The oil slump

The freefall in commodity prices gained momentum in 2015, battering resource-dependent economies and forcing companies to slash jobs and shelve spending plans. In a world awash with oil, crude prices have recently slumped to multiyear lows.

The loonie

The Canadian dollar was one of the worst-performing major currencies in 2015. A confluence of factors put downward pressure on the loonie, including the collapse in energy prices, a sluggish domestic economy and the expected path for interest rate hikes in the U.S.

Housing markets

Canada's housing markets are showing signs of settling down. Sure, Toronto and Vancouver remain hotbeds of activity, but many other markets have cooled, especially those with exposure to the commodities rout.

Alberta's economy

Alberta is feeling the ill effects of weak energy prices. The province's economy is believed to have contracted in 2015, while the number of Albertans receiving employment insurance benefits has grown for 14 consecutive months.

Central banking

The Federal Reserve hiked its benchmark interest rate in mid-December for the first time in nearly a decade, signalling confidence in the U.S. economy at a time when other central banks (such as Canada's) have eased policy to help stimulate growth.

Trans-Pacific Partnership

In October, Canada and 11 other countries struck a landmark deal to create the largest trade zone in the world. Together, the countries involved in the Trans-Pacific Partnership, which has yet to be ratified, account for 40 per cent of global economic output.

Greek debt crisis

This year's edition of the Greek debt crisis culminated in a high-stakes referendum, which resulted in a vote against creditors' bailout conditions. The months preceding the vote saw Greeks yank loads of cash from their bank accounts.

Innovation

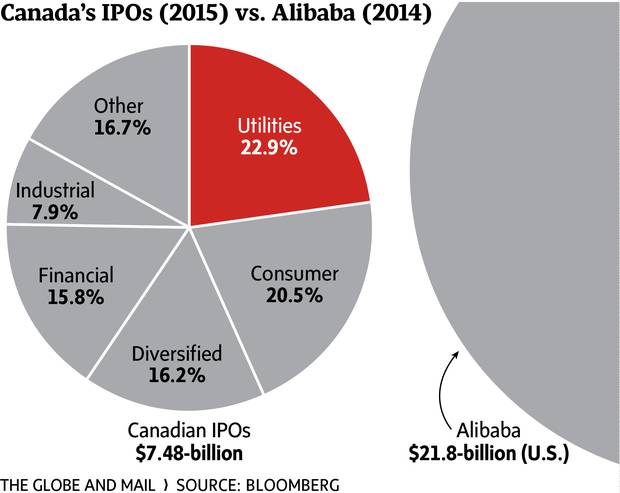

Canadian initial public offerings totalled $7.48-billion in value, highlighted by notable offerings from Hydro One and Shopify. For comparison: Alibaba, the Chinese e-shopping giant that had its own IPO in 2014, easily eclipsed Canada's entire 2015 IPO market.

China's stock plunge

China's markets soared in the first half of 2015 as retail investors piled into stocks, but promptly soured with a steep plunge, rattling global equities in the process. August wound up being Wall Street's worst month in years.

Mergers and acquisitions

Driven by deals in the pharmaceutical and financial industries, it was a banner year for mergers and acquisitions. In the year's biggest deal, Pfizer and Allergan agreed to a $160-billion (U.S.) merger that would create the world's largest drug maker by sales.