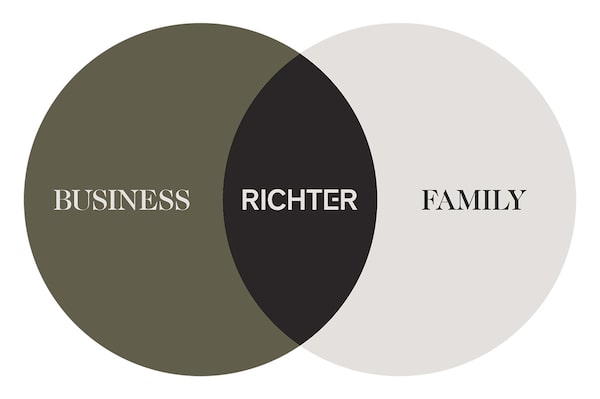

Thanks to its two-platform model, Richter's Business | Family Office helps clients integrate both their business interests and family interests.Supplied

Should family and business intertwine? Many successful business owners understand that family and business matters inevitably intersect, whether they want them to or not – and while aligning the two is an ideal strategy, it’s not always easy.

Professional expertise in this area can be hard to define, and even harder to seek out for business owners struggling to balance the two. So much so, in fact, that Richter, a Canadian based firm with presence in the U.S., has established an entirely new category to serve clients grappling with these overlapping concerns: the Business | Family Office.

“For business owners, there’s a certain complexity that resides at the intersection of business and family often regarded as separate interests,” says managing partner Tasso Lagios. “At Richter, we know from experience that business interests and family interests have and will continue to come into contact.”

An integrated approach

With a history that spans almost a century, Richter is uniquely positioned to offer its integrated approach that encompasses business, ownership and family. Started as an accounting firm in 1926, the company evolved to offer other advisory roles, such as tax planning, transaction and financial advisory and risk management to meet their clients’ needs. The Family Office was launched a few decades ago, making Richter one of the largest and oldest integrated multi-family offices in Canada. Today, its two-platform model helps clients reach their business and personal goals in tandem.

Like any successful business, Richter has innovated to meet the evolving needs of its clients, which include business owners, private clients, high net worth individuals and their families. As a result, Lagios explains, “We don’t fit in a specific ‘box’ whether it be the accounting firm box or the wealth management box or the box of a business advisory firm. We have taken the best of these businesses to create something new and perfectly aligned with our clients’ needs.”

Thanks to its two-platform model, the Business | Family Office helps clients integrate both their business interests and their family interests in a seamless manner.

The business advisory platform, Richter Consulting, ensures all advisory work links to a company’s long-term strategy. Business leaders are supported in all their business needs – from foundational services like financial reporting and tax planning to key strategic advice to help achieve their business growth and succession objectives.

The second platform, Richter Family Office, delivers independent strategic advice on families’ financial and personal objectives. This includes wealth management, family operations and finance, governance, estate planning, philanthropy and financial literacy.

“By being the integrator at the centre of the business and family, we make sure each decision is being made with the owner’s interest and his or her family’s interest in mind,” says Richter partner Marc Yedid. “We are the only firm to service both the business and the family interests of the owner in such an integrated manner.”

Richter's two-platform model.Supplied

Bridging the gap between business and family

Richter has assisted some of Canada’s most successful business families for close to a century. At the heart of its offerings is an unwavering commitment to nurture strong relationships with its clients and their extended families – often across multiple generations.

“We work with people, not the entities they own,” Yedid says. Investing the time to get to know the client, not just from the perspective of one’s business, but also from the personal or family side helps set Richter apart from other traditional financial advisors.

“We bridge the gap between family and business interests. Each demands a particular way of thinking, and the way we integrate these two areas ensures entrepreneurial success across generations.”

Helping clients build a legacy

To borrow a phrase from Microsoft founder Bill Gates, “with great wealth comes great responsibility.” And that responsibility means more than simply the transfer of wealth from one generation to the next. For some, the transfer of values is equally important.

“When you work with owners as closely as we do, it doesn’t take long to realize that it’s never just about money,” says Lagios. For a family’s financial capital to grow over time, it’s also important to nurture the collective social, spiritual and intellectual capital. This takes dedication and a well-crafted plan, and that’s where Richter can help by working with owners and their families to establish long-term goals that align with their vision for a legacy according to set values and objectives.

“Business owners dedicate their entire lives to growing their businesses, and when you put so much energy and care into creating something, wouldn’t you want to share it?” Lagios says. “Sharing it with your children, grandchildren, even with the community – that’s what it means to build a legacy and we will do everything in our power to help our clients achieve it.”

Advertising feature produced by Globe Content Studio with Richter. The Globe’s editorial department was not involved.