Briefing highlights

- Canada falls in home price ranking

- Bank of Canada sees market cooling

- IMF warns on market clout

- A Trudeau-Trump scene I’d love to see

- Markets at a glance

Canada falls in ranking

Canada is sinking fast in global rankings of real estate price growth amid new rules aimed at taking the froth off inflated markets like Toronto and Vancouver.

Canada held the No. 15 spot in the first-quarter measure by Knight Frank, down from No. 10 in the fourth quarter of 2017, according to the rankings released today by the real estate consultants.

It measured the 12-month change in Canadian prices at a gain of 6.6 per cent, but the annual six-month shift at a loss of 1.1 per cent. The annual three-month change showed a rise of just 0.2 per cent.

The fourth-quarter report put those numbers at gains of 8.9 per cent and 0.5 per cent, and a loss of 1.3 per cent, respectively.

As other statistics have showed, provincial and regulatory measures to cool markets are working. As The Globe and Mail’s Janet McFarland and Brent Jang report, for example, the latest numbers from Toronto and Vancouver illustrate the slump.

The Ontario and B.C. governments took the first moves, followed by the Office of the Superintendent of Financial Services, the commercial bank regulator, which brought in what are known as new B-20 mortgage-qualification rules early this year.

Topping the Knight Frank list in the first quarter were Hong Kong, Malta, Iceland, Ireland, Jersey, Turkey, Bulgaria, Mexico, Netherlands and the Czech Republic.

“The slowdown is likely to be attributable to several factors, including the three [Bank of Canada] rate rises in the last year, weaker economic growth (IMF downgraded their 2018 forecast from 2.3 per cent to 2.1 per cent in April), and the new mortgage rules, although these were only introduced in January,” said Knight Frank partner Kate Everett-Allen.

As The Bank of Canada noted in its Financial System Review today, “monetary, macroprudential and other policy measures have led to a slowing in household credit growth and have moderated activity in the housing market.”

Tighter mortgage standards are “also improving the quality of new mortgages,” and reducing the number of stressed households, it added.

“Although the market for single-family homes in Toronto has cooled, imbalances in condominium markets have continued to grow, particularly in Vancouver and Toronto and their surrounding regions.”

And in an interesting twist, some of the other Canadian markets, like Montreal, are gaining modestly after years of stability, the central bank said.

- David Berman: Higher rates, stricter mortgage rules curbing home prices but debt still a key risk: BoC

- Carolyn Ireland: Rates, limited inventory blamed for lacklustre Toronto spring housing market

- The arresting number that says it all about Toronto’s housing market slump

- Brent Jang, Janet McFarland: Toronto, Vancouver home sales slump as buyers and sellers wait on sidelines

- The ‘sea change’ in Canadian mortgages is going to really hurt

- Janet McFarland: Home sales drop as weaker markets ‘destabilized’ by new stress tests: CREA

- Remember halcyon days and times a-changin’? Canadian baby boomers now face a housing crisis

- Refuse to sell your house at these prices? Join the (growing) club

IMF warns on market clout

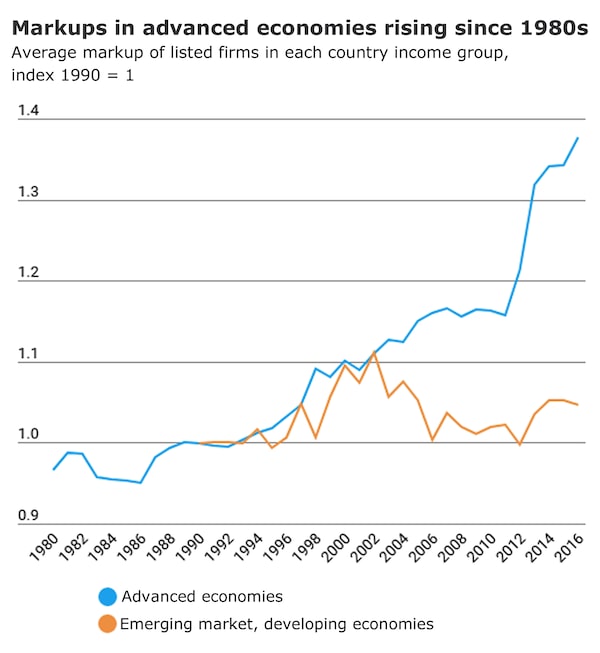

International Monetary Fund researchers are warning against the market power of “superstar” corporations and their penchant for “markups” over the past few decades.

“Markups among advanced economies have significantly increased since the 1980s, by 43 per cent on average, and this trend has accelerated during the present decade,” IMF economists Frederico Diez and Daniel Leigh said in an article posted on the influential group’s website.

“Second, among emerging market and developing economies, the rise of markups is much more moderate, a 5-per-cent increase on average since 1990,” they added in a post based on a working paper not yet released.

“More in-depth analysis shows that the increase in markups in advanced economies is mostly driven by ‘superstar’ firms that managed to increase their market power further, while markups in other firms have essentially been flat.”

They named no corporations.

Here’s what they found, based on numbers for publicly traded companies in 74 countries:

Source: International Monetary Fund

This “pattern” spans corporate sectors, not just information and communications technology, measuring average markups on goods and services.

A markup, they explained, is the amount charged for a product compared to the cost of producing an additional unit of that product, documented as a ratio and which “provides a measure of market power.”

Mr. Diez, an economist in the IMF research unit’s structural reform group, and Mr. Leigh, deputy division chief of the research department, noted society’s concerns over the concentration and clout “in the hands of too few,” from the airline to tech sectors.

“In particular, in advanced economies, rising corporate market power has been blamed for low investment despite rising corporate profits, declining business dynamism, weak productivity, and a falling share of income paid to workers,” Mr. Diez and Mr. Leigh said.

“The rise of corporate giants has raised fresh questions about whether this trend might continue and, if so, whether some rethinking of policy is needed to maintain fair and strong competition in the digital age,” they added, noting, too that market clout is hard to measure while frequently used indicators can be misleading.

They then raise the obvious question: Should we be concerned?

“The short answer is yes, especially if this trend continues,” the researchers warned.

“Our paper finds that, starting from low levels, higher markups are initially associated with increasing investment and innovation, but this relationship becomes negative when market power becomes too strong,” they added.

“Further, the link between markups and investment and innovation is more strongly negative in industries featuring higher degrees of market concentration.”

Read more

A scene I’d love to see

Photo illustration

Read more

- Adrian Morrow: Trump cites War of 1812 as trade dispute with Canada intensifies

- Robert Fife: Trump will ‘talk tough’ on trade at G7, adviser says

Markets at a glance

Read more

More news

Streetwise

- Sean Silcoff: OPTrust shows penchant for startups as pension fund manager backs Vancouver VC firm Yaletown