Canadians have endured more than 18 months of uncertainty and, for many, devastating personal loss. Today, they’re finally waking up to brighter days on a number of fronts. By the end of September, the country had regained all of the roughly three million jobs lost to the pandemic. More Canadians are being vaccinated, borders are reopening and businesses are starting to see customers coming through their doors.

Women, immigrants and racialized minorities are among demographics harder hit by the pandemic, says FP Canada President and CEO, Tashia Batstone.Supplied

But is it too soon to celebrate? Canada’s emergence from COVID-19 is diverging into different directions and is deepening divisions that already existed within various demographics.

Just as COVID-19 affected Canadians in ways that varied according to factors such as gender, race, income, occupation and age, the country’s recovery from the pandemic is likely to be a story of divergent and inequitable experiences.

This is the very essence of a K-shaped recovery – different people and sectors bounce back at different rates and levels. When it comes to recovering from the financial impact of COVID-19, some Canadians could struggle for years while others have already emerged either unscathed or even much better off than they were before the pandemic because they were able to save money.

As FP Canada and our professional financial planners mark Financial Planning Week and Financial Literacy Month, we must take stock of how all of us can help Canadians from all walks of life recover – including newcomers, low-income Canadians and those from racialized and marginalized communities. More than ever, we need to ensure that each and every Canadian has the financial confidence and well-being they need in the aftermath of COVID-19 and beyond.

At FP Canada, our Certified Financial Planner certification and Qualified Associate Financial Planner certification were designed to ensure that financial planning professionals have the training, skills and ethics to help all Canadians achieve financial wellness.

These designations provide consumers with the the confidence to know that their financial planners have met the rigorous standards of competence expected of a professional financial planner, that they’re obligated to put their clients’ interests first and that they’re accountable for their professional and ethical conduct.

We know Canadians are worried about money. According to FP Canada’s 2021 Financial Stress Index, almost 40 per cent of all Canadians say money is their No. 1 source of stress, even during a global health crisis, and more than half say they’ve lost sleep because of fears about their personal finances. Financial concerns are even more widespread among Canadians under the age of 35, with almost 45 per cent citing money as their biggest worry.

Women, low-income Canadians, immigrants and racialized minorities have been hit especially hard by the economic fallout from the pandemic. Consider that one in five women were forced out of the labour market during the pandemic and that between February 2020 and February 2021, roles held by women accounted for almost 74 per cent of lost jobs, compared to only about six per cent of positions held by men.

Think about the fact that workers earning $40,000 or less were three times as likely to lose their jobs during the pandemic than those making $80,000 or more. Or that about half of immigrants and racialized minorities reported a major or moderate financial impact from the pandemic, compared to only about 30 per cent of other Canadians, according to Statistics Canada.

Meanwhile, many of those who were doing well financially pre-pandemic and who were able to work from home when COVID-19 struck remained financially secure. Some actually saved money or even made more money from their investments.

As we recover from the pandemic, it’s clear that the economic and financial progress we are making on an aggregate, national level will be experienced differently by different demographic groups within the Canadian population.

For some, there may never be a financial recovery from COVID-19. Through our Coping with COVID-19′s Financial Impact study, conducted late last year, we found that one in three Canadians are afraid they’ll never get back on their feet financially after the pandemic.

We cannot accept this as a pre-ordained, immutable fact. We must take action to ensure that everyone in this country gets more than a fighting chance to recover financially.

To do this, we must make it easier for all Canadians – regardless of gender, race, income and age – to access professional financial planning services.

We’re aware of the key barriers that stand in the way. Despite the proven benefits of working with a financial planner, research funded by the FP Canada Research Foundation and conducted by the Smith School of Business at Queen’s University found that many Canadians are still confused about what the profession does and some have negative attitudes about financial planners. There are also those who don’t believe they have enough know-how to use a financial planner.

Yet we know financial planners deliver value and results. In our Tale of Two Pandemics survey, we learned that those Canadians working with a financial planner were more than twice as likely than those without a financial planner to have enough money to cover expenses for at least one year.

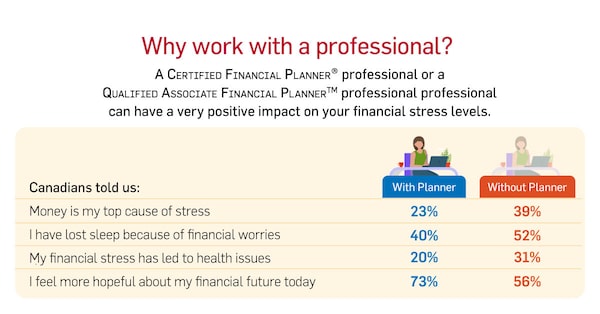

Similarly, this year’s Financial Stress Index found those who work with a professional financial planner feel much more positive about their economic well-being and less likely to say money is their top source of stress. They’re also twice as likely to say finances don’t cause them any stress, compared to those who don’t work with a professional.

These research findings underscore what we’ve known for a long time: When Canadians can access professional help and feel comfortable doing so, they take meaningful steps towards financial well-being and confidence.

These goals all tie into FP Canada’s intention to measure progress on these fronts. Our IMAGINE2030 initiative is aimed at giving all Canadians access to professional financial planning that supports their unique circumstances and needs. To advance this goal, we plan to undertake a benchmark survey each year until 2030 to gauge our profession’s progress in these important areas.

Working together, FP Canada and the 20,000 certificants who proudly carry the CFP credential or QAFP credential are committed to helping transform the economic recovery following COVID-19 – or any other economic crisis in the future – from one that is K-shaped into one that will deliver an equitable return to economic prosperity for all Canadians.

Because unless we all recover, none of us truly will.

Through our Coping with COVID-19′s Financial Impact study, conducted late last year, we found that one in three Canadians are afraid they’ll never get back on their feet financially after the pandemic.

Source: FP Canada’s 2021 Financial Stress Index

/cloudfront-us-east-1.images.arcpublishing.com/tgam/6GSM2GFMZZCX3HQIFKEJ3HXWNE.jpg)

IMAGINE2030 is FP Canada’s vision for achieving financial wellness for all Canadians. Its goals are that by 2030:

- Financial planning is a unified, recognized profession, deemed essential by society

- All Canadians have the financial confidence and well-being they need

- All Canadians have access to professional financial planning that supports their diverse needs

Learn more at fpcanada.ca/about/imagine2030

Advertising feature produced by Randall Anthony Communications. The Globe’s editorial department was not involved.