Briefing highlights

- How youth employment has tumbled

- Markets largely on the decline

- Turkey's central bank cuts rates

- A Melania Trump scene I'd love to see

- Earnings for TSX companies forecast to fall

- Video: Can you protect your job from robots?

Youth unemployment

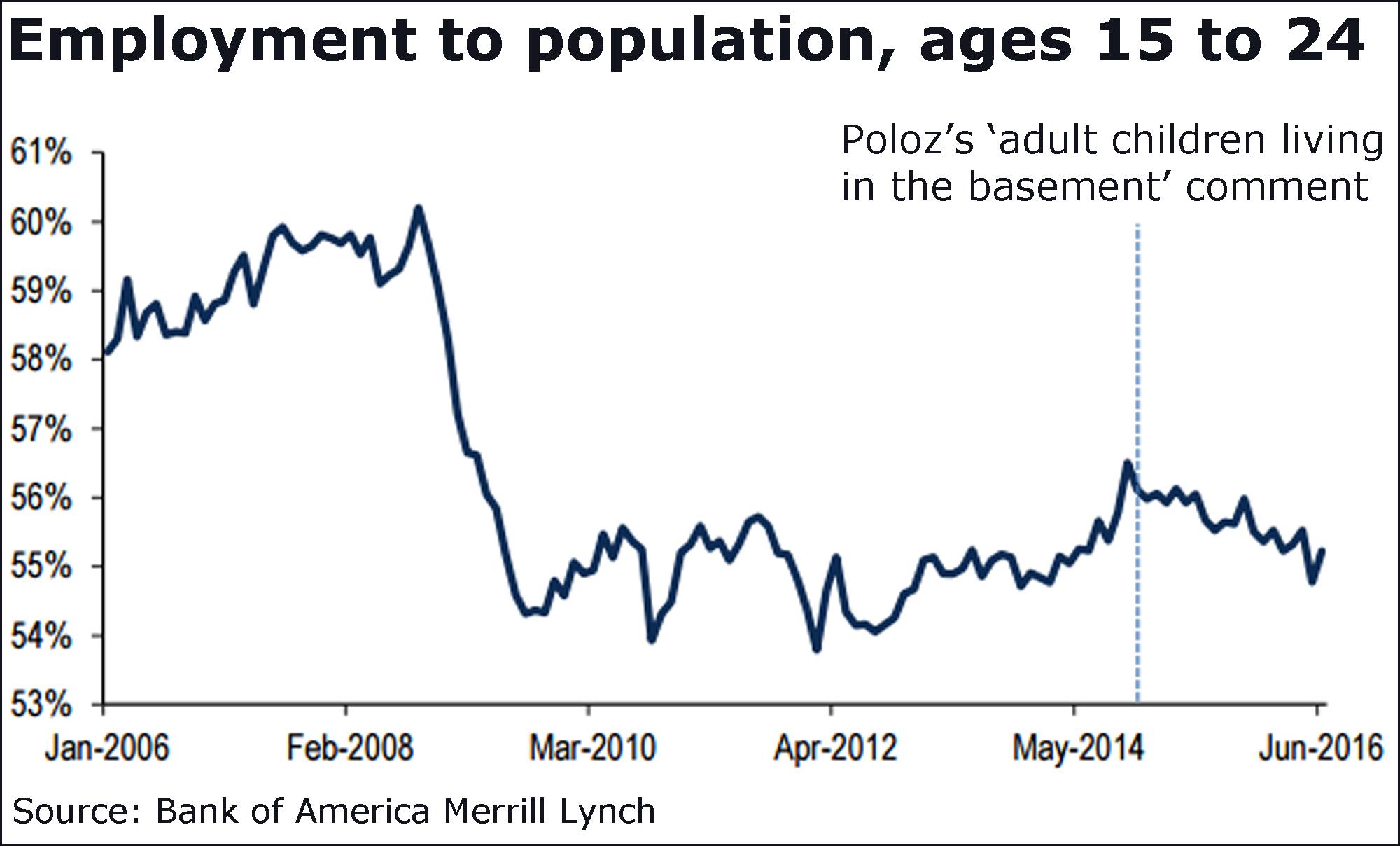

If one of your adult kids was living in the basement in late 2014, you’ll no doubt remember the Bank of Canada governor’s famous comment.

Welcome to mid-2016, where the basement’s becoming that much more crowded.

Emanuella Enenajor, the North America economist at Merrill Lynch, looked at youth unemployment before and after central bank chief Stephen Poloz said in November, 2014, that “I bet almost everyone in this room knows at least one family with adult children living in the basement.”

What she found is that it’s even more troubling now.

“Since then, the basement has gotten a little more crowded,” Ms. Enenajor said in a recent research note titled “The ‘kids in the basement’ are back.

“Since November, 2014, the number of employed 15-24 year olds has fallen by 78,300,” she added.

“The population of this cohort is also shrinking, so we compute an employment-to-population ratio to control for demographic trends. Clearly, prospects for this cohort continue to deteriorate, given the falling employment-to-population ratio.”

Unemployment among our young people stands at 13 per cent, with almost 365,000 out of work.

Canada’s overall jobless rate is 6.8 per cent, having dipped in June because people quit looking for work.

Given the weakness in the jobs market, Ms. Enenajor said, Mr. Poloz isn’t likely to consider raising interest rates any time soon.

A scene I'd love to see ...

“Well, that's what the teleprompter said to say.”

Investors sour

But for Japan, markets are largely down so far, with New York poised to open lower.

“The ‘wall of worry’ appears to be getting bigger, with investors trimming some positions after a good run that has seen some markets hit new all-time highs,” said IG senior market analyst Chris Beauchamp in London.

“The situation in Turkey continues to provide case for concern, as it becomes more and more apparent that President Erdogan is taking this opportunity to tighten his grip on the country in a way that will concern both the EU and NATO,” he added.

“Turkey’s strategic position means developments here will be keenly watched, with a shift to authoritarianism hurting the nascent rally in emerging markets.”

Tokyo’s Nikkei gained 1.4 per cent as it came back from a holiday Monday, though Hong Kong’s Hang Seng lost 0.6 per cent, and the Shanghai composite 0.2 per cent.

In Europe, London’s FTSE 100, Germany’s DAX and the Paris CAC 40 were down by between 0.5 and 1.3 per cent by about 6 a.m. ET.

New York futures were also down.

Netflix Inc.’s latest quarterly earnings report has certainly darkened the mood, While Nintendo, of course, is making like Super Mario on the wild success of Pokemon Go.

“So, we’re learning that the number of people signing up to watch films and TV series on their phones and tablets isn’t growing as fast as it was, while the number of people playing augmented-reality games on their phones is growing at an unbelievable rate,” said Kit Juckes of Société Générale.

“Something for anthropologists to ponder or just confirmation that it is, at last summer? I’m betting on the latter but I’m far too old to understand.”

Turkey's central bank cuts

Turkey’s central bank cut interest rates in the wake of the foiled coup attempt, but signalled it would keep monetary conditions tight for now.

The central bank cut its overnight lending rate to 8.75 per cent from 9 per cent.

It did not cite the specific turmoil in its statement, but did say that “domestic developments have led to fluctuations in financial markets” recently.

“The tight monetary policy stance, the cautious macroprudential policies and the effective use of the polidy instruments laid out in the road map published in August 2015 have increased the resilience of the the economy against shocks,” the central bank said.

“Taking into account inflation expectations, pricing behaviour and the course of other factors affecting inflation, the tight monetary policy stance will be maintained,” it added.

Turkey’s economy could be in dire straits, analysts say, citing the warning by Moody’s of a potential downgrade.

“The rating agency also highlighted the risks of accelerated capital outflows and a rapid decline in currency reserves,” noted London Capital Group senior market analyst Ipek Ozkardeskaya.

“In the worst-case scenario, Turkey could also face a crisis in its balance of payments, according to Moody’s analysts,” she added.

Earnings projected to tumble

As Canada’s quarterly earnings season begins in earnest, Here’s the latest projection from Matthieu Arsenau at National Bank Financial:

Second-quarter profits on the S&P/TSX composite are expected to tumble by 17 per cent from a year earlier, with IT and consumer staples gaining and a whole bunch of others, including health care and industrials, projected to sink. Declines in the latter two are projected at almost 31 per cent and 20.5 per cent, respectively.

Sales are forecast to climb, with financials and utilities at the top, and energy and health care slumping.