recognition in many of the Rogers magazine brands – Maclean's was recently ranked the second-most trusted media brand in Canada, ahead of the CBC, on the University of Victoria's second annual Gustavson Brand Trust Index (GBTI) – but that doesn't necessarily translate to advertising or subscription spending.

"I'm not surprised they did what they did," Christopher Waddell, an associate professor of journalism at Carleton University, said Friday. "If you take a look at Maclean's from 18 months ago versus Maclean's today, it's an awfully thinner magazine and there's no ads."

"Advertisers are moving away from traditional media, whether it's print or broadcast, and they're moving online, and as they're moving online, they're paying a lot less than they were before," Mr. Waddell said, adding that audience expectations and people's willingness to pay for content are also shifting like never before.

Tom Gierasimczuk, a media executive based in Vancouver and former editorial director of Rogers' Marketing Magazine, said the changes don't reflect readers' engagement with the magazines.

"It's really just following the ad spend," he said. "It was one of these long, sort of downward trending descents. So it really needed to be acted upon."

The road map to reinvent Rogers Publishing for a mostly digital audience has been in the works since early 2016. Mr. Brace sought counsel, in particular, from Time Inc. executive chairman Joe Ripp, whose publishing business is attempting its own digital leap.

Around the world, magazines have proven a punishing business of late. PricewaterhouseCoopers LLP estimates that global revenue from print magazine circulation will fall by $3.4-billion (U.S.) between 2014 and 2019, and that much of the digital readership will flow to magazine websites, rather than to digital subscriptions.

In Canada, Transcontinental Inc. bailed out of the consumer magazine space in April, 2015, selling 14 publications to powerhouse French-language publisher TVA Publications Inc. for $55-million. Later last year, TVA closed six of its own magazines to focus on its stronger titles. And, early in 2016, Rogers slashed 200 jobs from its media division, including some from publishing.

Transcontinental's main business remains printing and it has had an agreement to print Rogers' magazines and marketing communications since 2009, spokeswoman Jennifer McCaughey said. She said the company's contract with Rogers "does not safeguard against any volume reduction," so Rogers will pay no penalties for printing less. However, while the changes will mean less printing business for Transcontinental, she said, "it doesn't represent a meaningful amount on our overall portfolio."

To this point, Rogers Publishing as a whole has stayed in the black, but its profits are evaporating quickly. One reason ad revenue has declined so precipitously at Rogers publications may have to do with the way the media division has pitched bundles of ads across all of its platforms in recent years.

An internal reorganization of its advertising sales division changed the job descriptions of many ad reps, forcing them to focus on bigger-ticket sales and sponsorship packages, which tend to be led by television. Senior ad executives in Rogers Media also felt the pressure to ramp up TV sales to fill the huge inventory created by the company's 12-year, $5.2-billion rights deal with the National Hockey League. With those factors at play, the company's efforts to find print advertisers have withered.

"What we didn't want to get into was a situation where we're kind of underwater with our magazines, and now you're really scrambling to try and make the move," Mr. Brace said. In another year, "we'd be a lot worse off, quite frankly."

Until now, Rogers's big digital bet in publishing has been Texture, the all-you-can-read magazine subscription service formerly known as Next Issue. But Texture's subscriber growth has slowed to a crawl, hovering around 100,000 paying users who spend about $150 a year on average, which is far short of early projections. Steve Maich, the senior vice-president in charge of publishing since 2013, expects the service will turn a small profit for the first time this year, but concedes it's "a niche product."

Earlier in the week, Rogers said it will shut down Shomi, a subscription video-streaming service it owns jointly with Shaw Communications Inc., after two years in the market due to low subscriber numbers. The key difference is that "Shomi was a rental property" that licensed TV shows and movies, Mr. Brace said, and he believes "the key to success in the media business is content ownership."

Within publishing, the goal is now to move energy from a print business with plummeting revenue to a digital strategy that targets 25-per-cent, year-over-year growth. Unique online visitors to Rogers magazine brands are up 41 per cent from two years ago. But that rising digital line brings in far fewer dollars, which means that at least in the short term, Rogers Publishing will be boiled down to a smaller operation.

"It shrinks to the degree that the print market is shrinking," said Mr. Maich, whose role recently expanded to oversee a range of digital content.

That will mean job losses and changing job descriptions, although Mr. Maich wouldn't say how many jobs are at risk. "This is about shifting the mix of our work force," he said.

Mr. Maich also declined to reveal how much money Rogers expects to save by cutting back on print. But the company has earmarked $35-million to invest in "deeply un-sexy, behind-the-scenes stuff" like better data tools to measure engagement and reach, and to market its digital offerings more aggressively.

There is still a "huge delta" between print and digital ad rates, he said, so the company must close that gap by giving advertisers better information about readers, and by opening the door to more so-called advertorial content, which cloaks advertising in editorial dress.

Over the past nine months, executives "considered everything," according to Mr. Maich – even closing titles entirely. But Mr. Brace insists that the company, from CEO Guy Laurence to the board of directors and the Rogers family, still see value in the brands. "It was never a question of, let's get out of this entirely and walk away," he said of the publishing division.

"These things are never easy. This is pretty major," Mr. Brace added. "Out of the other end comes a very different media business."

Timeline of Rogers Publishing

1994:

Rogers Communications Inc., a cable giant with interests in media and cellular phones, wins approval for a $3.1-billion takeover of Maclean Hunter Ltd., the media conglomerate responsible for launching publications such as Maclean's magazine in 1905, the Financial Post business newspaper in 1907, Chatelaine in 1928 and Flare in 1979. That purchase marked the birth of Rogers Media, which carved out a publishing division to oversee a number of consumer magazines and more than 35 business titles.

1998:

The publishing arm acquires full control of Today's Parent Group, which owned the parenting magazine Today's Parent. It also launches industry-focused publications, including Advisor's Edge, which Rogers has now put up for sale.

2003:

Rogers Publishing claims to reach 12.1 million Canadians each month and has annual operating revenue of $290-million, far exceeding the TV or radio divisions. Even then, publishing was not immune to cutbacks – the company decided to "realign the cost structure." In 2015, by contrast, publishing accounted for only 9 per cent of Rogers Media's $2.1-billion in operating revenue, and the magazine brands now reach 3.8 million Canadians a month.

2006:

Encouraged by the successful launch of women's magazine Lou Lou in 2004, Rogers launches home decor magazine Chocolat. Through a partnership with Canada Post Corp., Chocolat was distributed to about 250,000 people who paid Canada Post for change-of-address notices on the assumption they would be interested in renovating or redecorating. But Chocolat never caught on and it closed in 2007.

2011:

Rogers announces a rare move in a difficult time for the industry: The launch of Sportsnet magazine, an entirely new print publication aiming to cover Canadian sports the way Sports Illustrated covers America. With Steve Maich as the first editor, the magazine was expected to fully integrate with Sportsnet's TV, radio and web operations.

2013:

Rogers makes its biggest bet yet on digital magazines, launching Next Issue with U.S. partners including Hearst Corp., Condé Nast and Time Inc. For $9.99 a month, readers got all-you-can-read access to digital editions of more than 100 magazines, plus premium titles such as The New Yorker and Sports Illustrated for $5 a month more. The service was renamed Texture a year ago and now offers more than 150 magazines, but after early growth, its subscriber base has levelled off at about 100,000.

-James Bradshaw