Senior government officials, most notably federal Natural Resources Minister Seamus O’Regan, regard SMRs as indispensable tools for meeting Canada’s greenhouse gas emissions targets, by replacing coal-fired plants and by electrifying mining and oil and gas facilities.Canadian Nuclear Labratories/Handout

Ontario Power Generation plans to make a decision this year that might determine the future of Canada’s nuclear industry.

The utility, by far Canada’s largest nuclear power producer, promises to select a design for a 300-megawatt reactor it proposes to build at its Darlington Nuclear Generating Station by 2028. The estimated price tag: up to $3-billion. It would be the first new reactor built on Canadian soil in well over three decades. OPG won’t make that decision alone, because it’s intended to be the first of many reactors of the same design built across the country.

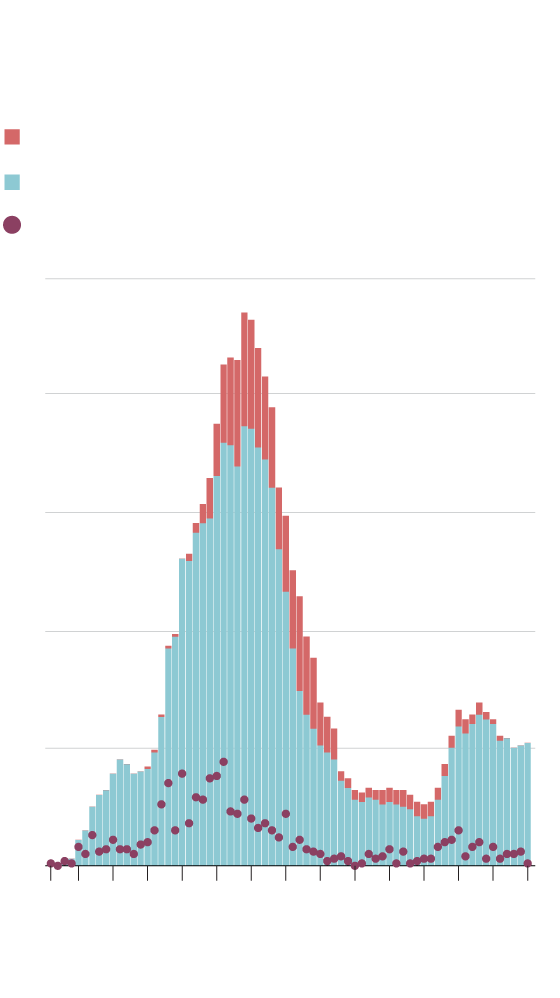

Nuclear reactors under construction around the world

In units, from 1951 to July 1, 2020

Construction abandoned or suspended

Construction under way or completed

Construction starts

250

200

150

100

50

0

1951

1960

1970

1980

1990

2000

2010

2020*

*As of July 1.

THE GLOBE AND MAIL, SOURCE:

MYCLE SCHNEIDER CONSULTING

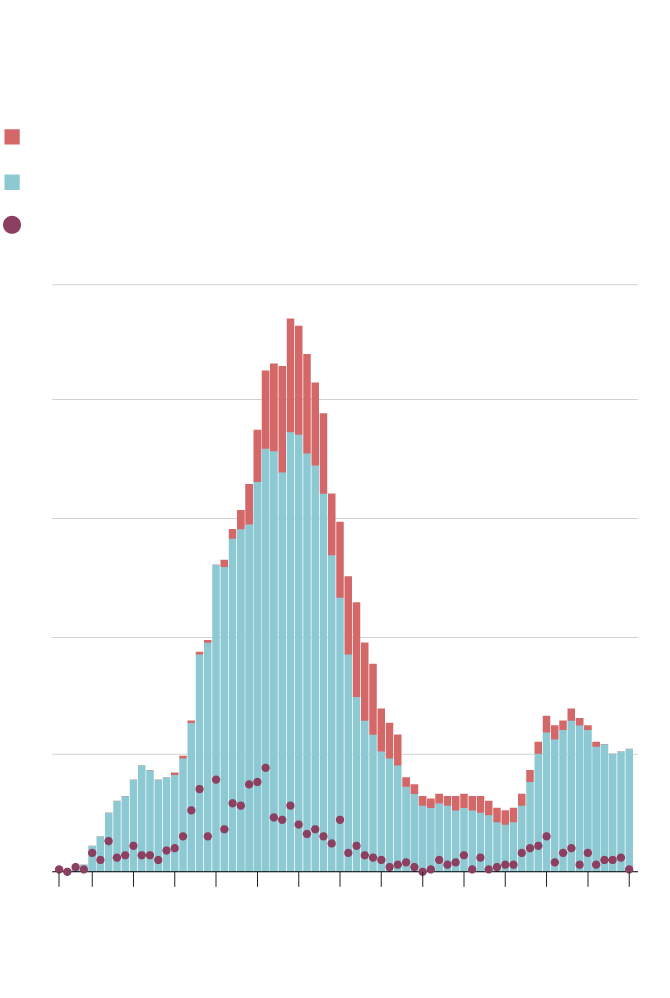

Nuclear reactors under construction around the world

In units, from 1951 to July 1, 2020

Construction abandoned or suspended

Construction under way or completed

Construction starts

250

200

150

100

50

0

1951

1960

1970

1980

1990

2000

2010

2020*

*As of July 1.

THE GLOBE AND MAIL, SOURCE: MYCLE SCHNEIDER CONSULTING

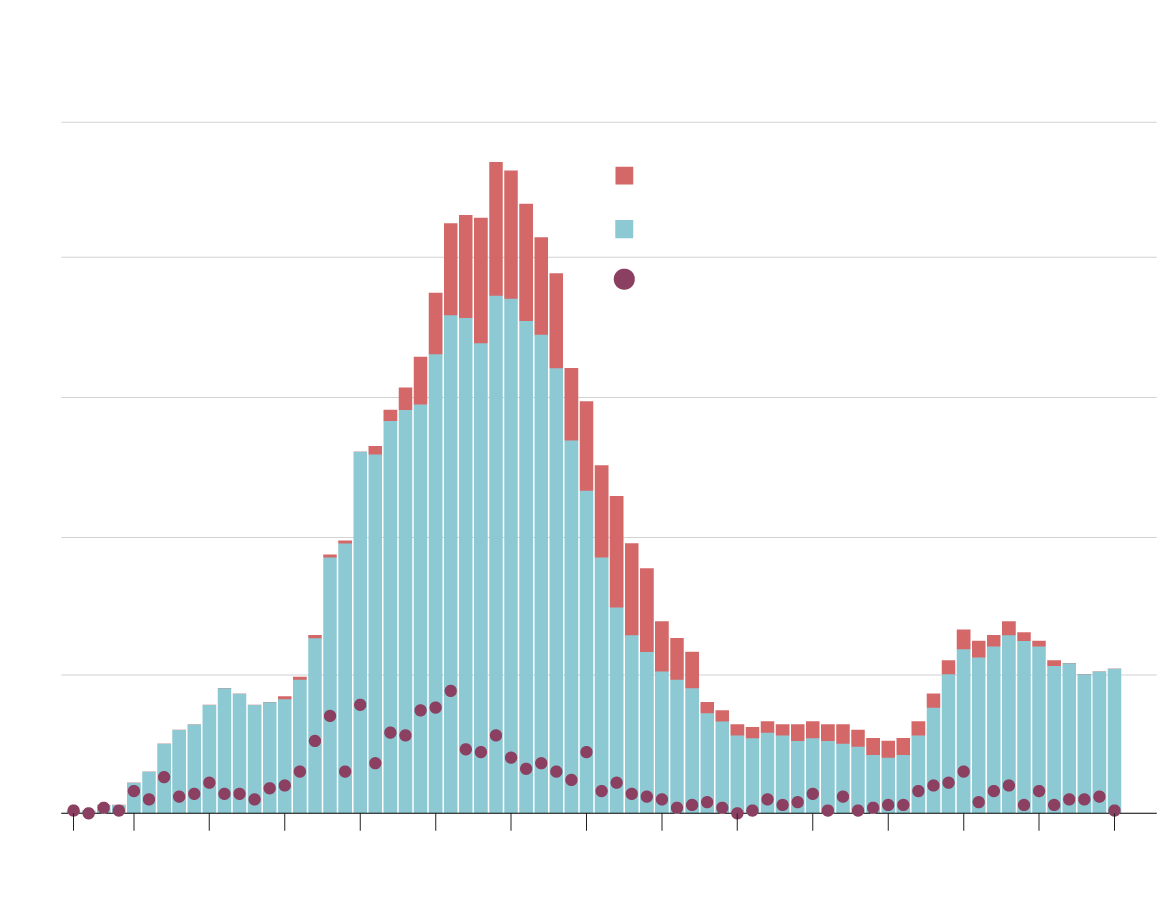

Nuclear reactors under construction around the world

In units, from 1951 to July 1, 2020

250

Construction abandoned or suspended

Construction under way or completed

200

Construction starts

150

100

50

0

1951

1960

1970

1980

1990

2000

2010

2020*

THE GLOBE AND MAIL, SOURCE: MYCLE SCHNEIDER CONSULTING

*As of July 1.

Canada’s nuclear industry desperately needs a next act. It employs 30,000 people (mostly in Ontario) and contributes $6-billion annually to the country’s economy, according to one federal government estimate. With a supply chain of more than 200 companies covering everything from uranium mining, to operating power plants, to decommissioning them, Canada is considered a Tier 1 nuclear country.

But lately, this machine has been devoted to squeezing more life out of old CANDU units, largely through Ontario’s $26-billion plan to refurbish its Darlington station, east of Toronto, and the Bruce Power complex, on Lake Huron. The industry has few, if any, exciting new products for sale.

This leaves it on the back foot as governments encourage electrification of cars, buildings and nearly everything else. Those efforts could double, even triple, electricity demand in the coming decades. But renewable forms of generation – hydro, wind, solar and biomass – have become preferred tools for decarbonizing electricity grids. And utilities can buy inexpensive wind turbines and solar panels today.

Seeking to catch up, dozens of nuclear vendors sprung up just in the past few years, promoting a dizzying assortment of next-generation models that have collectively been dubbed “small modular reactors” (SMRs).

Small reactors, grand aspirations

Most SMRs are at early stages of development. This conceptual sketch from Terrestrial Energy envisions how its Integral Molten Salt Reactor (IMSR) might support other facilities, such as wind turbines, solar panels, desalination plants and hydrogen production facilities.

Industrial

facility

Integral molten salt reactor plant

Desalination plant

Electricity

generation

Hydrogen

production

Grid balancing with renewables

THE GLOBE AND MAIL, SOURCE:

TERRESTRIAL ENERGY

Small reactors, grand aspirations

Most SMRs are at early stages of development. This conceptual sketch from Terrestrial Energy envisions how its Integral Molten Salt Reactor (IMSR) might support other facilities, such as wind turbines, solar panels, desalination plants and hydrogen production facilities.

Integral molten salt reactor plant

Industrial

facility

Desalination plant

Grid balancing with renewables

Electricity

generation

Hydrogen

production

THE GLOBE AND MAIL, SOURCE: TERRESTRIAL ENERGY

Small reactors, grand aspirations

Most SMRs are at early stages of development. This conceptual sketch from Terrestrial Energy envisions how its Integral Molten Salt Reactor (IMSR) might support other facilities, such as wind turbines, solar panels, desalination plants and hydrogen production facilities.

Industrial

facility

Desalination plant

Integral molten salt reactor plant

Grid balancing with renewables

Hydrogen

production

Electricity

generation

THE GLOBE AND MAIL, SOURCE: TERRESTRIAL ENERGY

Though the characteristics of individual designs vary widely, in brief, these compact new reactors promise to retain the main selling points of nuclear power generation – namely, low carbon emissions and predictable electricity output, rather than the intermittent power generated by wind and solar. The makers also hope to ditch the nuclear industry’s considerable baggage, which includes a long history of cost overruns and construction delays.

Most vendors seek to take advantage of mass production as well: These are to be highly standardized, factory-built reactors, produced in large quantities that will make them cheaper than traditional reactors while facilitating rapid deployment. Some vendors say SMRs are just around the corner: Candu Energy Inc. (owned by SNC-Lavalin Group Inc.) claims its model could be “shovel-ready” as early as 2023.

Senior government officials, most notably federal Natural Resources Minister Seamus O’Regan, regard SMRs as indispensable tools for meeting Canada’s greenhouse gas emissions targets, by replacing coal-fired plants and by electrifying mining and oil and gas facilities. U.S. President Joe Biden and U.K. Prime Minister Boris Johnson have also indicated they will also support SMR development, as have some prominent investors, notably Bill Gates.

Here’s the reality: Most SMRs exist only as conceptual designs and are not yet licensed for construction anywhere. (The international law firm White & Case says the only contemporary SMR in existence is located on a vessel anchored off Russia’s Arctic coast. According to reports, construction of China’s first SMR recently commenced on the southern island of Hainan.) The promised assembly lines that would churn them out like clockwork don’t exist; many vendors are early-stage companies with hardly any revenues.

To change this, the federal government will probably have to open wide the taxpayer’s wallet. And the industry must move quickly from bold marketing claims to commercially viable products.

Old ideas, new package

SMR is a marketing term, rather than a technical one, reflecting the industry’s aspirations rather than what it can deliver today.

In Canada, SMR has come to describe reactors that generate 300 megawatts or less. That isn’t exactly small – it’s enough to power a small city – but for comparison’s sake, Ontario’s largest current reactors generate around 900 megawatts. Some proposed SMRs would produce just a few megawatts. The industry pitches them for remote Indigenous communities, industrial use (at mines, for instance) and tiny island nations.

Small reactors aren’t new. They’ve been used in icebreakers, submarines and aircraft carriers. And many SMRs are based on concepts contemplated as long ago as the 1950s.

A SMR nuclear reactor.Handout

Oakville, Ont.-based Terrestrial Energy Inc., one of OPG’s potential partners, intends to use molten salt, rather than water, as a coolant. The company says its technology is a “game-changer”: The Integral Molten Salt Reactor (IMSR) would operate at much higher temperatures (about 700 C) than conventional reactors (about 300 C), greatly increasing efficiency and lowering costs per unit of electricity generated.

As for the “modular” part, the notion is that SMRs would be mass-produced on assembly lines and shipped to where they’re needed, rather than custom-built onsite. This plug-and-play approach is intended to reduce purchase costs and accelerate deployment.

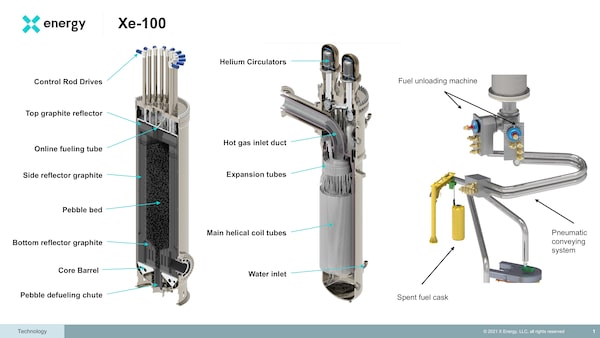

Some SMRs are also designed to rapidly adjust the amount of electricity they generate in response to changes in demand – a trait that could help compensate for sudden fluctuations in power generated from variable sources, such as wind and solar. Rockville, Md.-based X-energy, another prospective OPG partner, says its Xe-100 reactor can ramp up from 40 per cent of its generating capacity to 100 per cent and back within 12 minutes.

Other SMRs would consume spent nuclear fuel from other reactors, potentially reducing the volumes of nuclear waste that must be disposed of.

Like traditional large reactors, SMRs would provide power largely free of greenhouse gas emissions. SMRs would also require far less land per megawatt generated than solar or hydroelectric – no small advantage in a world of rapidly growing populations and land-use pressures. X-energy says the emergency planning zone for the XE-100 would be tiny because its fuel cannot melt down under any circumstances.

SMRs appeal to certain nationalist impulses as well: Canada is, after all, the world’s second-largest uranium producer.

But nuclear power has been thoroughly stigmatized by the catastrophes at Chernobyl and Fukushima. The industry has made limited progress in addressing wastes from decades-old reactors; it’s unclear how novel detritus from SMRs might be handled. Perhaps most damagingly of all, reactors have earned a reputation for being overpriced relative to other forms of generation, and often beleaguered by massive delays and cost overruns.

SMR game plan

The nuclear industry’s plan to reverse its flagging fortunes begins at Darlington. OPG announced late last year it was working with three SMR developers on preliminary design and engineering work: North Carolina-based GE Hitachi Nuclear Energy, Terrestrial Energy and X-energy. It promises to select a winner by year’s end.

By partnering with a well-financed, experienced nuclear operator, the winning SMR vendor will greatly increase its chances of building at least one reactor – not to mention leapfrog its competitors. Terrestrial Energy chief executive Simon Irish understands such an opportunity is exceedingly rare. “OPG represents a utility in North America, and probably in the Western world, that is in a leadership position, with clear intent and a clear set of motives: to select one of these SMRs, deploy and operate it,” he said.

Naturally, of course, no SMR developer aspires to be a one-hit wonder. So next up: Persuade Saskatchewan to build a fleet of the same reactors.

According to the Canada Energy Regulator, Saskatchewan generates more than four-fifths of its electricity by burning natural gas and coal. Don Morgan, the minister responsible for the province’s power utility, SaskPower, worries about the carbon taxes its fossil-fuel power plants will attract.

The province hopes to double its wind generation capacity, but needs other options for reliable baseload power. SaskPower is reviewing the same three SMR options as OPG, and has signalled it could build as many as four beginning in the 2030s.

Winning Saskatchewan would be a major coup: Jurisdictions that go nuclear tend to stay nuclear for decades. And getting multiple Canadian utilities behind a single SMR design could be crucial. “Deploying multiple SMR technologies in Canada with differing supply chains – as well as regulatory and operational know-how – could be problematic,” said a Conference Board of Canada report published in April. “It might limit economies of scale and the specialization needed to drive down costs.”

Saskatchewan is already an international centre for uranium production. It has flirted with nuclear power several times since the 1970s, but demurred each time. Mr. Morgan said one reason was the province couldn’t find a reactor to fit its particular size requirements – a problem SMRs might well address.

But another reason was that “it’s always been difficult to find a reactor that was a proven technology.” That quandary remains: Prospective SMR buyers such as SaskPower can only look at conceptual designs. “There’s been some small demonstration units built, but nothing of the size that we would expect to see in operational terms,” Mr. Morgan said.

“It would be an easier decision for us if there were five of them operating in different locations around the world.”

Nuclear ghosts

Twenty years ago, Canada’s nuclear industry staked its future on updating the venerable CANDU design. Atomic Energy of Canada Ltd. (AECL), the Crown corporation that pioneered it, talked up the Enhanced CANDU 6, CANDU 9 and Advanced CANDU Reactor (ACR) as safer, faster to construct, cheaper and better than previous models. The federal government pumped untold sums into their development.

None were licensed. None were ordered. None were built.

In 2011, the federal government sold AECL’s reactor business to SNC-Lavalin for a paltry $15-million. After six decades of development, and dozens of bona fide reactors built and operated in seven countries, the CANDU had become nearly worthless.

The proposed site for OPG’s first SMR, next to the existing Darlington Station, is an artifact of that era. In 2006, OPG began preparing to build up to four reactors at the same location. AECL’s Enhanced CANDU 6 and the ACR 1000 were candidates.

But the project was derailed in late 2013 when the Ontario government asked OPG to stand down, essentially because the province no longer needed the power. The viability of those “next-generation” CANDUs, however, was never clear.

It’s relatively easy to sketch a reactor design on the back of a napkin, or create promotional videos and brochures with snazzy renderings. Professor M.V. Ramana, of the University of British Columbia’s Liu Institute for Global Issues, says a few graduate students can develop a conceptual design for a few hundred thousand dollars.

But it’s quite another matter to advance a design to the point of actually building it. The real challenge, Prof. Ramana said, “is answering all the safety questions that any good regulator would ask: ‘How will this behave if there’s an earthquake or fire? What happens if there’s a complete blackout? What happens if this component fails?’ ” Answering such questions requires an intensive research program and countless hours of laboratory work, which can take decades. There’s no guarantee the answers will be favourable.

Portland, Ore.-based NuScale Power is a rare example of a vendor whose SMR design is backed by 20 years of research. According to published reports, it has spent around US$1-billion so far developing its product.

Even a mature design isn’t enough. Just as Ford wouldn’t build an assembly line for the Mustang Mach-E if it thought it could sell only a handful, SMR vendors need assurances they’ll receive enough orders to justify mass production. It’s unclear how many orders would be sufficient, but published estimates have ranged from as low as 30 to well into the hundreds.

“Our plan is to be building hundreds of these,” said Katherine Moshonas Cole, president of X-energy Canada. “There will be multiples in Canada and there’ll be multiples in the States ... and there will be multiples in Europe as well.”

Prof. Ramana said many of the earliest power reactors met the modern definition of SMRs. But their diminutive size was rarely a virtue: It meant they couldn’t take advantage of economies of scale, resulting in high costs per unit of electricity generated, not to mention disproportionately greater volumes of radioactive waste. Many were shut down early.

“The lesson that we learned from some of these experiences is that designs that might seem captivating on paper might not actually work so well in real life,” Prof. Ramana said. “SMRs are not going to be economical. You can see that from the outset.”

Terrestrial Energy’s Mr. Irish, though, is not counting on assembly-line manufacturing alone to bridge that gap. Rather, he says it’s the IMSR’s design that ensures it can compete with other forms of power generation. Its high-temperature operation, for him, is the ticket.

“That’s profoundly important for economics,” he said. “For the same amount of expensive capital kit, we generate 50 per cent more kilowatt hours. That surely must be the most important place you start to achieve your commercial objectives ... you want a much more efficient machine.”

Federal support - the crucial ingredient

In contrast with the CANDU, the nuclear industry promises SMRs will be funded largely by the private sector. Many observers are skeptical. “Without government programs and financial support promoting SMRs, industry alone is unlikely to invest in the high up-front costs,” opined lawyers at Stikeman Elliott in a recent commentary.

Nor are non-nuclear provinces likely to make the leap alone. Mr. Morgan confirmed Saskatchewan seeks federal support to deploy SMRs, although the form of that support has yet to be determined.

For several years, federal and provincial government officials have signalled they want Canada to be one of the earliest adopters of SMRs. They’ve partnered with industry to produce road maps for making that happen. The governments of Ontario, New Brunswick, Saskatchewan and Alberta have agreed to collaborate on advancing SMRs. Mr. O’Regan, the federal Natural Resources Minister, has fully embraced the industry’s claim that Canada’s clean-energy transition cannot succeed without them.

So far, however, such pronouncements haven’t translated into generous subsidies. The federal government has channelled just meagre amounts of funding to SMRs, such as $20-million last October toward development of Terrestrial’s IMSR, and $50.5-million to New Brunswick-based Moltex Energy in March.

The latest federal budget didn’t mention SMRs. Nevertheless, studying its fine print, lawyers at McCarthy Tétrault LLP noticed what they described as “exciting policy levers.” They pointed, for example, to an income tax break of up to 50 per cent for manufacturers of zero-emission technologies. There was also $1-billion offered for clean tech projects “where there is a perceived lack of patient capital or ability to scale up because of the size of the Canadian market.” SMR vendors could capitalize on such programs, the lawyers concluded, depending on how they’re implemented.

Meanwhile, SMR vendors seek relaxed safety requirements that could make SMRs more cost-competitive. Terrestrial, for instance, says that its IMSR will be “walk-away safe” thanks to “passive and inherent safety” features.

X-energy says its reactor’s safety radius is about a quarter of a mile, versus 10 miles for typical reactors. Ms. Cole said the Xe-100′s fuel, known as tri-structural isotropic (TRISO) particle fuel, cannot melt.

“We don’t actually need any emergency planning for our reactors, because there’s no plausible ... or even implausible ... accident that would result in any consequence to the surroundings outside the reactor’s perimeter,” she said.

It’s unclear to what extent the Canadian Nuclear Safety Commission (CNSC) will acquiesce.

Rumina Velshi, the CNSC’s president, said in a speech late last year that the organization regards SMRs as “poised to potentially be the next chapter in the evolution of Canada’s nuclear industry.”

To facilitate their development, the CNSC introduced a special program that allows its staff to provide feedback on reactor designs prior to a formal license application. Since 2016, its staff have reviewed a dozen designs, and bills the process as a way for vendors to learn upfront about any potential regulatory roadblocks.

The CNSC has heard claims of “passive safety” many times before. Christian Carrier, now a consultant, was until recently the CNSC’s director of new major facilities licensing. He said some gas-cooled and molten salt reactors have demonstrated inherent safety characteristics. But reactor design is only one of many factors considered when setting licence conditions. Others include the capabilities and internal practices of the operator.

Obtaining a licence typically takes a few years. “Experience has shown that it will be dramatically affected by the [proponent’s] capability of submitting adequate and complete information on day one,” Mr. Carrier said. Only one SMR has so far commenced a full licensing review: Ottawa-based Global First Power Ltd. submitted documentation for its Micro Modular Reactor in March.

An artist rendering of a cross section of the USNC-Power Micro Modular Reactor™ (MMR™) unit, in design for Chalk River.USNC-Power/Handout

The Union of Concerned Scientists, a long-time opponent of nuclear power, released a study in March which concluded that SMR designs, including molten salt reactors, are no safer than previous designs. It therefore urged regulators to maintain current requirements.

“The intense scrutiny, from policy makers and the public – given the safety and security angle combined with a nascent technology – will likely cause delays and conflicts” for SMR developers, lawyers from global law firm White & Case predicted in a recent commentary.

In short, SMRs’ future depends to a large extent on vendors delivering hard proof supporting their most ambitious promises about safety, efficiency, cost and other matters.

Dennis Langen is a regulatory lawyer with Stikeman Elliott. He says the earliest deployments of SMRs in Canada are at least a decade off. Nevertheless, he believes they ultimately will be built because they can support intermittent renewables such as wind and solar.

“Social and political pressures are driving us to decarbonize,” he said. “In the provinces that don’t have hydro, at some point there’s going to be a need for a shift, because you need to backfill that. And it’s that type of drive that’s going to get us to small nuclear.”

Yet a late arrival by SMRs could consign them to irrelevance. And right now, many observers regard them as too speculative to factor into forecasts. The federal government’s own Canada Energy Regulator projects the amount of power generated by nuclear reactors in Canada will continue on a declining trend.

Paris-based Mycle Schneider Consulting has reviewed the status of global SMR development three times since 2015. In the firm’s most recent review, published in September, 2020, it found little had changed over the period.

“Overall, there are few signs that would hint at a major breakthrough for SMRs, either with regard to the technology or with regard to the commercial side,” the firm observed. “Delays, poor economics, and the increased availability of low-carbon alternatives at rapidly decreasing cost plague these technologies as well, and there is no need to wait with bated breath for SMRs to be deployed.”

Ralph Torrie is a partner at Torrie Smith Associates, an energy and environmental consultancy. He says he’s focused on power generation options that can be built this decade to address a warming climate – a criterion that, in his view, disqualifies SMRs.

“They’re a long way off.”

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

Matthew McClearn

Matthew McClearn