Changing the ante

Bets for and against the Canadian dollar have taken a notable shift, turning to the bullish side of the ledger for the first time since last September.

That's because currency speculators are running for cover.

Having said that, the currency slipped over the past few days.

According to the latest report from the U.S. Commodity Futures Trading Commission, bets on the loonie have shifted to a small net long position of $355-million (U.S.), a move of almost $690-million from a week earlier.

While the latest reading may be small, and the shift gradual, it still marks a big move over time from the heftier net short of earlier this year.

This has occurred as the loonie gained strength along with the rally in oil prices and a more optimistic message from the Bank of Canada that suggests, at this point at least, that another rate cut is not in the cards.

"Details are somewhat concerning however, as we note the paring back of risk to both sides, hinting to broader uncertainty and a lack of conviction on the part of bulls," Bank of Nova Scotia currency strategist Eric Theoret said of the latest CFTC report, which was released on Friday with numbers as of last Tuesday.

At the same time, the fortunes of the U.S. dollar have been shifting as well.

"Bullish USD sentiment continues to fade, with this week’s moderation largely driven by short covering in EUR, GBP and CAD," Mr. Theoret said, referring to the U.S. dollar, the euro and the British and Canadian currencies by their symbols.

"The aggregate long USD position is now at $27-billion, its lowest level since August 2014 - with the $23.5-billion EUR short position representing the bulk of it."

Risk-taking among currency speculators has eased to its lowest level in almost a year, noted chief foreign exchange strategist Kevin Hebner of JPMorgan Chase.

"CAD and AUD positioning have increased five consecutive weeks (coinciding with improved trends in [West Texas Intermediate crude] and iron ore prices)," Mr. Hebner said in a research note, referring to the Australian dollar by its symbol.

"By contrast, [New Zealand dollar] positioning has been decreasing and is now the shortest currency covered here (reflecting the weakness in global dairy prices)."

The loonie has gained of late, but many currency watchers expect it to slide again as the U.S. dollar perks up.

There's a cycle to all this with a projected pick-up in the U.S. economy and the American dollar, and how oil prices factor into it all.

"A higher USD should also dampen oil prices while the supply increases as cost-cutting continues," Sébastien Galy and Stéphanie Aymes of Société Générale said in a report on the loonie.

"Over the coming quarters, though, Canada should increasingly benefit from U.S. growth and a cheap currency, leading CAD to once again gain."

A movie poster I'd love to see

Racing against the clock

Greece is fast approaching "crunch time" after months of fruitless negotiations with its lenders.

And as Elsa Lignos sees it, there are three scenarios for the embattled young government of Prime Minister Alexis Tsipras and his finance sidekick Yanis Varoufakis.

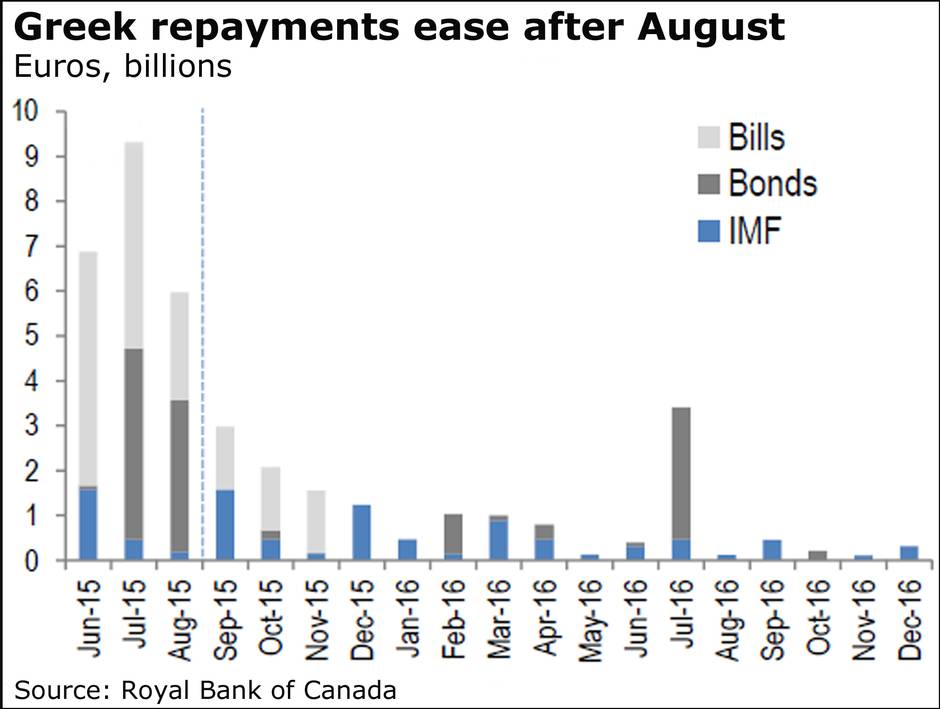

The senior currency strategist at Royal Bank of Canada says Greece appears likely to run of cash at some point between June 5 and June 12. It all looks better after August, but Athens has to survive until then.

This is, of course, the latest in a long-running bailout saga that has rattled markets for years. But this latest, post-election chapter has Greece at the precipice.

"Having scraped by until now, crunch time has arrived," Ms. Lignos said in a report.

"Greece is set to exhaust its cash reserves in the first two weeks of June and unless some deal is reached before then, it will be unable to pay the [International Monetary Fund] as the amounts become due."

Her three possibilities:

A fast deal: An agreement by early June would give Athens €7.2-billion in funds to get it through its "refinancing hump." But today is May 25. Said Ms. Lignos: "It is not impossible but technical negotiations would have to start moving at a much faster pace and then PM Tsipras would have to face rebels within his own party."

An interim deal and a summer break: This would see an extension of the existing bailout that "would delay harder negotiations (on pensions, labour reform, debt sustainability) until the autumn." Ms. Lignos didn't say this, but it would mean kicking the can down the road yet again, something at which all the parties involved are particularly adept.

A 'take it or leave it' demand by creditors:"With Greek banks heavily reliant on [emergency liquidity assistance], the government would have to accept the deal or shut the banks/impose very strict capital controls until a compromise could be reached."

That third scenario, by the way, would be the most likely to lead to a referendum, Ms. Lignos said, a development that would no doubt trouble investors even more.

"The main route to contagion is still, in our view, a euro exit (or, in the short term), a much higher threat of of euro exit," Ms. Lignos said.

By that, she means Greece leaving the euro monetary union, something she doesn't expect to happen. But it would be a material development.

"While capital controls would be temporary, an actual exit changes the architecture of the euro area for good," Ms. Lignos said.

"It makes the next crisis in any member state much harder to deal with," she added.

"We still think Greece will stay in the euro area as we have done throughout the crisis. But a referendum would create a binary risk."

Home price growth to slow

Home prices will continue to rise, Canada Housing and Mortgage Corp. says, but a slower pace is in store amid an expected move to less costly houses.

In a new forecast released today, CMHC projected the average Multiple Listing Service price at between $402,139 and $439,589 this year, and $398,191 and $457,200 in 2016.

"The gradual slowdown in the rate of price growth is explained by the expected change in the composition of MLS sales toward more moderately priced homes," the agency said.

It also predicted"disparities" across the regions amid the oil slump, as we've already seen.

"A slowdown in housing starts and resale transactions in oil-producing provinces such as Alberta will be partly offset by increased housing market activity in other provinces, such as Ontario and British Columbia, which benefit from the positive impacts of declining energy prices, a lower Canadian dollar and continued low mortgage rates," CMHC chief economist Bob Dugan said in a statement.

The agency also expects construction starts to see a slower pace.

CMHC forecast housing starts of between 166,540 and 188,580 this year, and 162,840 and 190,830 in 2016.

Sales, in turn, are projected to range between 437,100 and 494,500 in 2015, and 424,500 and 491,300 next year.

Vatican boosts ... earnings

The Vatican is rolling in green.

The Istituto per le Opere di Religione, commonly known as the Vatican bank, is reporting a marked rise in profit, to €69.3-million ($76-million U.S.) in 2014 from 2013's €2.9-million.

"This increase was mainly due to an increase in the net trading income from securities and a decline in extraordinary operating expenses," the institution said today.

The group has been reorganized and cleaned up under Pope Francis after years of scandal.

"The main focus is on fundamentally improving our overall client service standards and further professionalizing our asset management services," chairman Jean-Baptiste de Franssu said in a statement as he unveiled the annual report, which was audited by Deloitte & Touche.

Who knows, maybe one day the Istituto per le Opere di Religione will be on someone's too-big-to-fail list.

A comment I'd love to see

What to watch for this week

There's not all that much on tap for today, but there's a lot for the markets to ponder later this week.

Starting with the Bank of Canada policy decision on Wednesday.

Economists believe Governor Stephen Poloz and his colleagues will continue to hold its key overnight rate steady at 0.75 per cent, possibly with slight changes to its announcement.

"The Bank of Canada seems content to wait for more data before changing tack," said senior economist Benjamin Reitzes of BMO Nesbitt Burns.

"Expect a relatively benign statement with a hint of added caution due to the recent soft U.S. data, highlighting that Governor Poloz remains patient on policy."

At the same time, Canada's major banks will start rolling out their second-quarter results, beginning with Bank of Montreal and National Bank on Wednesday, followed by Royal Bank of Canada, Canadian Imperial Bank of Commerce and Toronto-Dominion Bank on Thursday, and Bank of Nova Scotia wrapping up the week, and the earnings, a day later.

"We start from the premise that housing is the principal form of collateral underpinning the quality of household credit in Canada," National Bank analyst Peter Routledge said in a recent preview of the big bank results.

"In other words, unless and until house prices deteriorate materially across the country, we will not see a sudden burst of Canadian household loans losses at the Big Six banks that impairs bank earnings," he added.

"Since we do not foresee a nationwide collapse in housing in [fiscal] 2015, we think the banks' domestic personal and commercial banking operations skate through the year largely unscathed."

0-0.5%

Forecast for economic growth

Investors will also get fresh earnings reports from the likes of CAE, Indigo, Costco, Tiffany and Heroux-Devtek.

Friday is going to be a disappointment as Statistics Canada reports on how the economy fared in the first quarter of the year. But we expected that.

That report is expected to show the economy flaming out in the first three months, with growth of somewhere between nothing and 0.5 per cent annualized.

"Reflecting the negative impact of lower oil prices, real GDP growth is likely to have essentially ground to a halt in Q1, advancing by a meagre 0.3 per cent quarter over quarter annualized," Toronto-Dominion Bank senior economist Randall Bartlett said in a report on what he expects.

Some other observers expect an even weaker showing, and still others something a bit stronger.

"The culprit will have been as much the poor weather and a stumbling neighbour to the south as it was the 'front-loaded' aspects of the oil shock," said Nick Exarhos of CIBC World Markets, who expects to see a reading of 0.5 per cent.

"So though investment should emerge as a more significant concern in the quarters ahead, the main disappointment in Q1 will have been tied to anemic export performance, and more restrained consumer spending."

In the United States on Friday, we'll get a revision to first-quarter economic growth that is expected to show a contraction of 0.9 per cent annualized.