Briefing highlights

- Subprime levels climb in Canda

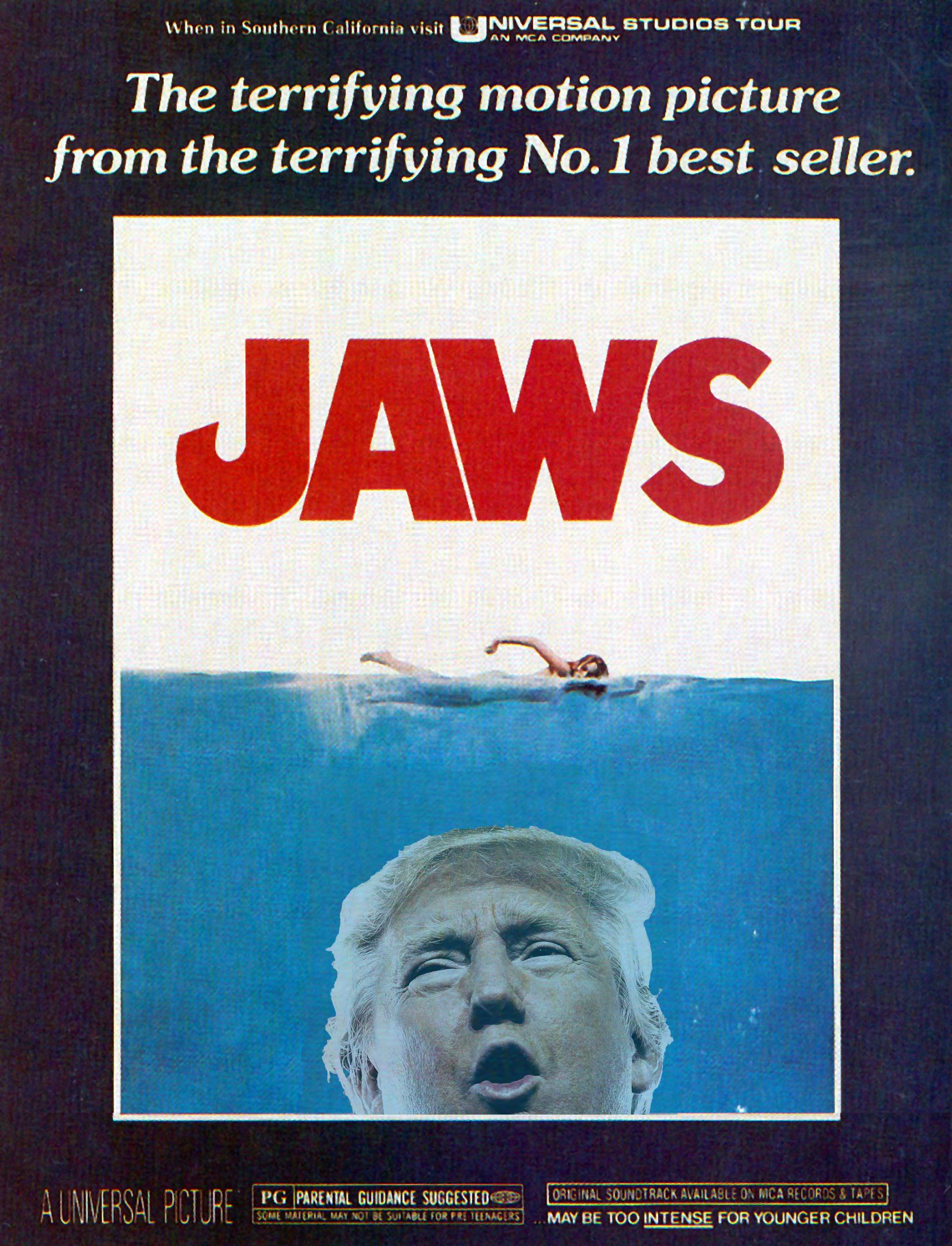

- Just when you thought it was safe ...

- Global markets slump as investors await Fed minutes

- Japan's economic growth surprises markets

- Video: How to build a perfect to-do list

Subprime levels climb

Subprime borrowers are becoming an ever-growing class of their own in Canada, piling on credit card debt at a marked pace.

The average card balance per consumer rose 5.7 per cent in the first quarter of the year, to $6,601, from a year earlier, a TransUnion report released today shows.

Average balances rose 2.6 per cent in the near-prime category, to $6,260, and fell 4.7 per cent for prime, 4 per cent for prime plus, and 1.5 per cent for super prime.

The average for prime is now $5,847.

“The story on the debt front is that average balances haven’t moved much, if you consider all Canadians together,” TransUnion’s Canadian director of research and analysis, Jason Wang, said in today’s report.

“But once we segment by risk tiers, we find a gradual shift where subprime consumers are increasing their share of the debt load relative to the low-risk population.”

Delinquency rates for non-mortgage debt also rose across Canada, by about 3 per cent, surging in Alberta by almost 12 per cent from a year a year earlier, TransUnion said.

A movie poster I'd love to see ...

Stocks slump

We’re back to a sea of red across trading screens this morning.

Tokyo’s Nikkei lost 0.1 per cent, Hong Kong’s Hang Seng 1.5 per cent, and the Shanghai composite 1.3 per cent.

In Europe, London’s FTSE 100, Germany’s DAX and the Paris CAC 40 were down by between 0.2 and 0.3 per cent by about 5:45 a.m. ET.

New York futures were little changed as investors await this afternoon’s release of the minutes of the last Federal Reserve meeting.

“The big event of the week, Fed minutes, is up later today, so we can expect the generally cautious tone to continue when U.S. markets open,” said IG senior market analyst Chris Beauchamp.

“The world’s most powerful central bank continues to be constrained by concerns about tightening financial conditions in advance of a rate hike, and it still looks odd to see the Fed try to head towards higher rates while others keep cutting,” he added.

“Something has to give if we are to avoid a summer selloff.”

Japan's economy expands

The latest economic numbers from Japan surprised markets today, and left questions about what comes next from Prime Minister Shinzo Abe.

Japan’s economy expanded at an annual pace of 1.7 per cent in the first quarter, a much better showing than expected.

“While some could attribute at least part of this to the leap year effect and downward revision to previous quarterly growth, domestic demand contribution to GDP also inched up 0.2 percentage points thanks to higher spending,” said London Capital Group chief analyst Brenda Kelly.

“Business investment remains a key bug bear, and it’s expected that the government will hold a fairly flexible policy stance amid developments in China and global market volatility,” she added.

“Widely expected to announce new fiscal stimulus during the G7 summit this month as part of his ‘Abenomics 2.0’ program, we still await news on whether this sales tax will be delayed.”