About those debts ...

Here’s some good news - if you can call it that - for Canadians juggling fat debts and living in fear of higher interest rates.

First, rates are going nowhere any time soon. And, second, a new report suggests that Canadian consumers only appear “reckless” only next to their American cousins.

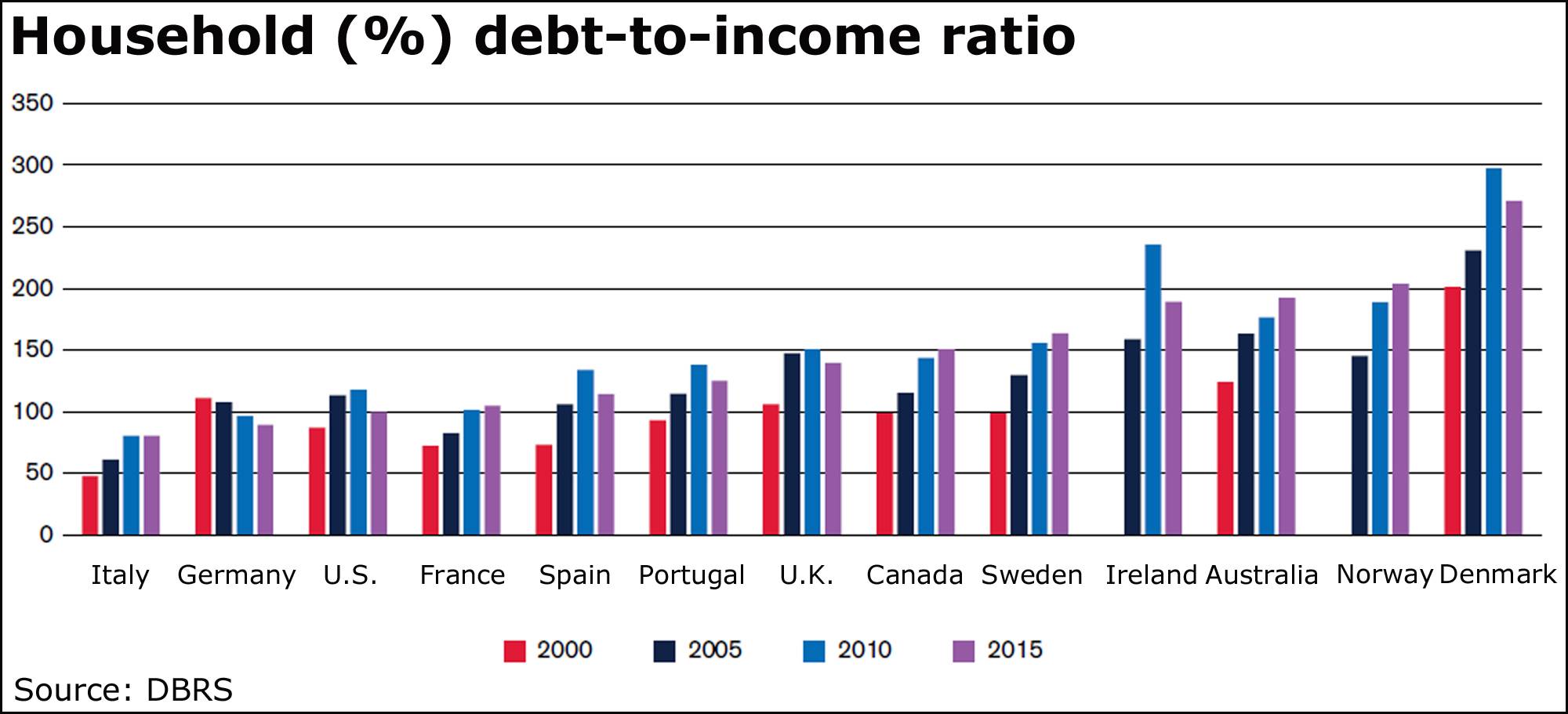

“In fact, Canada is less leveraged than countries like Australia, Sweden and Norway, and has levels similar to those of the United Kingdom,” says a new report from rating agency DBRS Ltd.

“The silver lining in the great debt debate is that Canadian consumers only look reckless when compared to American consumers,” the report adds.

“Even though Canadians are more comfortable with higher debt levels than before, on the global level, Canadian consumers are less indebted than many other countries.”

There’s a big but there. Other countries aside, DBRS still sees household debt at “dangerous” levels.

“In general, Canadian debt levels have been rising steadily by 3 per cent to 4 per cent a year since the early 2000s, largely fuelled by mortgages, while credit cards, lines of credit and auto loans have made up the remainder,” the report says.

“An appreciating housing market, looser lending standards in the preceding decade, such as the 40-year mortgage, changes allowing RRSPs to contribute to down payments on homes and lower interest rates on all debt financing have contributed to higher levels of indebtedness.”

We’ll get a clearer picture of this on Friday, when Statistics Canada releases its quarterly report on wealth and debt.

That second-quarter report is expected to show a record when it comes to the key debt-to-income ratio.

But there’s more to that story.

“The net-worth-to-disposable-income ratio rose to a record 767 per cent in Q1, and will likely climb further as higher home prices and a weaker Canadian dollar boost asset values, though weaker equity markets will act as a restraint,” Bank of Montreal senior economist Benjamin Reitzes said in a look-ahead to Friday’s report.

“Over all, debt loads may be significant, but are only a bit more than 21 per cent of net worth and trending lower, leaving Canadian balance sheets in good shape.”

HBC sees profit rebound

Hudson’s Bay Co. is boasting a “transformative quarter” today amid a profit rebound and a pickup in sales.

The Canadian retailer, which also owns Saks and Lord & Taylor, posted a second-quarter profit turnaround to $67-million, or 33 cents a share diluted, from a loss a year earlier of $36-million or 23 cents.

Sales climbed to $2-billion from $1.8-billion.

“This was a transformative quarter for us, with multiple major initiatives that will shape HBC for years to come,” said executive chairman Richard Baker.

Lululemon gains

Lululemon Athletica Inc. has issued a second-quarter report that showed a 16-per-cent jump in revenue and a slightly higher profit outlook for the year.

Second-quarter revenue climbed to $453-million (U.S.) from $390.7-million a year earlier. Same-store sales, a key measure in retailing, rose 6 per cent.

Profit came in at $47.7-million, or 34 cents a share, compared to $48.7-million or 33 cents.

Lululemon also boosted its full-year profit outlook slightly to a range of $1.87 a share to $1.92.

Worth noting

Here’s an interesting thought in a new economic forecast from BMO senior economist Sal Guatieri:

“The outcome of the Oct. 19 federal election could have a modest impact on next year’s growth, as the three leading parties (running neck and neck in the polls) have different mandates to provide stimulus, at the possible expense of running deficits.”