Briefing highlights

- How Trump could wound Canada's economy

- Samsung slashes profit forecast

How Trump could wound Canada

Donald Trump could wound Canada deeply if he’s elected president next month.

While a Clinton presidency could also hurt America’s northern neighbour, it would be nowhere near as bad, economists say, citing Mr. Trump’s trade policies and potential impact on markets.

“A negative impact on trade could not come at a worse time for Canada considering how a recovery in export growth to the U.S. will be crucial to stimulate business investment and growth locally,” warned Charles St-Arnaud of the Nomura economics group.

Mr. St-Arnaud believes Democratic hopeful Hillary Clinton would be “only marginally negative compared with the status quo” where Canada’s economy is concerned, and that we’d suffer “a much bigger negative impact” from a Trump presidency.

“This would come from the decline in trade, from both rejection of trade agreements and his impact on the U.S. economy, increased border frictions, increased environmental costs, and higher borrowing costs in Canada due to higher yields in the U.S.,” he said.

“This could be mitigated slightly by an increase in oil exports following the construction of the Keystone XL and other pipelines and by the positive impact on Canadian growth from higher military spending that his international disengagement could generate.”

(And just think, if we lose our jobs because of him, and get sick because we’re not working, our “catastrophic” health care system, as he called it at the last debate, won’t help us.)

Mr. St-Arnaud looked at the potential impact across the economy. These are his categories:

Trade

The biggest impact would come here, observers say, given Mr. Trump’s proposals to redraw or even rip up the North American free-trade agreement, among other things.

Ms. Clinton doesn’t like the Trans-Pacific Partnership deal, but she’s not threatening to pull out of NAFTA, so she’d be “the safer bet for Canada by most measures,” said BMO Nesbitt Burns senior economist Sal Guatieri.

“Trump hasn’t put Canada on his tariff list (the country accounts for less than 2 per cent of the U.S. trade deficit, versus almost half with China and a 10th with Mexico), but the possibility of the U.S. withdrawing from NAFTA would slash trade between the two nations, throw a wrench into highly integrated supply chains, and create uncertainty for exporters and importers,” Mr. Guatieri said.

“There is no guarantee that the old [Canada-U.S. free trade deal] would replace NAFTA,” he added.

“Canada’s economic challenges would clearly mount if it lost preferential access to its largest and most loyal trading partner (buyer of 76 per cent of goods exports, with the share little changed in the past decade).”

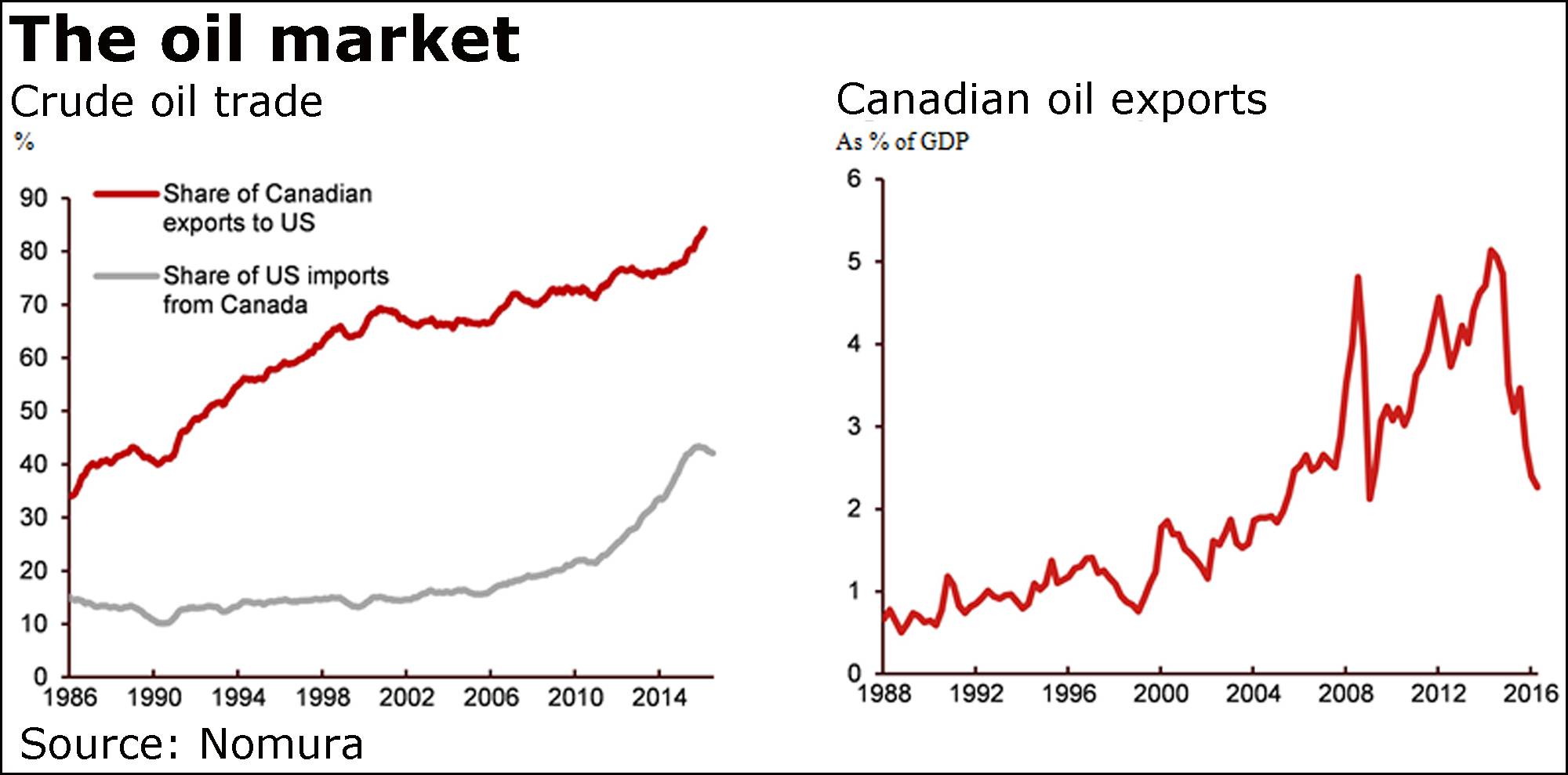

Indeed, added Mr. St-Arnaud, Canada’s exports to the U.S. account for a hefty one-fifth of our gross domestic product.

“NAFTA is not the only trade agreement that is being targeted by Mr. Trump,” Mr. St-Arnaud said, also noting the Republican candidate’s vow to not ratify the TPP deal that includes Canada.

“It is likely that without the participation of the U.S., the agreement will not go forward. This would slow Canada’s trade diversification toward Asia and would mean that the country would have to rely on negotiating bilateral agreements.”

Of course, some economists question whether Mr. Trump’s bluster would translate into full-scale action.

Mr. Trump is also obviously seen as targeting Mexico in his anti-NAFTA policies. But that, said CIBC World Markets, underscores the “populist view” that Mexico has won the most from the trade deal at America’s expense.

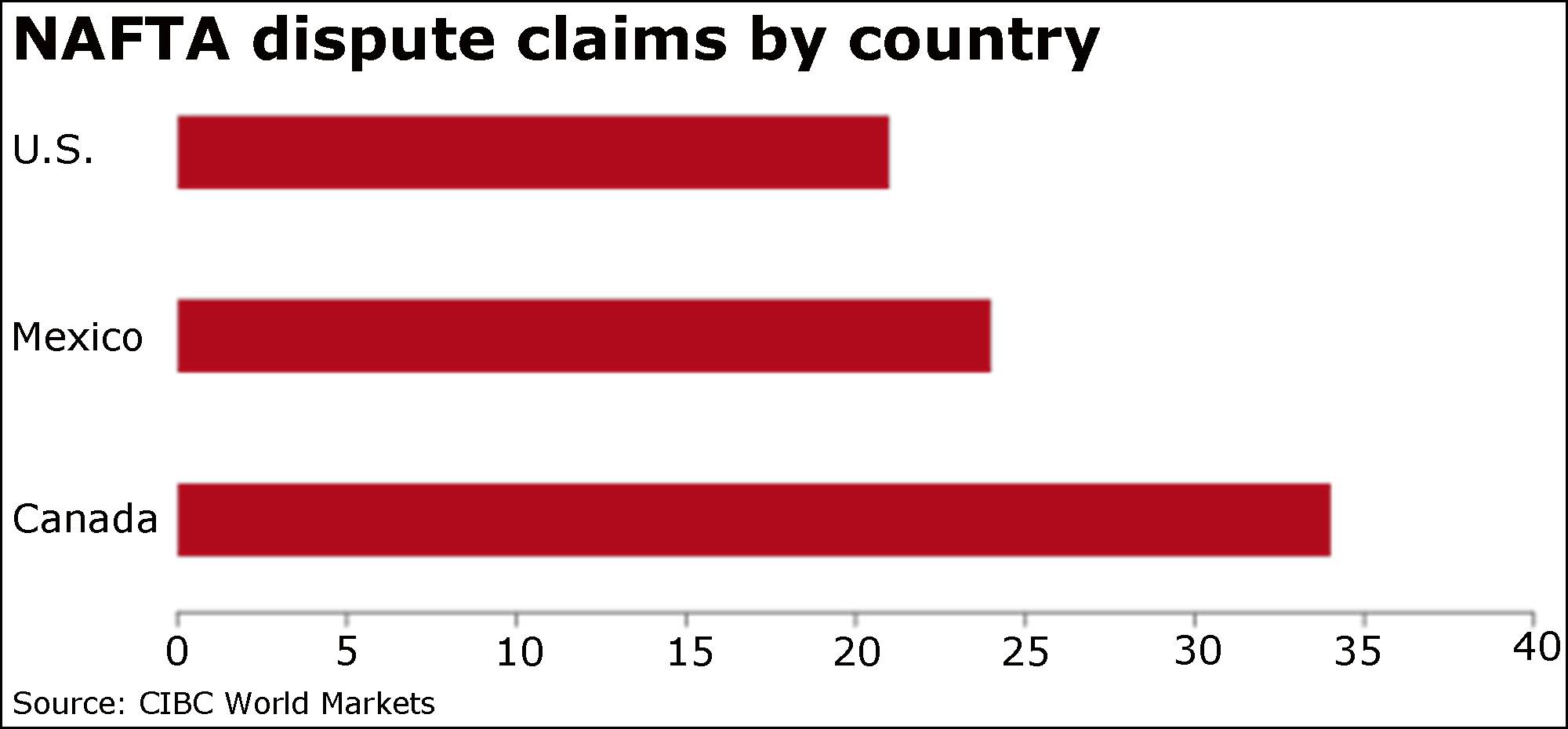

“That simplistic spin has helped Trump, but it ignores the inconvenient fact that Canada has been the actual NAFTA boogeyman for the U.S.,” said Bipan Rai, CIBC’s executive director of macro strategy, citing this chart of disputes filed against companies under NAFTA in the past 11 years.

“North American economic integration has increased exponentially since the launch of NAFTA in 1993, but one can make a reasonably sound argument that Canada has benefited the most, with exports to the U.S. expanding exponentially over the last 20 years, and total trade between the two nations the largest globally,” Mr. Rai said.

“A Trump victory would be another strike against the globalization era that has been in place since the 1980s, and the pain felt by a more insular U.S. trade sector would extend to small, open economies that are already running wide external deficits,” he added, noting Canada is among them.

The border

Mr. Trump isn’t proposing to wall off Canada, but there would likely be tougher controls along the world’s longest border, where almost $600-billion (U.S.) in goods trade was done last year, Mr. St-Arnaud said, citing proposals for a biometric-visa-tracking system at all points of entry.

“While it is unclear what this plan would entail, and how cumbersome and time-consuming the process might become, it would likely increase friction at border crossings between Canada and the U.S., causing some headwinds to trade.”

(To say nothing of Americans wanting to flee across the border to escape a Trump America, and the Canadians who just might choose to stay home.)

Oil

Okay, this one goes half to Mr. Trump, who would approve TransCanada Corp.’s Keystone XL pipeline, though he’d tax the profits, while Ms. Clinton would continue to withhold approval.

Mr. Trump’s plan, said BMO’s Mr. Guatieri, would “give Alberta’s oil industry a much-needed shot in the arm.”

Ah, but …

Said Mr. St.-Arnaud: “Mr Trump has vowed to reduce barriers that are preventing the expansion of energy production in the U.S. This means that oil and gas production would likely increase meaningfully. This would reduce the need for the U.S. to import oil and gas and the increased supply would likely push down energy prices. Both outcomes would be negative for Canada.”

International policy

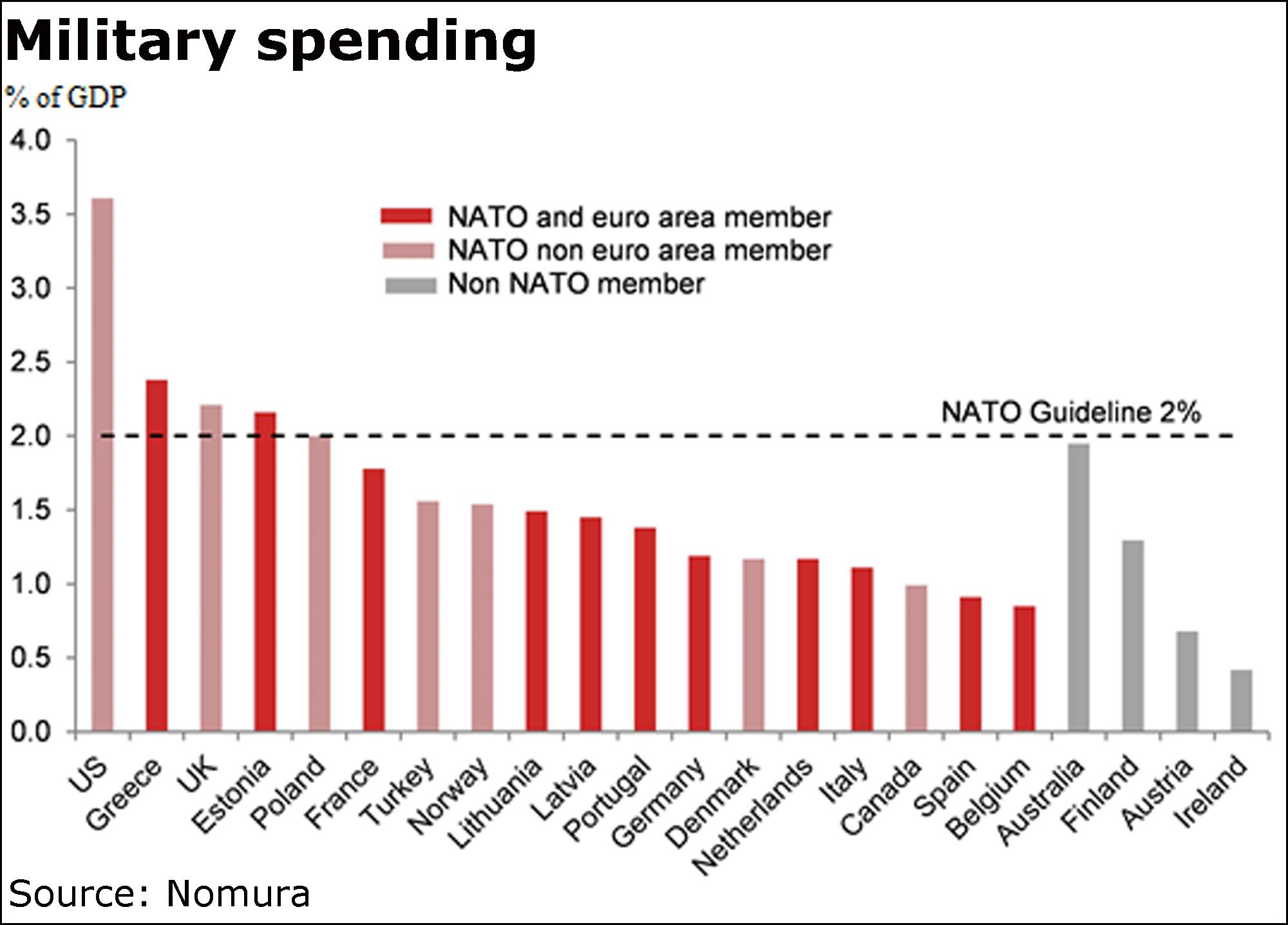

Mr. Trump’s “isolationist” view of foreign policy, as Mr. St-Arnaud put it, could see him demand money for U.S. defence spending from allies.

And maybe more money from Canada to take part in the North American Aerospace Defense Command, or NORAD, and enjoy “the implicit protection the U.S. military provides to Canada.”

(I know, right? Who wants his protection?)

Still, a potential impact here, according to Mr. St-Arnaud:

“An increase in military spending would actually be positive for [Canadian economic] growth. However, the question is whether cuts would be made elsewhere in the federal budget to compensate for the permanent impact such an increase in government spending would have on the budget balance. We believe that the current government is unlikely to cut other spending, especially in the current context of weak growth and the government’s positive attitude toward fiscal stimulus.”

The environment

Mr. Trump would pull out of the Paris Agreement on climate change, which Mr. St-Arnaud believes could force Canada to follow suit so that our companies wouldn’t be at a disadvantage in America.

That could be good news for Canada in the short term, but he’d likely also put coal-powered plants back into production, and allow new ones, spewing bad air into Ontario and Quebec, which Mr. St.-Arnaud says would mean an added burden on health care.

(Talk about catastrophic, Mr. Trump.)

Markets

There’s a lot here, much of it indirect.

As Mr. St-Arnaud sees it, Mr. Trump’s policies could drive up inflation, meaning the Federal Reserve could respond with higher interest rates, in turn juicing the U.S. dollar.

Which would mean a softer Canadian dollar, a boon to Canadian exporters. Ah, but remember those potential trade issues.

Then there’s the potential for higher short-term rates and added government borrowing pushing up long-term bond yields in the U.S., which could ripple across the border.

“This would increase the cost of borrowing for both Canadian businesses and households,” Mr. St-Arnaud said.

“An increase in borrowing costs in Canada could have some negative impact on the highly leveraged households and affect consumer spending,” he added.

“This could even have an important impact on financial stability in Canada, given the size of household imbalances.”

A hit to Canadian trade could have a similar impact.

“To shield the economy, the Bank of Canada could ease policy (possibly deploying negative interest rates),” said Mr. Guatieri.

“This, alongside a rising trade deficit, would hammer the Canadian dollar,” he added, though our exporters could benefit if Trump targets Chinese and Mexican goods and leaves us alone.

Some observers envision a different short-term scenario, arguing the U.S. dollar could fall and the Fed hold back on raising rates because of the uncertainty a Trump victory would cause.

As for longer term, JPMorgan Chase analysts agreed in a recent report that the top currencies “most likely and most severely impacted” by U.S. trade measures would be the yuan, Mexico’s peso, and the loonie.

Samsung slashes forecast

The Galaxy Note 7 fiasco is costing Samsung dearly.

The Korean electronics giant, which has halted production and sales of its recently launched device, has cut its forecast for third-quarter operating profit to about 5.2-trillion won ($4.7-billion U.S.), a drop of almost $2.5-billion.