Briefing highlights

- Canada slips in real estate ranking

- China cuts bank reserve requirements

- Canada creates 81,000 jobs in August

- U.S. job creation at 130,000, fewer than expected

- Stocks, loonie, oil at a glance

- Fed eyes quarter-point cut: report

- Required Reading

What the rankings show

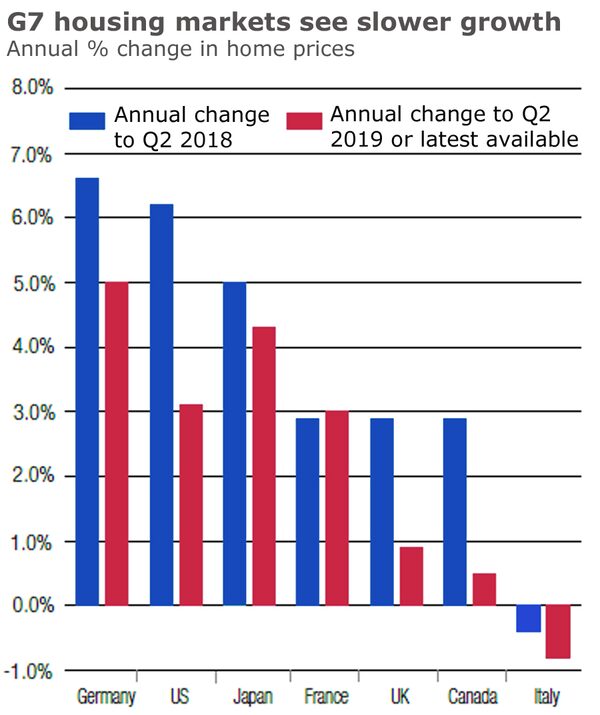

Canada’s housing market continues to fall further down the list in a global ranking.

Canada ranked No. 49 in the second-quarter study of 56 countries by real estate consulting group Knight Frank.

The Knight Frank rankings are based on the annual percentage change in housing prices. For Canada, that was a gain of just 0.5 per cent to the end of the second quarter 2019. Note, though, that the three-month percentage increase was 1.2 per cent.

Canada’s latest showing marked a drop from No. 37 a year earlier and No. 44 in the first quarter of this year.

Of course, if you go back to the heady days, Canada ranked No. 4 in the second quarter of 2017.

The top 10 for the second quarter included China, Malta, the Czech Republic, Luxembourg, Mexico, Hungary, Chile, Slovenia, Taiwan and Portugal.

Sharing the bottom with Canada were Israel, Britain, Poland, Brazil, Switzerland, Morocco, Italy, Finland and Australia, the last four notable for outright price declines over 12 months.

Many global markets are seeing slower growth in a period marked by uncertainty, Knight Frank said.

“Although still in positive figures, the global house price index has seen a slowdown in annual growth for six consecutive quarters,” the group said in its report.

“From trade wars (U.S./China and Japan/South Korea) to Brexit, from political protests to weakening economic forecasts, headwinds are mounting and weighing on buyer sentiment despite a raft of interest rate cuts in the last three months.”

Source: Knight Frank

Where Canada is concerned, you’ve got to keep in mind that this is just what British Columbia, Ontario and federal policy makers wanted to see when they moved to cool down bubbly markets with tax measures and new mortgage-qualification stress tests.

This also means affordability is improving, though Vancouver and Toronto are still out of reach for many potential buyers.

“Prices are still rising at a national level but the rate of growth continues to slow,” said Knight Frank partner Kate Everett-Allen, citing the mortgage-qualification stress tests, which came into effect at the beginning of last year, and earlier higher interest rates.

Canada, of course, is not just one market, but several, with Vancouver and Toronto often skewing various findings.

“The national picture conceals significant variations at a city level, with Ottawa and Montreal still registering price growth of 5 per cent to 6 per cent per annum, whilst Calgary and Vancouver saw prices decline over the 12-month period,” Ms. Everett-Allen said.

As The Globe and Mail’s Janet McFarland and Brent Jang report, the Toronto and Vancouver markets are perking up, according to the latest statistics from local real estate boards, released this week.

The Vancouver market “is taking longer to balance out than Toronto did, but slow progress continues,” said BMO Nesbitt Burns senior economist Robert Kavcic.

He noted, too, that developments in the housing market suggest that “so far, this is a near-perfect landing from a policy maker’s perspective.”

Read more

- Janet McFarland, Brent Jang: Toronto, Vancouver home sales rise as Canadians adapt to tougher mortgage rules

- Canada’s perkier housing market: Uh-oh, here we go again?

- Remember when you couldn’t afford a home in Toronto or Vancouver? Affordability has just improved big time (and you still can’t afford it)

- Janet McFarland: The shrinking gap between condo and other property prices is pushing buyers to low-rise housing

- Overvalued? Overheated? Overly vulnerable? The state of 15 Canadian housing markets

- Janet McFarland: Home-building jobs fall in Ontario as construction for low-rise houses declines

- Housing market ‘has passed its cyclical bottom’: If you’re looking to buy or sell, check out this city-by-city look

- Rob Carrick: We need to come clean with millennials on big-city home ownership dreams

- Hitting market bottom: A five-year forecast for house prices in 33 Canadian cities

China cuts reserve requirement

China’s central bank is moving again to juice the economy by cutting the reserve requirement ratio for commercial banks.

The People’s Bank of China said the ratio will be cut by half a percentage point for all commercial banks, effective Sept. 16, while some banks get additional cuts of half a point in mid-October and mid-November.

This should mean the equivalent of more than US$125-billion in liquidity, the central bank said.

“Given that the headwinds to China’s economy from weaker external demand and cooling property construction are likely to intensify in the coming months, we doubt the PBOC will stop at just one RRR cut,” said Julian Evans-Pritchard, senior China economist at Capital Economics.

He estimated further cuts by early next year, along with other measures.

“All of this should help to shore up credit growth, which has started to slow again recently,” Mr. Evans-Pritchard said.

“However, with wider credit spreads and tight shadow banking regulation dampening the monetary transmission mechanism, any acceleration in credit growth is likely to remain modest,” he added.

“The upshot is that the ongoing shift towards a more accommodative monetary stance is unlikely to prevent a further slowdown in growth nor subsequently drive a strong rebound.”

Read more

Canada churns out jobs

Canada’s economy churned out 81,000 new jobs in August, with a surge in hiring for part-time positions, the country’s statistics agency said today.

That report from Statistics Canada was well above what economists had expected.

Employers created almost 24,000 full-time jobs and more than 57,000 part-time positions, the agency said.

The jobless rate held steady at 5.7 per cent as more people searched for work.

The finance/real estate, education and professional and technical sectors all chalked up increases, noted BMO chief economist Douglas Porter.

“While there have been a few hot spots this year, the biggest winner has been the professional and technical sector, with a roaring 7.4-per-cent year-over-year gain - tech boom, anyone?” he said.

The economy has now created about 471,000 new jobs since August, 2018, with full-time positions eclipsing part-time work.

“If the Bank of Canada was on the fence about cutting rates in October, today's jobs numbers might be one further push towards standing pat,” said CIBC World Markets chief economist Avery Shenfeld.

“It doesn't take an economics degree to conclude that a gain of 81,000 jobs, while, as always, including a wide statistical error term, is a hefty reading.”

Markets will now be “pricing down” the odds of the central bank cutting its benchmark rate in October, Mr. Shenfeld said, but “we still see a December cut as on the table, as we expect to see some softer data emerge by then.”

The central bank held its overnight rate steady at 1.75 per cent earlier this week.

The U.S., in turn, created 130,000 jobs, fewer than expected, as unemployment held at 3.7 per cent.

The U.S. numbers are “consistent with our forecast for slowing monthly job gains as workers get tougher to find,” said Toronto-Dominion Bank senior economist Leslie Preston.

“We expect monthly hiring to slow towards 100,000 per month through the end of the year,” she added.

That said, the low unemployment rate, and decent wage gains still paint a picture of overall health for the labor market.”

Read more

- Unemployment rate steady as Canadian economy adds 81,100 jobs in August

- U.S. job growth slows more than expected, while wages and hours increase

Markets at a glance

Read more

Ticker

Fed eyes quarter-point cut: WSJ

Federal Reserve policy makers aim to cut interest rate probably by just one-quarter of a percentage point when they next meet, rather than a full half-point, The Wall Street Journal reports, based on interviews and public comments.

Fitch downgrades Hong Kong

From Reuters: Fitch Ratings has downgraded Hong Kong’s long-term foreign currency issuer default rating to double-A from double-A-plus following months of unrest and protests in the Asian financial hub.

Huawei showcases chipset

From Reuters: Huawei Technologies showcased its chipset for a new high-end smartphone on Friday, pressing ahead with plans to launch its Mate 30 range, despite uncertainty about whether the new phones will be able to run Google’s Android operating system and apps.

Required Reading

Li Ka-Shing firm eyed Inter Pipeline

Hong Kong-based CK Infrastructure Holdings Ltd., a company backed by one of Asia’s wealthiest families, bid $12.4-billion for Inter Pipeline Ltd. this summer, only to see the Calgary-based utility spurn the takeover for reasons that include perceived political risks. Andrew Willis and Jeffrey Jones report.

Softwood case sent back to ITC

A binational panel has sent the Canada-U.S. softwood case back to the U.S. International Trade Commission for further review, citing flaws in the ITC’s 2017 ruling that Canadian lumber shipments are injuring the U.S. forestry sector, Brent Jang writes.

Indicator suggests U.S. stocks in trouble

U.S equity markets are priced for a sharp recovery in profit growth that at least one leading indicator suggests is unlikely to happen, Scott Barlow reports. The end result is a notable increase in portfolio risk, as a continuation in sluggish earnings growth would likely result in a significant market correction.