Reforming retirement

The deputy chief economist at Canadian Imperial Bank of Commerce is making an impassioned plea to reform the country’s retirement system as quickly as possible.

“Add it all up, and there are some 5.8 million working-age Canadians who will see more than a 20-per-cent drop in their living standards upon retirement,” Benjamin Tal said in a report.

“That’s why the time to act is now.”

Canada’s Conservative government is studying the possibility of a voluntary expansion of the Canada Pension Plan, the idea being that working people could pay higher premiums for stronger benefits down the road.

It’s not just CPP, Mr. Tal added in an interview, but also the fact that Canadians simply aren’t saving enough. So “we have to be more creative” to encourage savings, whether via CPP, RRSPs or other ways.

“Without getting into the politics of it, it is important to remember why a change to the system is essential,” said Mr. Tal.

“While many Canadians, particularly those now close to 65, are on a path to the retirement of their dreams, the data show that millions of others are headed for a steep decline in living standards in the decades ahead, particularly those who are currently younger and who are in middle income brackets,” he added.

You’re okay if you were born during the Second World War because you’d maintain your standard of living when you take lower expenses into account.

The “leading edge” of the baby boomers are set up almost as well.

“But their children are much less well positioned, given the current trend towards lower savings rates and reduced private pension coverage,” said Mr. Tal, who arrived at the 5.8-million figure by studying age and income groups.

“On average, the replacement rate of those born in the 1980s, who will retire towards the middle of this century, will be only 0.7, implying a 30-per-cent drop in their standard of living.”

The first rule of the Greece-EU Fight Club ...

"... is to talk about whatever you want, and start any rumour that strikes your fancy."

'Interminable'

As always, you never really know if there’s real hope of resolving the Greek crisis.

But things do seem to be moving, at least.

Athens has sent new reform proposals to its creditors, which Prime Minister Alexis Tsipras said today is a “realistic plan for Greece to exit the crisis.”

And as our European bureau chief Eric Reguly reports, European leaders held a surprise crisis meeting that included German Chancellor Angela Merkel, France’s François Hollande, European Central Bank chief Mario Draghi, European Commission leader Jean-Claude Juncker and International Monetary Fund managing director Christine Lagarde.

The Wall Street Journal reported that the creditors reached “a consensus” on proposals they’ll put to Athens.

“They say a week is a long time in politics and the Greek talks are certainly making this week seem interminable,” said Brenda Kelly of London Capital Group.

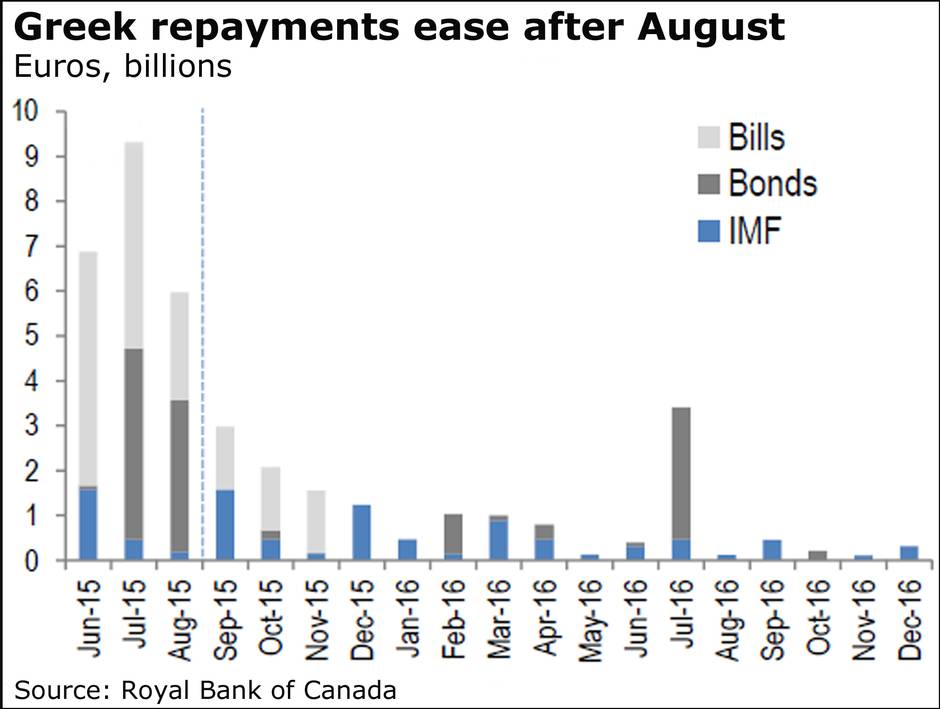

“Growing doubts continue to surround the ability of Greece to meet its debt obligations now and talks at the moment appear to be in a deadlock, with many expecting to see some sort of ultimatum from either side at some stage this week.”

Airline boosts targets

Air Canada has raised expectations for key financial targets later this decade, saying it has made significant progress since it issued its 2013 targets.

The airline said Tuesday that return on invested capital; earnings before interest, taxes, deprecation, amortization and impairment and aircraft rent as a percentage of operating revenue (EBITDAR); and its leverage ratio should improve by 2018.

The target for annual EBIDTAR is between 15 per cent and 18 per cent through 2018, while return on invested capital should grown by 13 per cent to 16 per cent.

Tweet of the week (so far)

From @chrischofield1: ‘Woman announces harsher austerity from a solid gold throne wearing a crown made of 2,868 diamonds’

Fitbit eyes IPO price

Fitbit Inc., the company behind the wristband that has taken fitness enthusiasts by storm, says it’s looking to price its shares at between $14 (U.S.) and $16.

In the run-up to its IPO, Fitbit said today it will offer 22.4 million shares, with stockholders offering 7.5 million.

Fitbit is looking to list on the New York Stock Exchange under the symbol FIT.

“Fitbit is transforming the way millions of people around the world achieve their health and fitness goals,” the company said in documents filed with U.S. regulators.

Fitbit, which at the top end of that price range would be worth more than $3-billion, reported first-quarter profit of $48-million and revenue of $336.8-million.

A bit of this, and a bit of that

Australia’s central bank held fast today, though central bankers in India cut their key rate for the third time so far this year.

And, some observers say, it could move even further.

The Reserve Bank of India cut its repo rate by one-quarter of a percentage point, to 7.25 per cent, bringing the cumulative decrease to three-quarters of a point.

“Looking ahead, we think that there is still some scope, albeit limited, for further loosening,” said Shilan Shah of Capital Economics.

In Europe, the latest reading showed consumer prices picking up in the euro zone for the first time in six months, with May inflation at 0.3 per cent to set the stage for this week’s ECB meeting.

Core inflation, which strips out volatile items, also rose.

“These figures should significantly ease deflation worries in the region,” said senior economist Benjamin Reitzes of BMO Nesbitt Burns.

“However, a negative economic shock would quickly reignite concerns, so don’t expect the ECB to ease off the monetary gas pedal any time soon.”