Missing Letterman

It’s not like Canadian fans caught just eight of the Top 10, but they did miss a few key minutes of David Letterman’s farewell.

And the country’s broadcast regulator wants to know why, and what the cable companies plan to do about it.

The Canadian Radio-television and Telecommunications Commission has written to both Rogers Communications Inc. and Shaw Communications Inc. over a flood of complaints from viewers.

Viewer Frank Sommer, for example, complained that “to have it happen on this most historic of television occasions has made me recall that famous line from the movie Network, “I’m as mad as hell, and I’m not going to take it any more!”

This all has to do with something known as simultaneous substitution, long a flashpoint in Canada, under which Canadian broadcasters sub their signals and advertisements on U.S. channels.

Big money at stake, obviously.

What appears to have happened here is that cable viewers were switched over before the program, which ran longer than expected, had finished, denying Mr. Letterman’s fans of some of his farewell, among other things.

“The Commission has received several complaints regarding improperly executed simultaneous substitutions by Shaw Cable that took place on 20 May 2015 near the end of the final David Letterman show,” Donna Gill, the CRTC’s senior manager, distribution regulatory policy, said in a letter to Dean Shaikh, Shaw’s vice-president, regulatory affairs.

“As you are aware, being the last David Letterman show, this was a significant television event,” she added.

“This program was extensively advertised and a large number of viewers were expected to watch the program, either live or on a delayed (recorded) basis.”

A similar, though not identical letter, went to Susan Wheeler at Rogers, the vice-president, regulatory media.

The CRTC, which is barring “simsub” during the Super Bowl beginning in a couple of years, is demanding details of what happened, and whether the carriers had advance warning.

The regulator also warned that under its policies, if a local broadcaster was at fault, it could lose its abiility to sub for a period of time. If the fault lay with the distributor, “it would have to provide a compensatory rebate to its customers.”

Rogers is apologizing to its customers for what happened, a spokesman said today, and “we’re taking active steps to prevent errors from happening in the future, including the development of better processes through an industry working group.

“We had an internal miscommunication about the show running late, which meant that some customers missed about a minute of the show,” he added.

Shaw also apologized, a spokesman saying it’s investigating what happened so it can prevent future errors.

“Shaw is committed to developing an industry approach to simultaneous substitution to protect the interests of our customers,” he added.

A movie scene I'd love to see

“I think I'll skip the FIFA annual meeting this year.”

Economies take hit

Canada’s economy slumped in the first quarter of 2015, hampered by the plunge in oil prices and an unusually harsh winter that ground North American activity to a standstill, The Globe and Mail’s David Parkinson reports.

Gross domestic product contracted by 0.6 per cent at an annualized rate in the first three months of the year, down sharply from the fourth quarter’s 2.4 per cent.

“The Canadian GDP results were plain awful, with the worst performance since the 2008/09 recession,” said senior economist Krishen Rangasamy of National Bank.

“The disappointment was largely due to business investment spending, but consumption was also soft.”

The U.S. economy took a similar hit, shrinking by 0.7 per cent in the first three months of the year, according to the Commerce Department’s revised reading today.

“The record cold winter in the Northeast and the slump in the shale oil industry were the principal reasons why first-quarter GDP apparently shrank by 0.7 per cent annualized, which was a worse outcome than the initial estimate of a 0.2-per-cent gain,” said Paul Ashworth of Capital Economics.

“Nevertheless, it is also clear that there are some very strange seasonal effects here, which have been artificially depressing the expenditure-based measure of GDP in the first quarter of recent years.”

Scotiabank beats

Bank of Nova Scotia capped the second-quarter results of Canada’s big banks today with a $1.8-billion profit.

The $1.42-a-share showing marked a rise of 2 per cent from a year earlier, The Globe and Mail’s David Berman reports.

The bank also announced that it will buy back up to 24 million of its own shares, starting next week, representing about 2 per cent of its outstanding shares.

Never-ending crisis

The markets have lost their patience with Greece and its creditors.

Just like the last time. And the time before that.

It’s different this time, though, as the young government of Prime Minister Alexis Tsipras tries to fulfill his anti-austerity mandate.

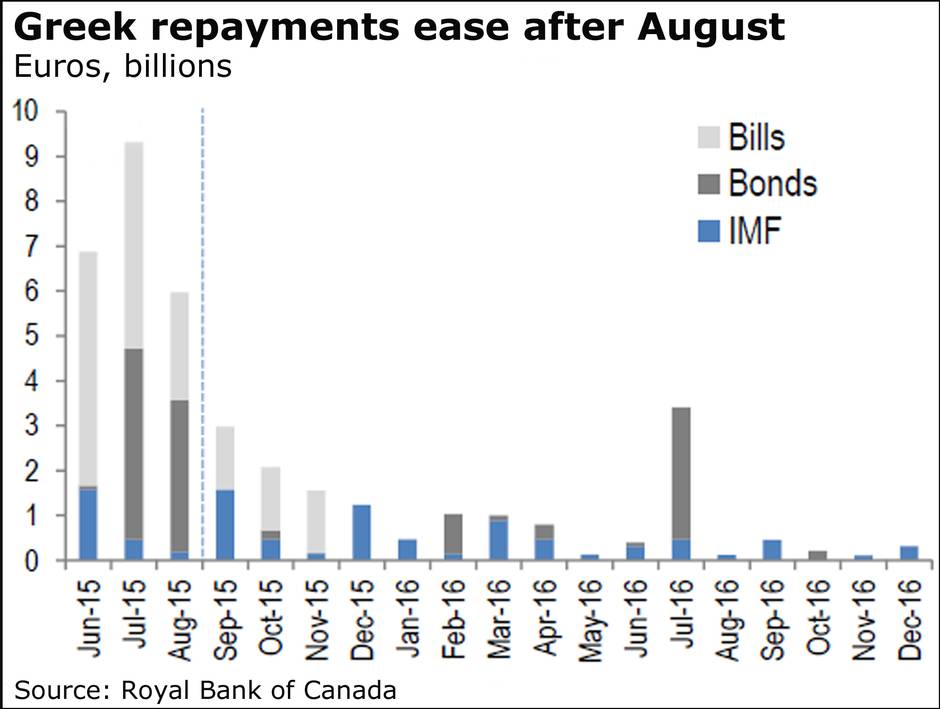

Greece now hopes it can strike a deal by Sunday with the International Monetary Fund, the European Central Bank and the European Commission as it runs up against a payment to the IMF next week.

Of course, it said as much a few weeks ago, and several Sundays have passed.

And, as always, there are different reports and varying comments from officials.

This is playing out in the markets again today.

“The long-winded negotiations and the lack of resolution between Greece and its creditors continues to hang over equity markets like the sword of Damocles this morning with European indices shedding an average 1 per cent in early trade,” said analyst Brenda Kelly of London Capital Group.

“Despite assurances from each side that progress is being made behind the scenes, the rhetoric from [IMF chief] Christine Lagarde and the European Commission would suggest that a default would equate to Greece leaving the euro,” Ms. Kelly added.

At this point, she noted, markets see a 70-per-cent chance that Athens will default.

There has been a crisis atmosphere surrounding Greece since the election, and the new government is looking to ease the controversial austerity measures put in place earlier in bailout talks.

The markets don’t know what to think – other than that there’s trouble – and the ups and downs of currencies and stocks bear that out.

“Traders are sick of the non-stop back and forth, and whenever Greece is in crisis talks there is always a series of comments from different parties involved in the negotiations which contradict each other, and traders do not know who to trust,” IG market analyst David Madden said yesterday in a research note.

“For the time being no deal has been reached, and the longer the talks go on without a deal being struck the more likely they are to drop stocks.”

The IMF and the ECB, Mr. Madden said, will ultimately decide whether Athens can “remain solvent or not.”

“Traders know deep down that a deal will be reached in the nick of time, but those who don’t have the stomach for it are getting out of the market while they can,” Mr. Madden said today.

“Greece has been in revolving door crisis talks for five years now, and [Finance Minister] Yanis Varoufakis is refusing to bow down to the international creditors.”