Briefing highlights

- Numbers suggest Trump off base on NAFTA

- Sudden rate hikes could hit housing: CMHC

- Rate hike could be near, Fed chair says

0.04%

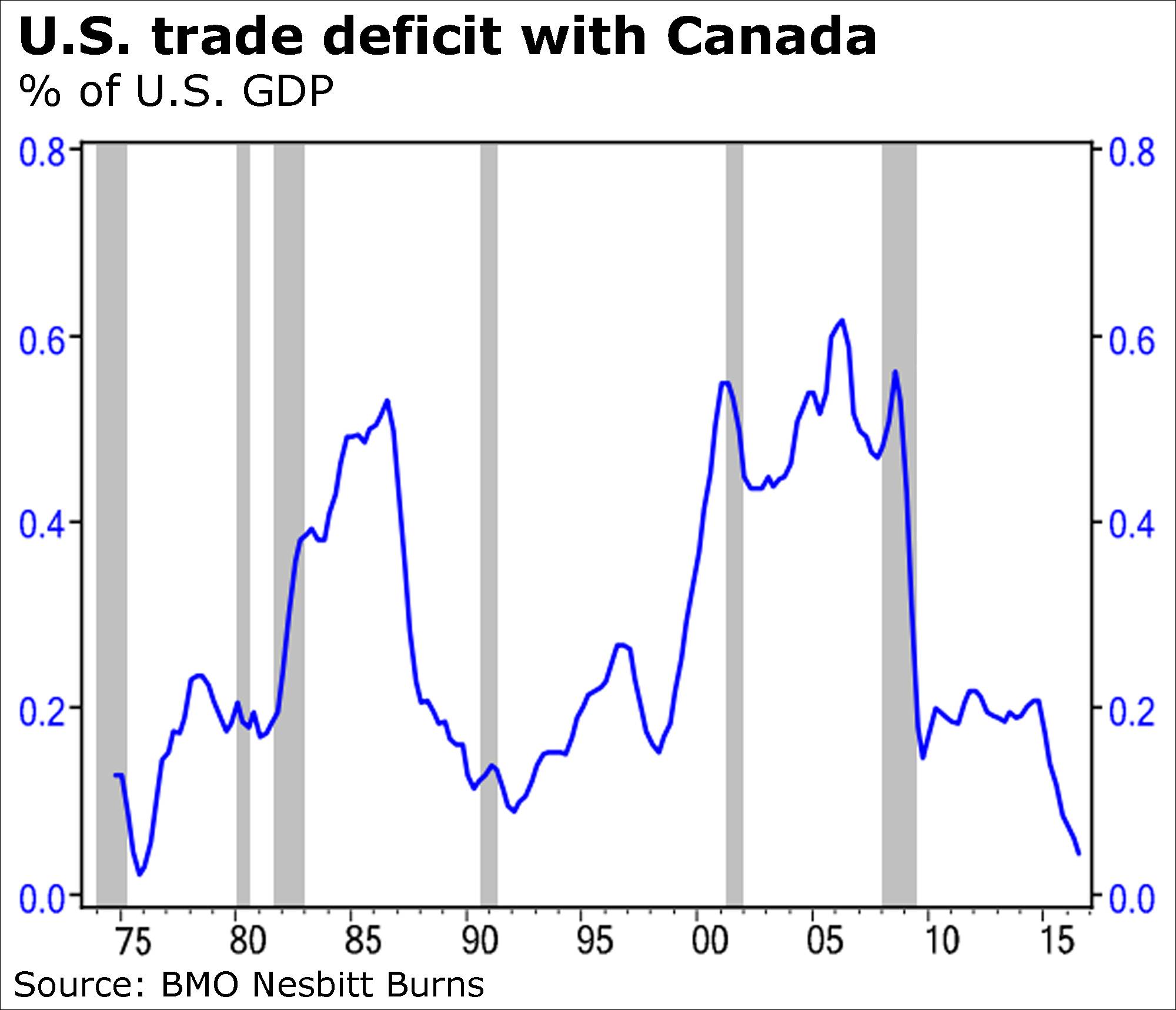

U.S. trade gap with Canada as a share of GDP

The numbers alone raise questions about Donald Trump’s condemnation of the North America free-trade agreement.

Indeed, they suggest the U.S. president-elect is somewhat off base, leading BMO Nesbitt Burns to ask how NAFTA can possibly be an “existential threat” to the American economy.

A 12-month total to September shows the U.S. trade deficit with Canada shrinking to only $8.1-billion (U.S.), from an oil-fuelled peak of about $80-billion in 2008, BMO chief economist Douglas Porter noted.

The latest number, he said, is “literally a rounding error,” accounting for a teeny 0.04 per cent when expressed as a share of gross domestic product.

“The U.S. bilateral trade deficit with Canada has been whittled down to nearly nothing in recent years,” Mr. Porter said.

“This is due to the combination of lower commodity prices, firmer Canadian domestic spending, and the loss of Canadian manufacturing share in the U.S. market.”

Mr. Porter didn’t say Mr. Trump was off base, though his numbers also show that the U.S. deficit with Mexico, which has taken the brunt of the president-elect’s complaints, is 0.3 per cent, or $63-billion, over the same period.

“Combined, the two countries account for less than 10 per cent of the total U.S. trade deficit, begging the question of why so much focus is falling on NAFTA,” Mr. Porter said.

“Even at its ‘peak,’ the deficit with Canada was running at an unremarkable 0.6 per cent of U.S. GDP. Put another way, U.S. exports to Canada are now equal to 97 per cent of imports from Canada, almost precisely balanced.”

That’s on the goods side. When you include services, the Americans have actually been running a surplus of $7.7-billion. That, too, is basically a rounding error, this time in favour of the U.S. equivalent to 0.04 per cent of GDP.

The total deficit with Mexico came in at $60-billion.

“But that’s less than a fifth of the imbalance with China, smaller than the deficit with Germany and in line with the shortfall with Japan,” Mr. Porter said.

“Thus, overall trade in goods and services with its NAFTA partners generates a deficit of less than 0.3 per cent of U.S. GDP,” he added.

“We would simply ask: In what way, shape, or form, does that pose an existential threat to the U.S. economy?”

CMHC warns

A sudden sharp rise in interest rates could cause Canadian home prices to plunge 30 per cent, triggering more than $1-billion in losses to the country’s government-backed mortgage insurer, according to the results of stress tests by the federal housing agency.

Canada Mortgage and Housing Corp. released the results of internal modelling that tests how its mortgage insurance and securitization business would perform under a variety of severe economic shocks, The Globe and Mail’s Tamsin McMahon reports.

The results of each scenario on CMHC’s regulatory capital requirements (% MCT) are as follows:

| For the 2017-2021 Period | Base Case | Global Deflation | Oil Price Shock | Earthquake | Reverse Stress Test | US Style Housing Correction |

|---|---|---|---|---|---|---|

| Peak unemployment rate | 6.6% | 13.5% | 8.8% | 8.4% | 11.3% | 12% |

| Change in housing prices | 9.0% | -25.0% | -7.8% | -0.6% | -30.0% | -30.0% |

| Cumulative net income/loss - Insurance | $6,476 | -$3,124 | $3,530 | $4,445 | -$1,130 | -$2,047 |

| Lowest Insurance capital (% MCT) – current MCT | 408% | 304% | 411% | 404% | 262% | 286% |

| Lowest Insurance capital (% MCT) – new MCT | 235% | 210% | 238% | 233% | 190% | 183% |

| Cumulative net income - Securitization | $2,119 | $2,201 | $2,078 | $789 | $2,287 | N/A |

| Lowest point of available capital - Securitization | $2,224 | $2,513 | $2,393 | $1,067 | $2,198 | N/A |

Scenario Descriptions

| Scenario | Description |

|---|---|

| Base Case | Non-stressed situation according to CMHC’s Corporate Plan. |

| Global Deflation | Severe and prolonged economic depression. |

| Oil Price Shock | Price of oil falls to US$20 per barrel in 2017 and subsequently ranges between US$20-30 for further four years. |

| Earthquake | Multiple scenarios of a high-magnitude earthquake that disrupts critical infrastructure and services in a major urban centre, including broader financial impacts as a result of its effects on homeowners and businesses, were run. Reporting reflects the most severe outcome of the simulations. |

| Reverse Stress Test | A sudden increase in interest rates leads to higher borrowing costs for both Canadian consumers and financial institutions, causing a severe drop in Canadian house prices and ultimately the failure of a Canadian financial institution. |

| US Style Housing Correction | A 5 percentage point increase in the unemployment rate with a 30% decline in house prices. |

The most dramatic involved a severe and prolonged global economic depression, which would send unemployment soaring and home prices tumbling. Sharply rising interest rates – a more realistic scenario – could cause unemployment to rise by 11.3 per cent, CMHC said, leading to lower losses compared to a global depression.

Rate hike near

Federal Reserve chair Janet Yellen is telling markets to expect a rate increase “relatively soon.”

In her opening statement to the Joint Economic Committee in Washington, Ms. Yellen said the target range for the federal funds rate will, as always, depend on what the indicators show.

“At our meeting earlier this month, the committee judged that the case for an increase in the target range had continued to strengthen and that such an increase could well become appropriate relatively soon if incoming data provide some further evidence of continued progress toward the committee’s objectives,” she said.

“Were the FOMC to delay increases in the federal funds rate for too long, it could end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of the committee’s longer-run policy goals,” she added.

“Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and ultimately undermine financial stability.”