“I'm middle class. Honestly.”

Morneau's budget

As BMO Nesbitt Burns puts it, fiscal policy will take “a dramatic turn” in Ottawa today.

Finance Minister Bill Morneau unveils the new Liberal government’s first budget this afternoon, one that’s expected to include about $10-billion in stimulus and a $30-billion deficit for fiscal 2016-17.

Mr. Morneau is expected to announce several measures, some that were part of the Liberal campaign pledges.

The government is raising taxes on the wealthy. And you can expect to hear a lot about how it’s helping the “middle class,” just like we did during the election campaign.

“Ottawa will table its hotly anticipated fiscal year 2016-17 budget on Tuesday, and federal fiscal policy is about to take a dramatic turn in Canada,” said BMO senior economist Robert Kavcic.

“Ottawa now looks set to run a deficit of around $30-billion in fiscal year 2016-17, or roughly 1.5 per cent of GDP, with shortfalls pushing out beyond fiscal year 2019-20,” he added.

“To date, the big question was ‘Would Ottawa come to the table with more or less stimulus than outlined in the Liberal election platform?’ And, word on the street now is that the amount will be as promised (roughly $10-billion, including what has already been announced).”

On the monetary policy side, the Bank of Canada is holding firm, waiting to see what Mr. Morneau unveils, and the potential impact of those measures.

“We expect a growth upgrade at the next [Bank of Canada] meeting, reflecting federal stimulus,” said Emanuella Enenajor, North America economist at Bank of America Merrill Lynch, and Ian Gordon, a currency strategist.

“Further out, we continue to see the BoC on hold through year-end and beyond,” they added in a report.

“Although government spending reduces the need to ease, the fragile recovery will keep them from hiking for the foreseeable future.”

What’s not known are the details of the stimulus spending, the targets of that spending, or the timeline.

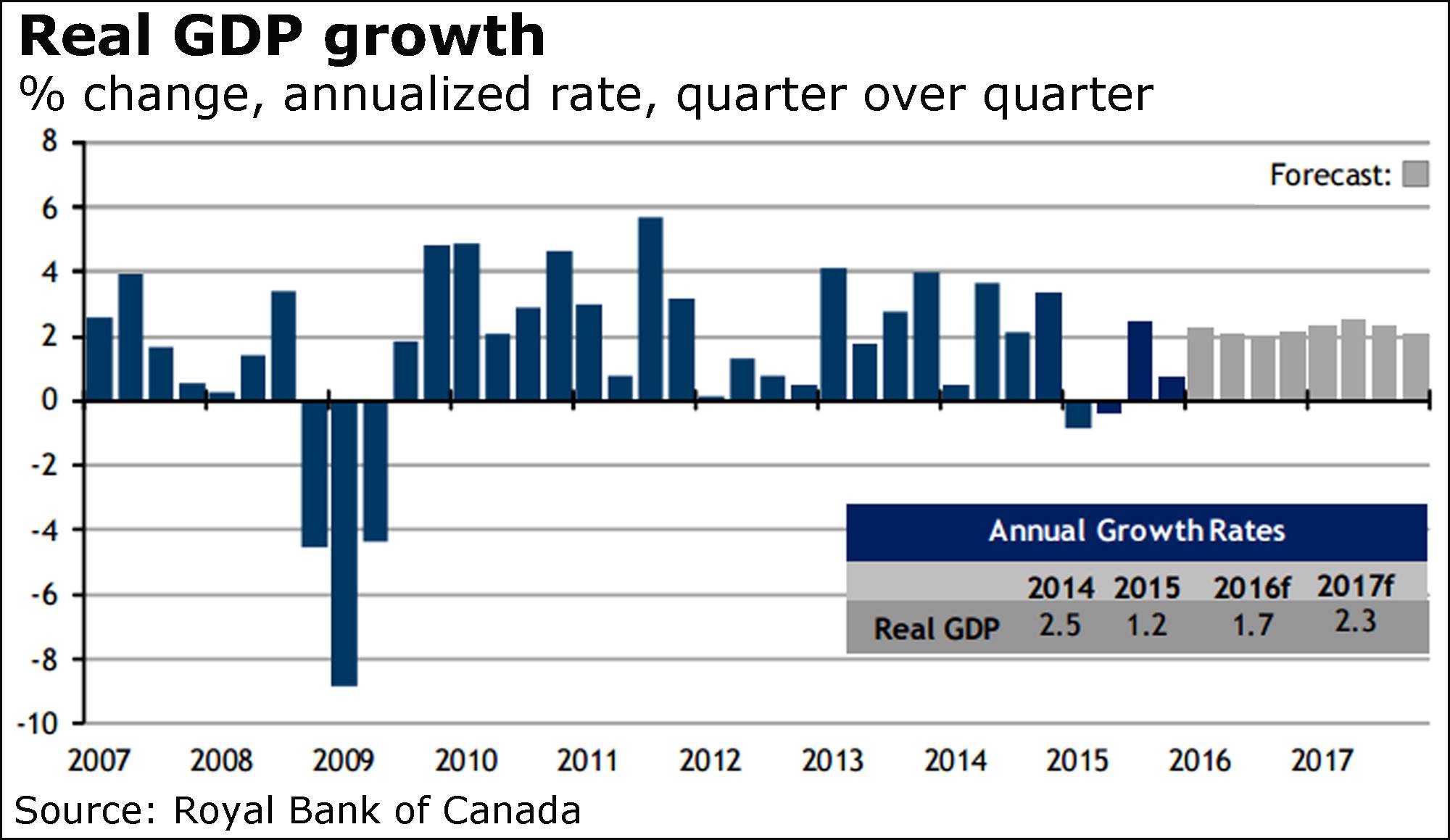

But economists say the expected level of today’s projected deficit is appropriate given what the oil shock has done to Canada. Here’s why:

1. Canada’s economy has been slammed by the collapse in oil prices, with jobs disappearing and investment shrinking in the oil patch. Alberta is believed to be in a second year of recession, and the impact is rippling out.

But for Switzerland, Norway and Greece - Greece! - Canada’s economic growth has been the slowest among OECD countries, BMO chief economist Douglas Porter noted.

“Canada’s relatively modest growth reflects a highly imbalanced regional performance, highlighted by the significant retrenchment in investment and hiring under way in the energy-dominated producing provinces of Alberta, Saskatchewan and Newfoundland and Larbrador,” added Bank of Nova Scotia’s deputy chief economist, Aron Gampel, noting that B.C. and central Canada are gaining.

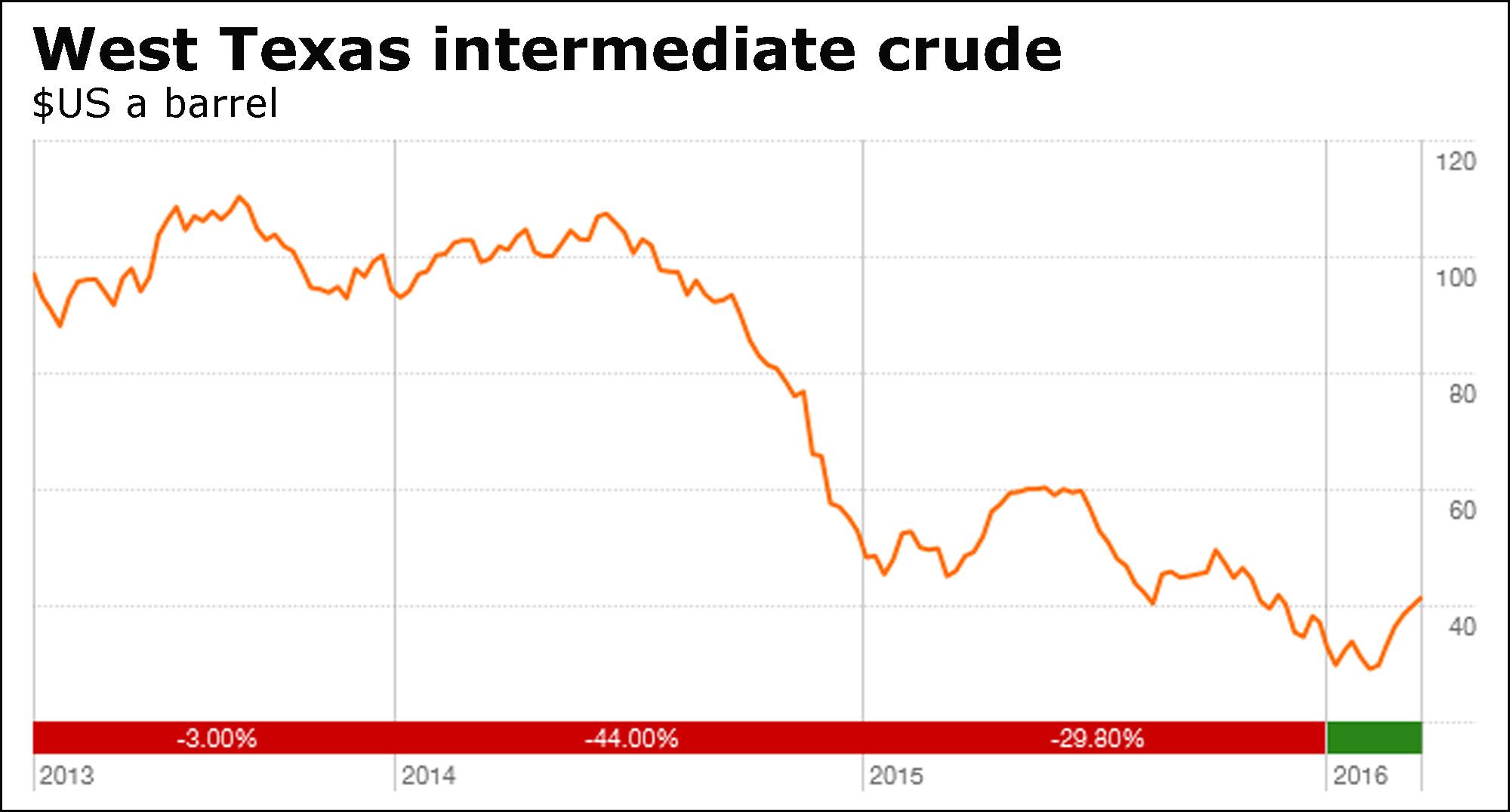

2. Crude prices, so key to Canada's fortunes along with other commodities, appear to have stabilized for now, but at far lower levels than those that made the oil patch the place to be.

“Going forward, an improvement in economic activity around the globe - particularly in China, as stimulus measures take effect - should help to lift commodity prices off their first-quarter bottoms,” said Toronto-Dominion Bank economist Dina Ignjatovic.

“However, the low price environment is likely to persist for some time. Several markets are swimming in supply, which will take time to work down.”

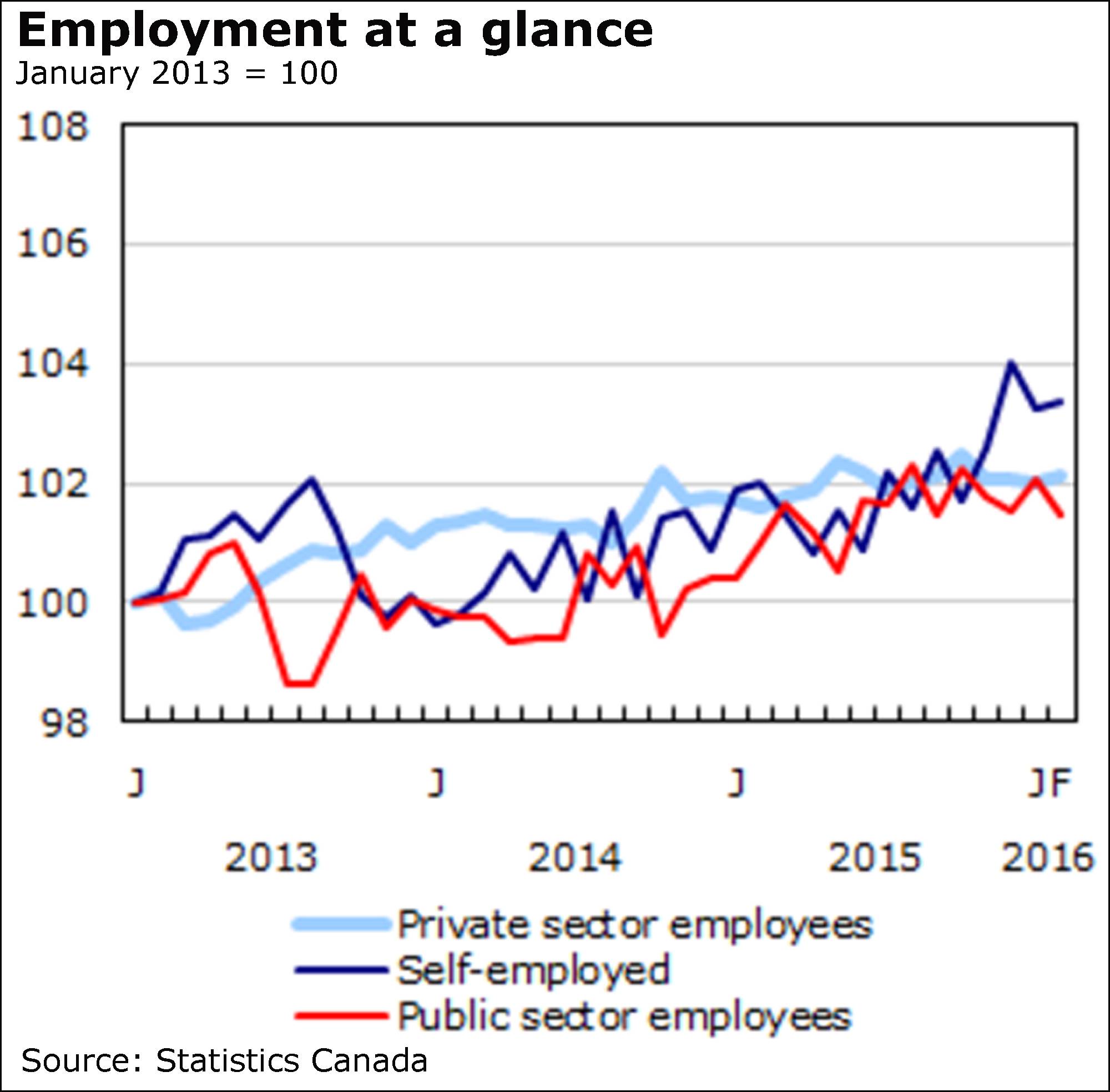

3. “Almost alone among major economies, Canada has actually seen its unemployment rate rise over the past year (up to 7.3 per cent in February from a cycle low of 6.6 per cent in early 2015,” said BMO’s Mr. Porter.

It’s not uncommon for jobless levels to lag economic performance, said senior economist Leslie Preston of Toronto-Dominion Bank.

Which is why, unfortunately, she considers last month’s troubling jobs report as “the new normal” in Canada.

“Canada’s economy arguably retained more hiring momentum in 2015 than would have been expected given the collapse in oil prices, so was overdue for a period of softer jobs numbers,” Ms. Preston said.

“Looking ahead, we expect the national unemployment rate to remain fairly steady over the next few quarters, as weakness in oil-producing provinces is offset by greater vigour elsewhere.”

4. Indeed, consider this chart, and the spike in self-employment.

5. Or this one, and the spike in part-time jobs.

6. Or, when it comes to Alberta, this depressing look.

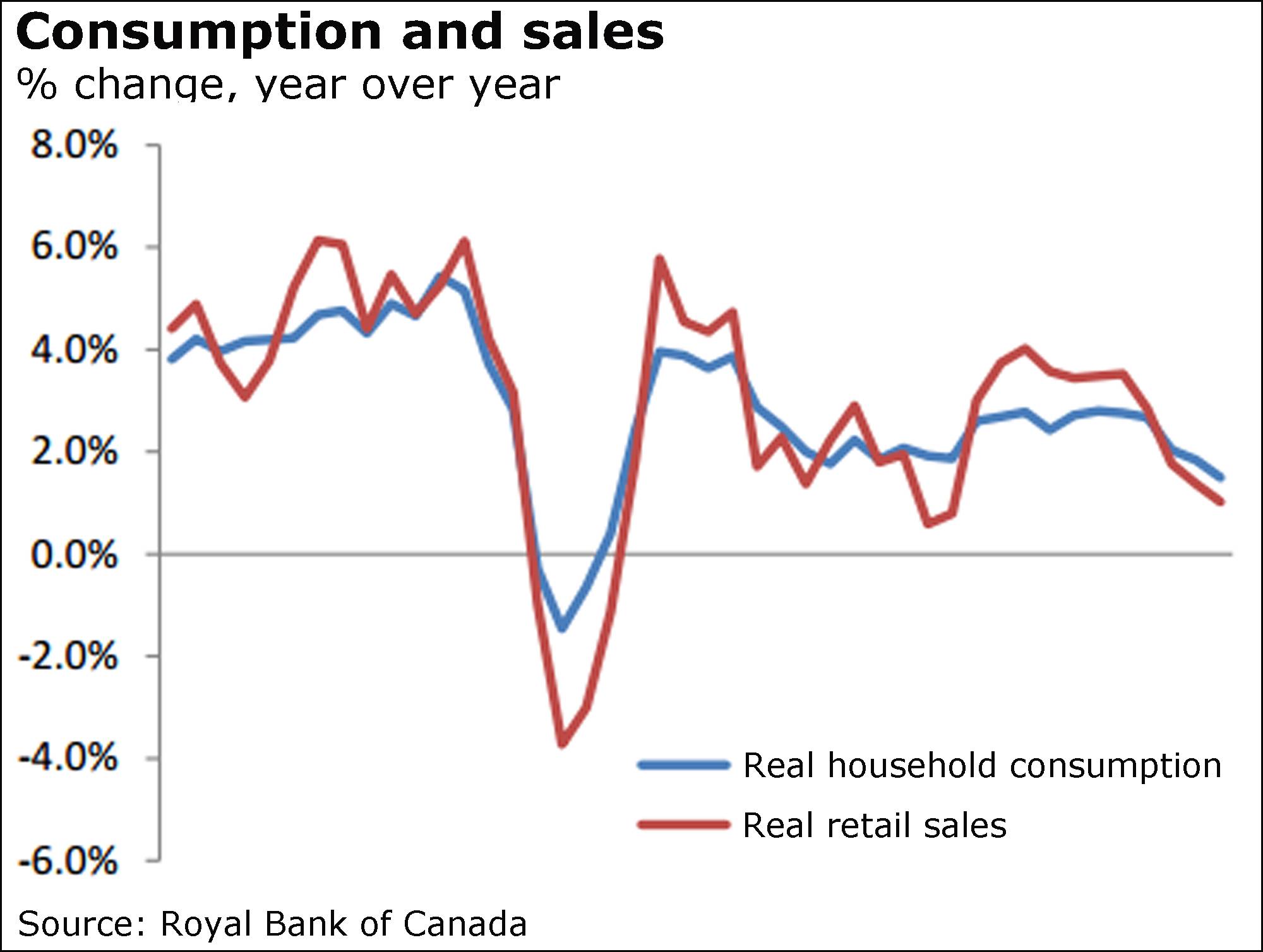

7. It’s true that certain indicators of late have come in better than expected, including retail sales.

But the Canadian consumer, besides being bombarded with dismal news, is weighed down by a record debt burden, which doesn’t bode well for household spending.

“There have to be some concerns about how much more can be wrung out of the consumer - particularly given the latest national balance sheet data,” said observers at Royal Bank of Canada.

8. Low interest rates have helped, of course, by allowing consumers to juggle their high debts, RBC strategists Mark Chandler and Simon Deeley, and economists Paul Ferley and Nathan Janzen said in a recent report, noting debt service ratios in Canada.

“On a seasonally adjusted basis, they continue to hover around 14 per cent of disposable income or about where they averaged for the past five years,” they said.

“However, that still compares to an average of 12.8 per cent dating back to 1990, and a moderate increase in interest rates could crimp spending, with the household savings rate at just 4 per cent,” the RBC observers added.

“That leave Canada right back where we started: leaning heavily on expected fiscal stimulus and on non-energy exports. Luckily, the former is around the corner and the latter is (finally) showing some concrete signs of life.”

No currency impact

CIBC World Markets, for one, has been asked what impact the deficit could have on the Canadian dollar.

The answer: Not much if all goes as expected.

“In the short term, a $30-billion deficit is not expected to shift the dial much, though large deviations from that could have implications,” said Bipan Rai, CIBC’s director of foreign exchange and macro strategy.

“Theoretically, over the longer term, the effects on the [Canadian dollar] from an expansionary fiscal policy will likely offset part of the effects from loose monetary policy. This is generally the case in economies with high capital mobility.”

That’s if it plays out as markets expect it will.

“We think a higher-than-expected deficit would be [Canadian dollar] positive and the shorter-term the skew to increased spending the more positive it would be for the currency,” said RBC strategist Adam Cole in London.