Careful what you wish for

Canada’s next government may well find itself in a dicey fiscal bind.

So much so that the warring federal parties should be careful what they wish for.

Canada’s weaker-than-expected economic showing promises to take its toll on federal finances, raising questions about whether campaign promises can be fully funded and, more importantly, whether measures under the new balanced budget act could kick in.

Were the latter to actually happen, federal politicians and officials could find their pay slashed.

The hit to federal coffers, and the potential ramifications, are outlined in a new report from Warren Lovely, National Bank Financial’s head of public sector research and strategy, who warns in no uncertain terms of the threat to Ottawa’s finances.

“It’s not easy being a finance minister these days,” Mr. Lovely said.

“With slower growth threatening to drag revenue profiles down, federal and provincial governments face a difficult choice: Launch fiscal countermeasures such as spending cuts or tax hikes (which risk further compromising the economic outlook) or let the budget balance deteriorate (eroding future fiscal capacity and potentially jeopardizing credit ratings), all without alienating too many voters or losing the confidence of investors.”

The Conservatives, fighting for re-election on Oct. 19, have already forecast a small budget surplus for the 2015-16 fiscal year. The Parliamentary Budget Officer, Mr. Lovely recalled, disputes that given the state of the economy.

The Tory pledge could yet hold up, Mr. Lovely added, while noting there’s little real difference between the projected $1.4-billion surplus and the PBO’s suggested $1-billion pre-contingency deficit.

“Unfortunately, 2016 looks to be just as challenging, if not more so, for Canada’s budget makers,” he said.

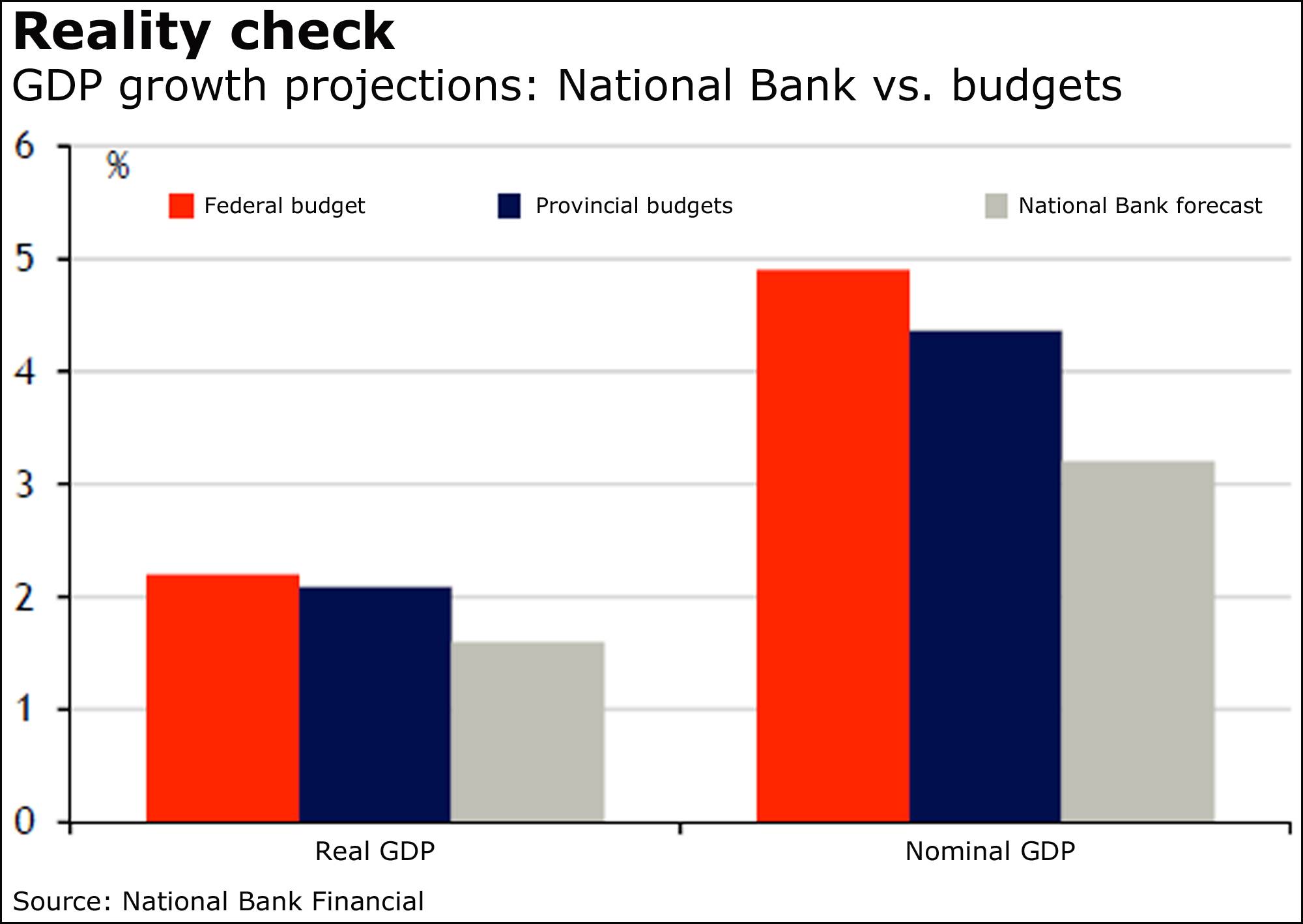

Here’s how he sees it: The rise in nominal gross domestic product next year could be “barely” 3 per cent, or well shy of the 4.9-per-cent assumption of the federal budget.

“Thus, next year’s average level of nominal GDP risks falling roughly $35-billion short of the federal government’s latest planning assumption,” Mr. Lovely said.

“That’s a non-trivial miss,” he added.

“Given the federal revenue share of GDP, our relatively lower nominal GDP profile would imply $4-billion to $5-billion in missing revenue in 2016-17, on top of any pressure being felt in 2015-16.”

And the fallout, he warned, could be more than anyone is bargaining for.

“That may be sufficiently large to trigger corrective actions under the new balanced budget legislation requirements, and would likewise imply less fiscal wiggle room to fund promises being made by those parties committed to balancing the budget (all else equal),” Mr. Lovely said.

Both the Conservative Party and the New Democratic Party promise to balance the books, while the Liberals are looking at deficits and say they’ll kill what they consider a dumb Tory balanced budget act.

No surprise there, given that they’d all face pay cuts.

A government that forecasts a deficit – because of reasons other than a recession or “extraordinary situation” like a war – would now trigger certain operating budget freezes and a 5-per-cent pay cut for the prime minister, ministers and deputies.

A scene I'd love to see

The Conservative election campaign after its overhaul

Debt burden on rise

Congratulations, you’re richer. And deeper in debt.

The key measure of debt burden climbed in the second quarter of the year to a record 164.6 per cent, up from the first quarter’s debt-to-disposable-income reading of 163 per cent.

That’s because debt rose by 1.8 per cent, far faster than disposable income, at 0.8 per cent.

Household net worth, though, rose 0.9 per cent, though that’s the slowest rate since a year ago, Statistics Canada said today.

The value of our financial assets inched up 0.5 per cent, which is well down from the 4.6-per-cent pace of the first quarter.

“Growth in mutual fund and pension assets was muted in the second quarter after strong gains in the previous quarter,” the statistics agency said.

“The increase in financial assets was more than offset by a 1.8-per-cent gain in financial liabilities, notably mortgages.”

And we all know what that means.

Total credit market debt now stands at almost $1.9-trillion, with mortgages accounting for $1.2-trillion of that, having climbed by $2.3-billion.

Oil tumbles

Oil prices are sinking in the wake of a new forecast from Goldman Sachs Group Inc. that raises the prospect of $20-a-barrel (U.S.) crude.

That’s not what the Wall Street giant expects to happen. It cut its estimate on U.S. oil to $48.10 a barrel this year and to $45 next.

But it didn’t rule out an even further slide to $20.

“Goldman Sachs threw its hat into the ring, calling for $20 oil today, sending crude prices lower,” said IG analyst Joshua Mahony.

“However, the flip side to these low oil prices is that output will begin to wane significantly at some point,” he added.

Political mechanics

DesRosiers Automotive Consultants has done an election poll of its own, this one with a twist.

The consulting group asked more than 1,500 car owners who they’d most trust to work on their auto if the party leaders were technicians.

The NDP’s Tom Mulcair was the choice of owners of cars between one and three years old. Those in the four- to 12-year bracket went for Stephen Harper, and those with vehicles 13 years or older picked Justin Trudeau.

A second question may be even more telling: Mr. Trudeau was “by far the most popular choice” of who those polled who would find him as the most interesting passenger on a countrywide road trip.

“What this means we have absolutely no idea ... aside from the fact that the team of analysts here at DAC is perhaps a little too obsessed with understanding the thoughts of the Canadian vehicle owner.”