How Canada compares

Canada lags the leading countries in the quality of its jobs, a new OECD report concludes.

According to the study from the Organization for Economic Co-operation and Development, the quality of Canadian jobs is just “average,” putting the country in the same league as Belgium, the Czech Republic, France, Ireland, Israel, Japan, Korea, Mexico, the Netherlands, New Zealand, Slovenia, Sweden, Britain and the United States.

Topping the list are Australia, Austria, Denmark, Finland, Germany, Luxembourg, Norway and Switzerland, while Estonia, Greece, Hungary, Italy, Poland, Portugal, the Slovak Republic, Spain and Turkey sit at the bottom.

The findings are similar to those of a study in the summer of 2014, basically showing no gains where Canada is concerned.

The OECD measures three things, including earnings, job security and working environments.

Countries at the top of the rankings fared “relatively well” in at least two of those categories, while those in the middle scored one or less in the top or bottom 10.

Those in the basement didn’t score well in any.

Unemployment is high in Canada, at 7.2 per cent, driven up by the impact of the oil shock. In Alberta, particularly, the jobless rate has spiked.

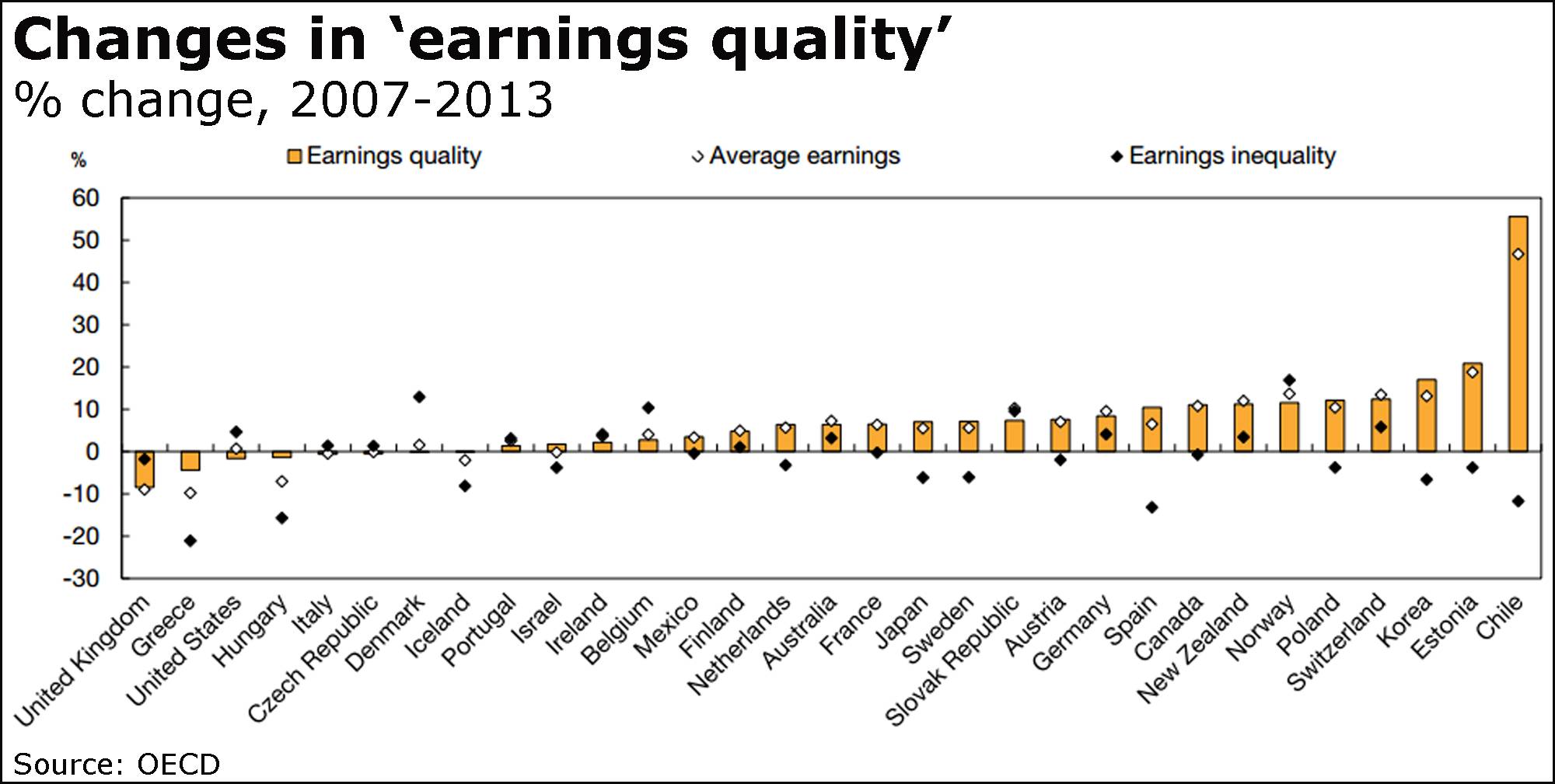

“The deep and often prolonged economic crisis has taken a toll on the labour markets of most OECD countries, with often dramatic increases in unemployment and its duration,” the report said.

“The crisis has also affected those who remained in employment, changing remarkably the quality of existing jobs.”

Canada-U.S. relations if he actually won?

Yellen sticks to script

Federal Reserve chair Janet Yellen may be sticking to the party line but, analysts say, the markets aren’t buying it.

In her written testimony to a Congressional committee in Washington today, Ms. Yellen reiterated that the U.S. central bank is still looking at continuing to raise its benchmark rate on a gradual basis, though not necessarily next month.

“This view is clearly at odds with futures markets, which imply that any additional rate hikes are now off the table,” said Paul Ashworth of Capital Economics.

His group, by the way, projects more stable conditions that would allow the Fed to raise rates again in June.

“Yellen’s prepared testimony suggests that the [Federal Open Market Committee] is working on the assumption that it will be able to continue nudging its Fed funds rate target range higher over time,” said Dana Saporta, director of economics research at Credit Suisse.

“But her comments underscore the fact that the committee is not blind to the risks emanating from abroad and the tighter financial conditions at home. And, in our view, they suggest that a rate hike as soon as March is not likely.”