Don't cut rates, LePage says

One of Canada’s major real estate firms is urging the Bank of Canada not to cut interest rates tomorrow.

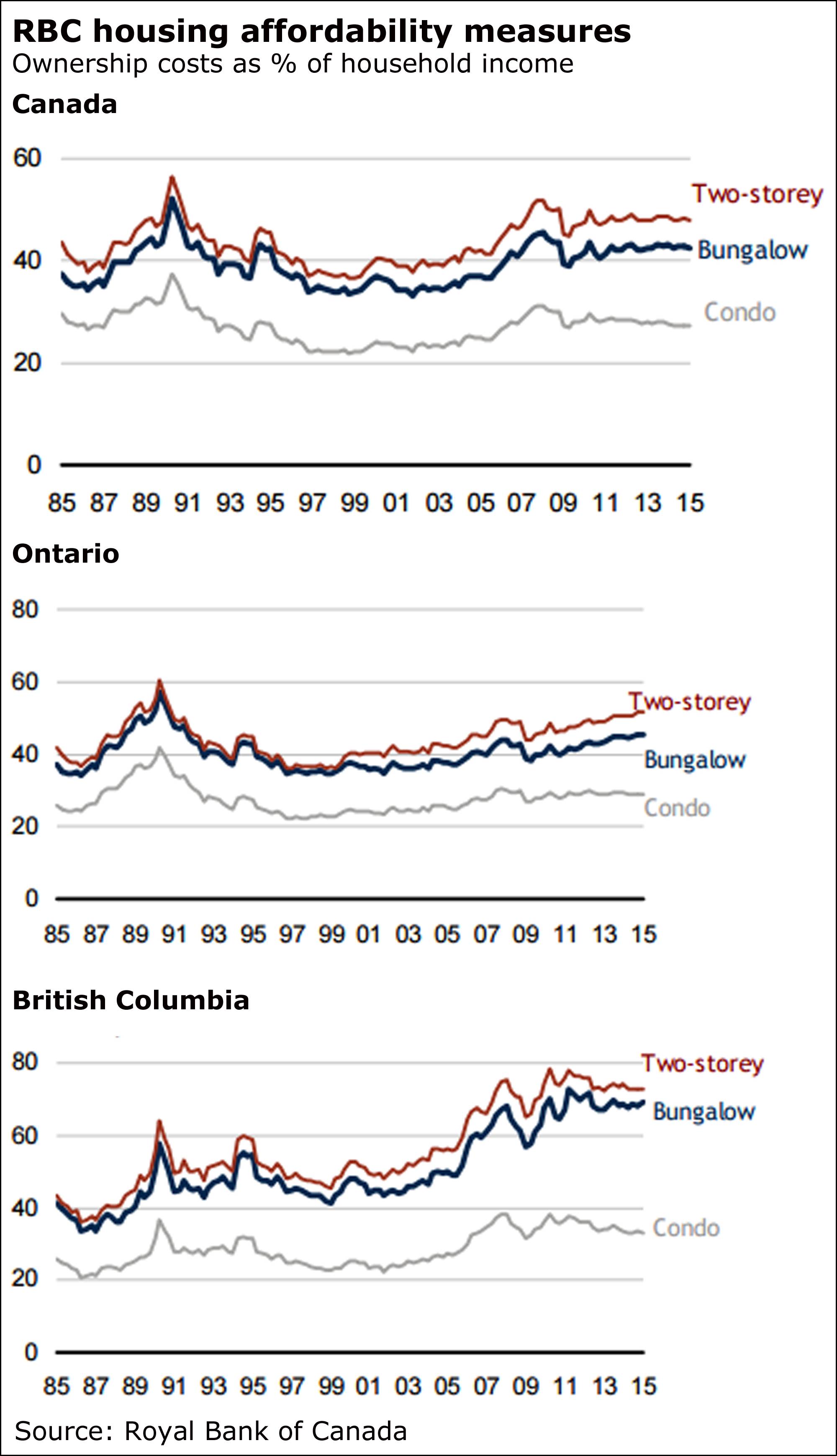

Royal LePage says it’s worried that a cut in the central bank’s benchmark rate could “over-stimulate” already high-flying markets such as Toronto and Vancouver.

Those are the two Canadian cities deemed the most frothy, with prices running up sharply as consumers add to already swollen debt levels in a low-rate environment.

“While the oil shock has been a troublesome drag on our economy this year, it seems premature to ring the recession alarm bells now, injecting further monetary stimulus,” said LePage chief executive officer Phil Soper.

“The country’s all-important real estate market simply does not need a rate cut,” he said today in releasing the firm’s look at how the market performed in the second quarter.

“I worry that stoking this engine further could move us from a perfectly manageable major market expansion into a more difficult correction, as price levels decouple from more household incomes.”

Royal LePage's warning came as the latest reading showed Canadian home prices climbing yet again, though that’s because of gains in specific home types and regions.

Prices rose 1.4 per cent in June from a month earlier, marking the sixth straight jump in a row, and 5.1 per cent from a year earlier, according to the Teranet-National Bank home price index released today.

Vancouver and Toronto again led the way, with prices up 8.5 per cent in the former and 7.8 per cent in the latter on an annual basis.

The index is now at a fresh high, but only Toronto, Vancouver and Hamilton are actually at record levels.

“In these markets, well above average price growth from a year ago reflect tight resale market conditions,” said National Bank senior economist Marc Pinsonneault.

Those gains, though, aren’t across the board, with condo prices up 4.7 per cent and 3.2 per cent, respectively, in Toronto and Vancouver and others up a far sharper 10 per cent.

“Were it not for non-condo dwellings in these two regions, house prices at the national level would have risen rather modestly over the last year,” Mr. Pinsonneault said.

The Bank of Canada is set to announce its rate decision tomorrow morning, and some market watchers say there’s a good chance it will follow January’s surprise cut with another, which bring the key rate down to just 0.5 per cent.

The central bank is counting on a bounce in non-energy exports to help juice the economy, hoping the economic buoys will shift to trade and away from consumers.

A rate cut tomorrow could threaten that, warned Derek Holt of Bank of Nova Scotia.

Such a move, he said in a recent report, “risks delaying the rotation of growth sources away from the household sector and toward the investment and export sectors through over-stimulating consumption and housing and setting a low bar for hurdle rate targets.”

If Greece's Tsipras were to resign ...

... he could always do a guest spot on Real Housewives.

Video: Six numbers that explain the Greek deal

Earnings parade begins

The latest earnings season began in earnest today, with major U.S. banks kicking off the latest results.

Tweet of the week (so far)

“I can’t remember a year that I had this much fun.”

50 Cent, on Sunday, a day before he declared bankruptcy.

About that recession ...

We should keep some things in mind when we toss around the word recession.

It’s true Canada may have slipped back into recession in the first half of the year amid the oil shock. But the key terms there are may have, first half and oil shock.

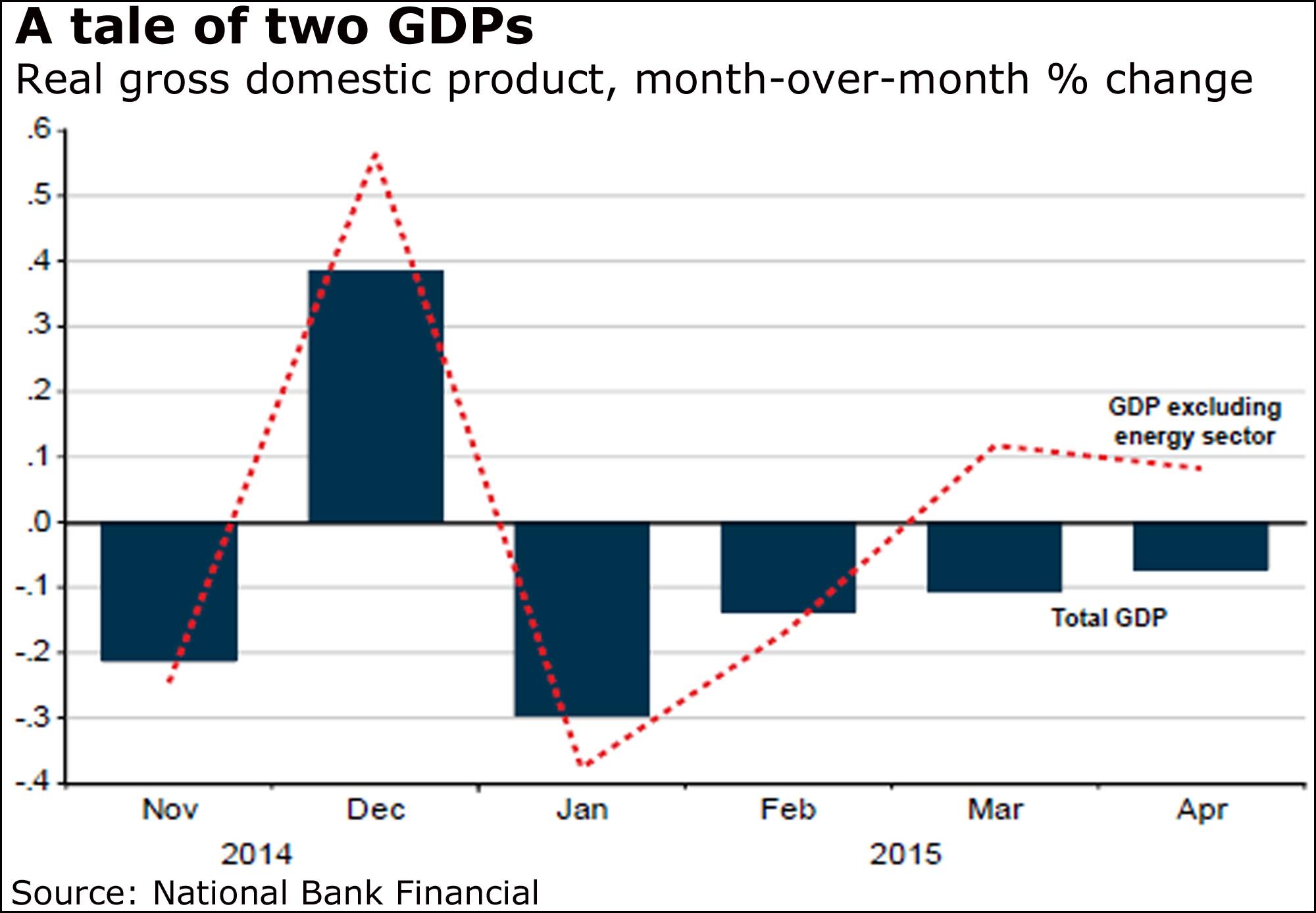

Canada’s economy contracted in the first three months of the year, and again in April to kick off the second quarter, leading some forecasters to suggest Canada has just gone through another recession. Their projections are based, too, on some recent indicators such as trade.

Ah, but ...

But: That doesn’t mean we’re in a recession. It may, at most, mean we’re just out of one, and presumably a mild one, at that. Said chief economist Douglas Porter and Mr. Reitzes of BMO Nesbitt Burns: “While there is little debate that Canada’s performance so far in 2015 has been a big disappointment, we believe it is premature - and perhaps somewhat negligent - to officially declare Canada to be in recession. Even if this episode is somehow eventually deemed to be a recession, it clearly will only qualify as a Category 1 variety (i.e. the mildest possible).”

But: Canada’s troubles are regional and sector in nature. National Bank chief economist Stéfane Marion, for example, said in a recent report: “The recent poor showing is neither Canada-wide nor economy-wide. The downturn is in energy and was concentrated in Alberta in Q2. Though GDP may have edged down for a second consecutive quarter, it would be hard to call this a recession.”

But: Indeed, the economies of Alberta and Newfoundland and Labrador are projected to shrink this year, while Saskatchewan comes close to, but not, stalling. Toronto-Dominion Bank’s deputy chief economist Derek Burleton and economist Jonathan Bendiner said in a recent forecast they expect other provinces to fare better than the oil regions: “There remains a clear divide in the outlooks for oil-producing regions and the rest of the country.”

But: Take energy out of the equation, and Canada’s economy “appears” to have grown by 1 per cent to 1.5 per cent, said National Bank’s Mr. Marion, adding that “the gap between the energy sector and the rest of the economy has never been so wide.”

But: True, recent export numbers have been dismal. Mr. Marion on trade: “There is reason to believe that the weakness in May was due in part to wildfires in Alberta, which crimped oil production, and that a rebound is likely. The non-energy economy will benefit in the second half of the year from improvement of the U.S. economy and a favourable exchange rate.”

But: We’re still buying things like houses and cars, and consumer confidence is up.

But: What’s a recession? It’s typically defined by two consecutive quarters of contraction, which is why some economists see the first half as a slump. But, as Bank of Nova Scotia’s Derek Holt, noted, there’s more than one way to define it, the other being to look at a wider set of indicators: “Canada may be just barely meeting one definition but probably only temporarily so, and is not at all meeting the sounder definition with what we know now ... We’ll call this the Great Canadian Non-Recession.”

But: Even then, the second quarter is still a question mark. Alexander Lowy, associate economist at Moody’s Analytics, had this to say, though he noted the uncertainty created by Greece and China: “At present, the Moody’s Analytics baseline forecast is for anemic growth in the second quarter, avoiding what would be a technical recession with two quarters of decline.”

This is not to mask the problems that, even absent the energy sector, still remain.

Unemployment, remember, hovers just below 7 per cent, trade is a question mark, and there are certainly red flags going up about the red-hot housing markets of British Columbia and Ontario.

“The Canadian economy is a wobbly three-legged stool featuring an oil sector that is in recession, a housing market that is frothy and excessively leveraged, and a manufacturing sector that is struggling in the face of stiff cyclical and structural headwinds,” Kevin Hebner, the chief foreign exchange strategist at JPMorgan Chase & Co., said in a report that, among other things, projected a contraction in the second quarter.

Chart of the day

BMO's Mr. Porter calls it Canada’s shifting job market in “one simple chart.”

He compared unemployment in London, Ont., now down to 5.9 per cent, to that of Calgary, now up to the same level.

London, he said, is representative of southern Ontario’s manufacturing base.

“Aside from a very brief spell in 2004 - back when U.S. growth was strong and the [Canadian dollar] was around 75 cents - this is the only time that London’s rate has not been above Calgary’s in the past 15 years,” Mr. Porter said.