‘The frozen economy’

Statistics Canada is expected to report today that the economy not only stalled in the fourth quarter, but came awfully close to stalling speed for all of 2015.

“There’s no sugar-coating it,” said BMO Nesbitt Burns senior economist Benjamin Reitzes, who expects the federal agency’s report this morning to confirm that Canada’s economy expanded last year at the slowest pace since the dark days of 2009.

Here’s how it works:

The economy contracted at an annual pace of 0.7 per cent in the first quarter of 2015 and 0.3 per cent in the second, but advanced in the third by 2.3 per cent.

The fourth quarter should again come in weak when Statistics Canada releases its latest measure of gross domestic product today.

BMO believes the economy grew at an annual rate of just 0.3 per cent in the last three months of 2015. Some other economists believe it was even slower than that.

Statistics Canada could also revise the earlier quarters.

Annual GDP growth is calculated by comparing the average GDP level for the year to the average level of the year before.

All things being equal, BMO expects that to come in at 1.2 per cent for 2015.

There’s another calculation, too, which would compare the fourth quarter of 2015 to the corresponding three-month period of 2014. And BMO expects that to be a slim 0.4 per cent.

As for the fourth quarter alone, economist Dominique Lapointe of Laurentian Bank Securities is in the 0.1-per-cent camp, suggesting today’s report will detail “the frozen economy” of late last year.

“First, household consumption likely slowed during the fourth quarter due to the moderation in household income growth,” Mr. Lapointe said.

“Second, private non-residential investment shrank for a fourth consecutive quarter as the deeper and more prolonged contraction in the oil and gas industry was not offset by stronger commercial or industrial investment in Central Canada,” he added.

And, third, slower growth south of the border sparked a hefty drop in Canadian exports to the U.S. in the fourth quarter.

Economists believe we’re now in the midst of a modest rebound.

Toronto-Dominion Bank senior economist Leslie Preston expects to see “only gradual growth” of about 1 per cent this quarter, and she notes the hits to federal and provincial governments.

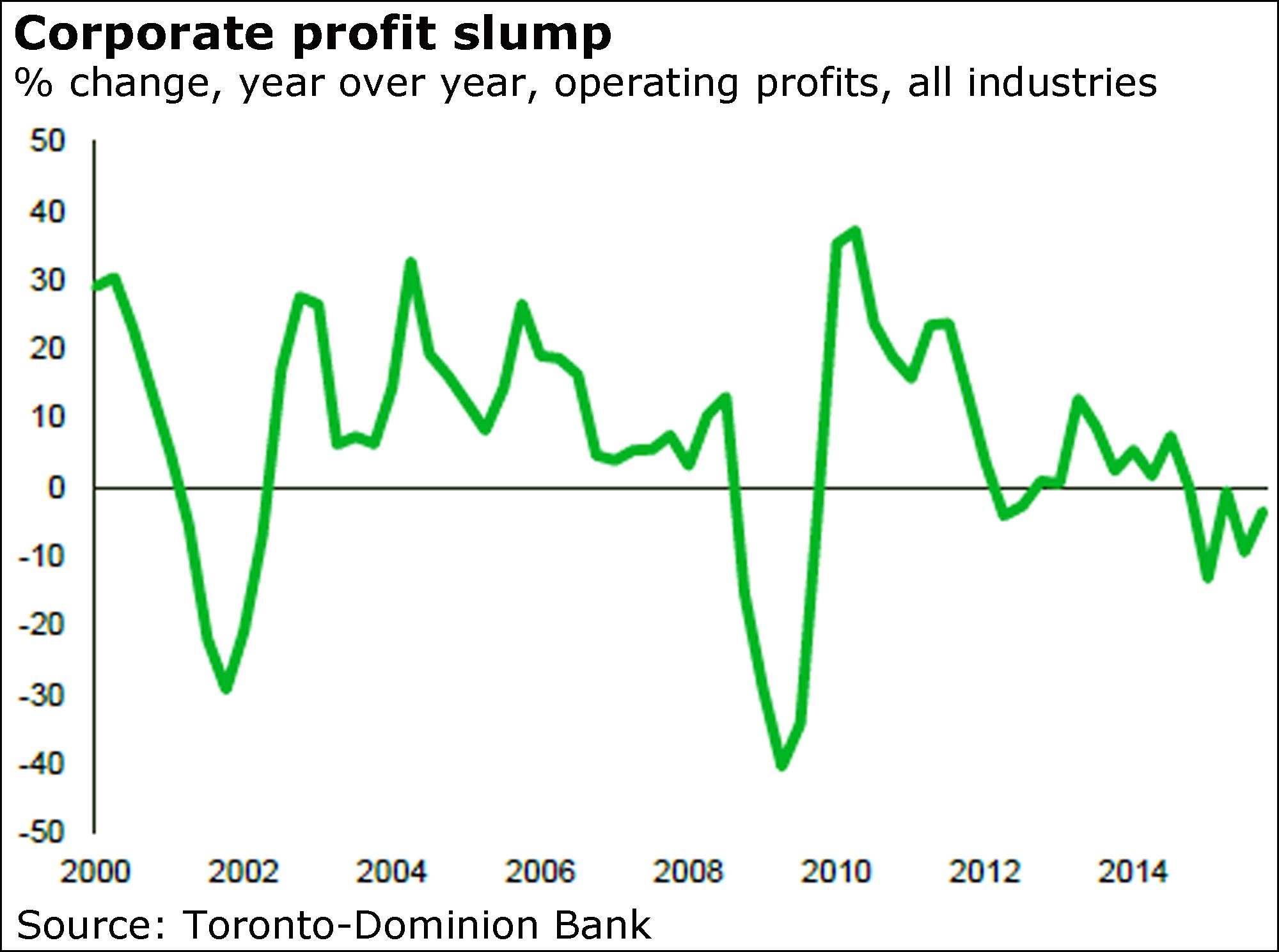

“All told, Canada’s recession of 2015 may be in the rear-view mirror, but its impact is still being felt in boardrooms and at cabinet tables, leading to belt tightening on all fronts,” Ms. Preston said.

If Trump got to choose next Supreme Court justice ...

Scotiabank boosts dividend

Bank of Nova Scotia closed out the latest round of earnings among Canada’s big banks with a dividend hike and a jump in first-quarter profit.

Scotiabank boosted its quarterly dividend by 2 cents to 72 cents as profit climbed to $1.8-billion, or $1.43 a share, from $1.7-billion or $1.35 a year earlier.

Chief executive officer Brian Porter applauded the results despite “continued volatility in the markets and some moderation in select areas of our operations.”

Stocks climb

Stock screens are flashing green this morning as markets rise around the world.

Tokyo’s Nikkei gained 0.4 per cent, Hong Kong’s Hang Seng 1.6 per cent, and the Shanghai composite 1.7 per cent.

In Europe, London’s FTSE 100, Germany’s DAX and the Paris CAC 40 were up by between 0.4 and 1.3 per cent by about 4:55 a.m. ET.

New York futures were also up.

This comes despite a weaker purchasing managers index reading in China today. Other global PMI measures are also being released.

“It’s PMI day and the results already have been disappointing, particularly in China, but nobody was expecting anything stellar from there in any case,” said London Capital Group chief analyst Brenda Kelly, noting that the People’s Bank of China cut the reserve ratio requirement for big banks yesterday.

“The reduction in the RRR yesterday was ultimately a signal that the PBOC was attempting to front-run the weak data and avoid the selloff usually associated with the release in recent months.”

Barclays sinks

Barclays PLC stock tumbled today after the British bank chopped its dividend and unveiled plans to sell its African operations.

The bank cut the payout to 3 pence from 6.5 pence.

“Shares of Barclays tanked over 10 per cent after the British bank caught markets by surprise by cutting its dividend by a half for 2016 and 2017, and selling off most of its Africa unit,” said CMC Markets analyst Jasper Lawler.

“CEO Jes Staley is continuing down the same path as predecessor Anthony Jenkins of stripping the bank back to its origins with a U.K.-U.S. focus.”

ICE eyes LSE

Deutsche Boerse may have a fight on its hands in its quest for London Stock Exchange Group.

Intercontinental Exchange said today it’s considering a rival bid, though it hasn’t made any decision yet, driving up LSE stock.

“Shares in London Stock Exchange Group have jumped as U.S. rival ICE ponders a takeover offer, challenging Duetsche Boerse,” said London Capital Group’s Ms. Kelly.

“The latter may now be forced to up its own offer, which has been described as a ‘nil-premium’ merger,” she added.

“A bidding war may be in the offing now and we can likely expect some choppy price action between now and March 22 - the deadline for Duetsche Boerse to submit a formal offer for the LSE.”

Euro jobless rate dips

Unemployment across Europe is still elevated, but at least it’s heading in the right direction.

The euro zone’s jobless rate dipped in January to 10.3 per cent from 10.4 per cent a month earlier to mark the lowest level since August, 2011, the Eurostat agency said today.

Across the wider European Union, unemployment declined to 8.9 per cent from 9 per cent. For the EU, it’s the lowest since the 2009 depths of the recession.

Some countries, however, remain crippled by the number of people who can’t find work.

Greece, for example, is still suffering unemployment of almost 25 per cent, while Spain’s jobless rate sits at 20.5 per cent.

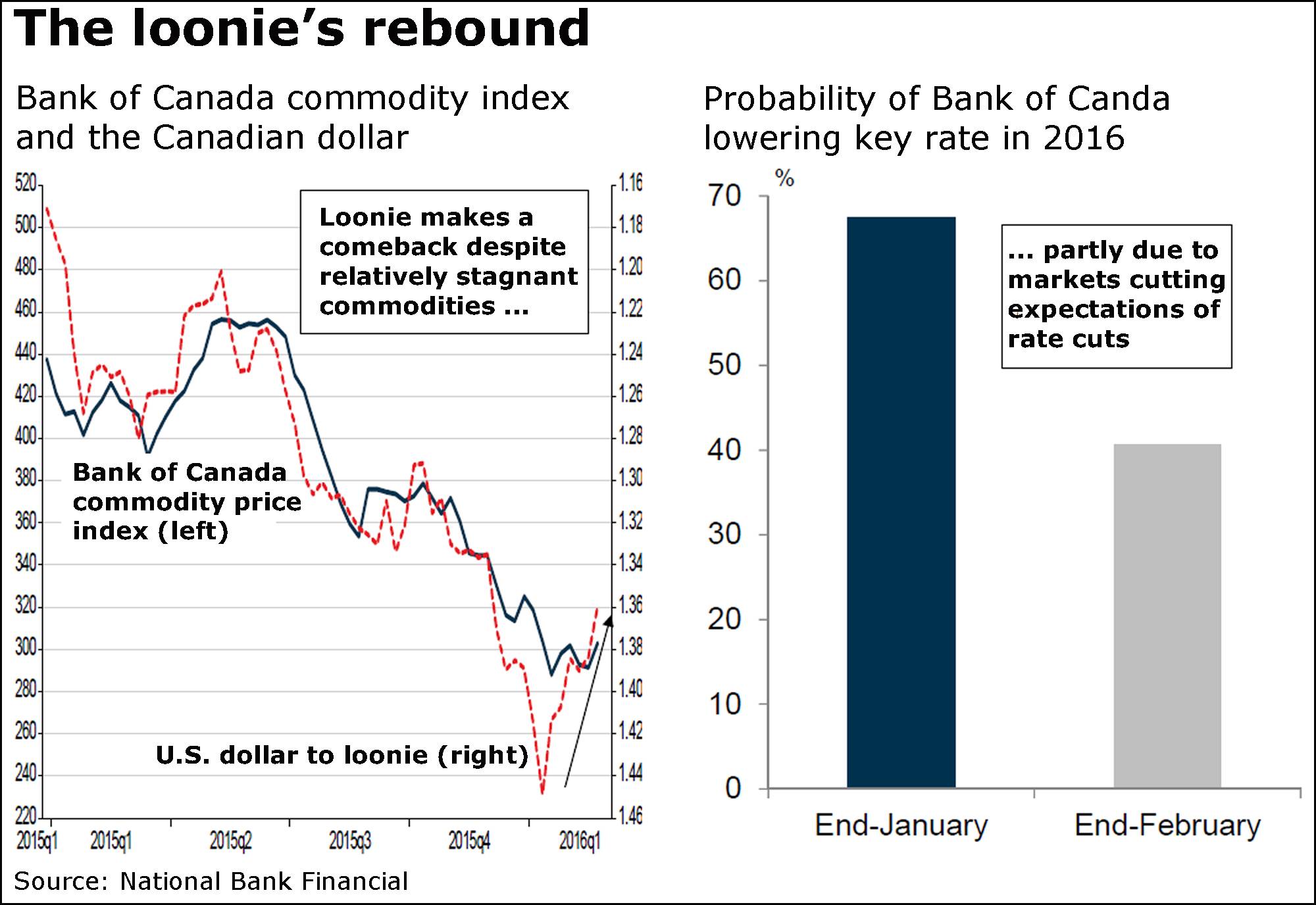

Chart of the day: ‘The Revenant loonie’

I wonder what National Bank Financial would have done had The Big Short swept the Oscars.

Instead, its economists got to refer to “the Revenant loonie” in a new report that looks at the Canadian dollar's rebound and projects it will go higher yet.

“Even Leo DiCaprio should be impressed,” the National Bank said.

“Mauled by bears and left for dead just a few weeks ago, the Canadian dollar is now back with a vengeance.”

They look at its plunge to almost 68 (U.S.) cents early this year, followed by its rebound to about 74 cents today, projecting 75 cents in the second and third quarters, 76 cents in the fourth and 77 cents early next year.

“The loonie’s Revenant-like performance was helped by a softening greenback, but markets are also looking at yields and starting to question whether or not the Bank of Canada really needs to cut interest rates considering that upcoming fiscal stimulus will provide a boost to the economy.”