Briefing highlights

- Canadian dollar sinks to 77 cents

- Economists cut GDP forecasts

- Some Trump Facebook posts we might see?

- Giant diamond sells for $63-million

- Video: How to say no to more work

Loonie slips to 77 cents

The loonie fell today as commodity prices slipped and the outlook for Canada’s economy darkened.

The currency has traded between 76.84 cents U.S. and 77.48 cents so far today, and was just above the 77-cent mark by mid-afternoon.

Having climbed earlier amid speculation about the impact of the Fort McMurray fires on production, oil prices slipped back, along with hits to other commodities such as copper and iron ore.

On top of that, noted Shaun Osborne, Bank of Nova Scotia’s chief currency strategist, Canada’s economy has been looking weaker of late.

He cited recent trade data and the fact that economists are now slashing their forecasts for second-quarter economic growth in the wake of the disastrous Fort McMurray wildfires.

Facebook posts we could soon see?

Here’s what Donald Trump posted on his Facebook page last week:

One can only wonder if these might be his next ad campaigns ...

The wildfire's toll

Analysts are slashing their projections for Canada’s near-term economic growth in the wake of Fort McMurray’s devastation, though raising them for later in the year as the city rebuilds.

They now expect slow to no growth in the current second quarter, with the city in ruins and oil sands operations hampered.

It’s too early to gauge the final impact, but projections for the second quarter have been scaled back dramatically. It’s not just the tragedy of Fort McMurray, but other weak indicators, as well.

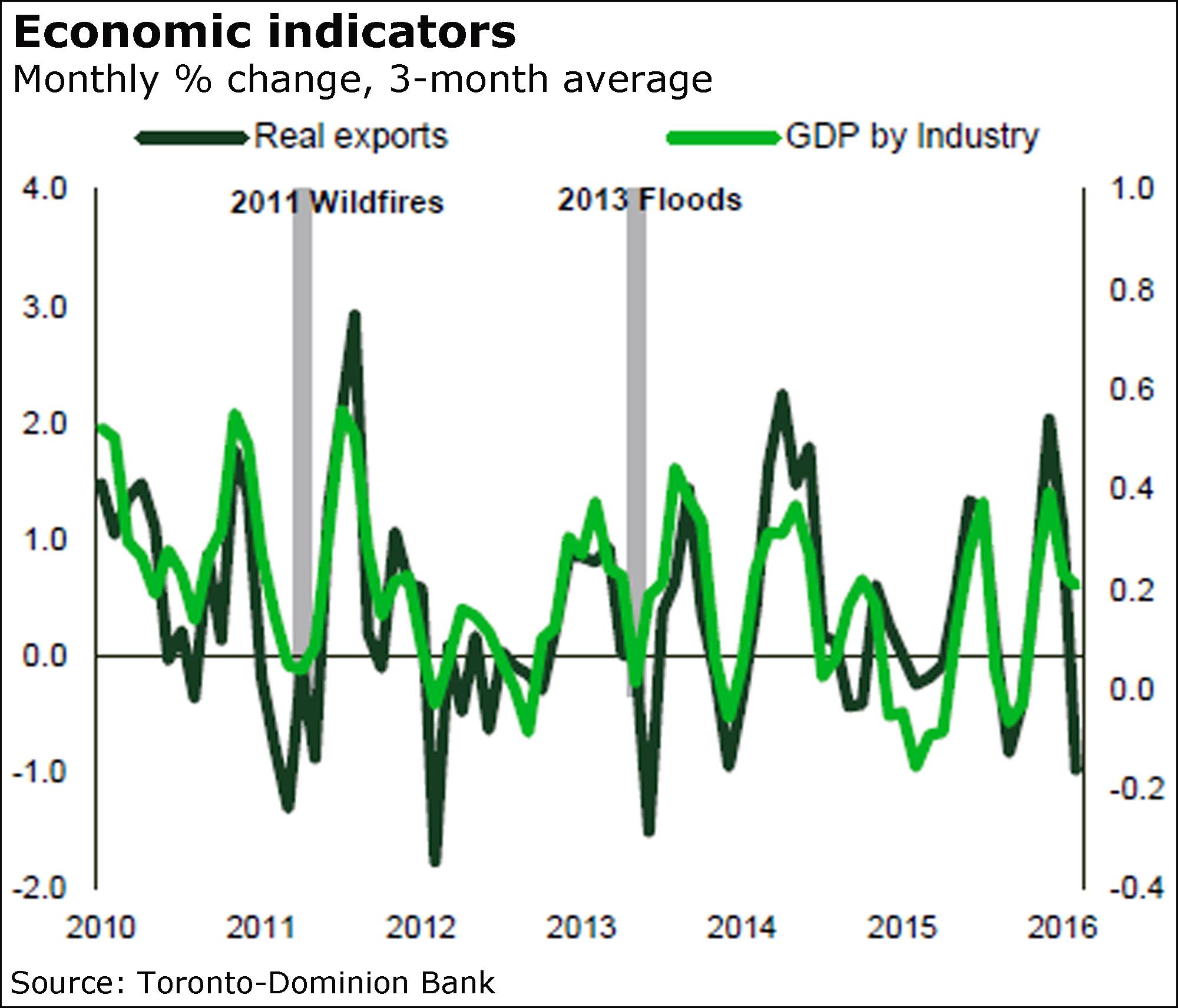

“In light of the wildfires in Alberta, the economy may be hard pressed to grow in the second quarter of the year,” said Toronto-Dominion Bank economist Diana Petramala, down from what could otherwise have been growth at an estimated, though still weak, annual pace of 1 per cent, in light of soft trade and employment showings.

“As production ramps back up again and reconstruction efforts begin we could see economic growth could jump back to 3 per cent in the third quarter of the year.”

BMO Nesbitt Burns chief economist Douglas Porter agreed that the economy was on a weak footing even before the Alberta damage.

“And then came the horrible news of the wildfires in Fort McMurray,” he said.

“Given that the fires are still blazing, we cannot confidently make any precise estimates on the economic impact of the disaster, and will have to adjust our forecasts on a week-by-week basis,” Mr. Porter said in a report Friday.

“But based on what we do know at this point about the production curtailments, and based on the hit to GDP five years ago from the best parallel we have (fires at Slave Lake in May, 2011, when the energy sector GDP fell 3.6 per cent), we have cut our [second-quarter] GDP estimate to zero,” he added.

“At the same time, we are assuming that output will recover in due time, and have also revised up our [third-quarter] growth estimate by roughly one percentage point to 2.5 per cent.”

Given the fires and other weak data, BMO has cut its growth forecast for the year to 1.6 per cent from 1.8 per cent.

Emanuella Enenajor, the North America economist at Bank of America Merrill Lynch, is a bit more optimistic, projecting second-quarter growth at an annual pace of 0.6 per cent, down by 0.6 of a percentage point from an earlier forecast.

She, too, sees a stronger third quarter.

It’s not just the hit to production that plays into the numbers but, for example, the reduced spending among the tens of thousands who have been evacuated and the ripple effect, said Royal Bank of Canada, whose economists cut their quarterly forecast to an annual pace of 0.5 per cent.

“A longer shutdown of operations would result in even weaker [second-quarter] growth with a stronger rebound in [the third quarter],” said RBC’s Paul Ferley, Nathan Janzen and Gerard Walsh.

“Longer-term an offset will be provided by the rebuilding of destroyed assets in the Fort McMurray area.”

By the numbers

Bank of Nova Scotia took a deep look today at the potential impact of the wildfire shock. A synopsis based on the report from Scotiabank’s Derek Holt and Dov Zigler, who note it’s still an unfolding story:

“Our initial revised forecast estimate is for no growth in [the second quarter], which could be optimistic with further downside risk stretching up to a 1-2-per-cent annualized contraction, followed by a rebound of 2-2.5 per cent in [the third quarter] with annual average growth in the 1.5-per-cent range for 2016.”

“The impact upon national exports is likely to be a drag of at least 2-3 per cent month over month in May and then a comparable rebound spread over ensuing months. All crude petroleum, refined petroleum and natural gas exports equal about 10 per cent of total nationwide exports.”

“Manufacturing shipments will likely decline by 2-3 per cent month over month or more in May as a direct result of the disrupted energy production.”

“There is scope for significant volatility in job readings for May and beyond. Some workers will have lost their jobs as businesses were destroyed. Some may be highly uncertain over whether they still have jobs.”

“The impact upon national retail sales is likely to be in the low single-tenths of percentage points to the downside in May and to the upside thereafter. Alberta represents about 14 per cent of total nationwide retail sales and we figure that the Fort McMurray area represents around 2-4 per cent of that total.”

“1,600 homes will need to be rebuilt, subject to further developments minus arguments concerning the potential for not fully rebuilding.”

Diamond in the rough

Canada’s Lucara Diamond Corp. says it has sold a huge rough diamond for more than $63-million (U.S.).

That’s $77,649 for each of 813 carats in a sale the company said today is the highest for any rough diamond.

Up next, in late June, is the sale of a 1,109-carat diamond.