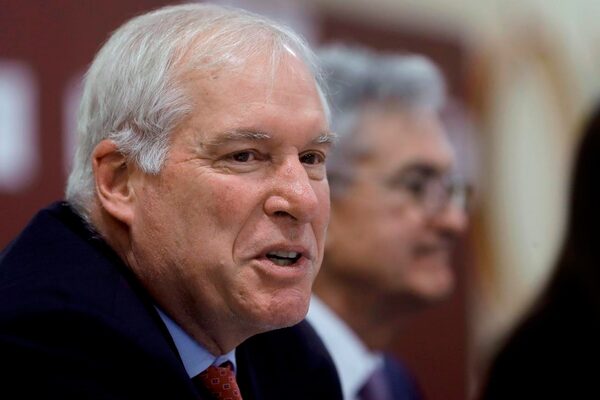

Federal Reserve Bank of Boston President Eric Rosengren as seen on Nov. 25, 2019.The Associated Press

Two U.S. Federal Reserve officials sounded increasing pessimism on Friday on the swiftness of any economic recovery from the novel coronavirus epidemic and warned the unemployment rate could rise again if the disease is not brought under control.

The central bank already made clear it expects a full economic healing from the impact of the virus to take years as it kept interest rate near zero at its policy meeting last week.

But nascent signs of recovery in U.S. economic data, with better-than-expected job gains and retail sales for the month of May, had fueled some hopes that the United States could bounce back more quickly.

Fed officials pushed back on that view on Friday and cautioned against reopening the economy too hastily after the end of state lockdowns aimed at containing the virus, which has killed more than 118,000 Americans.

California, North Carolina and a string of U.S. cities mandated or urged mandatory use of masks on Thursday to get a grip on spiraling coronavirus cases as at least six states set daily records.

“This lack of containment could ultimately lead to a need for more prolonged shut-downs, which result in reduced consumption and investment, and higher unemployment,” Boston Fed President Eric Rosengren said in a virtual event organized by the Greater Providence Chamber of Commerce.

Minneapolis Fed President Neel Kashkari also said the economic recovery would take longer than he had hoped just a few months ago, and warned the recent positive trend on job gains could soon be reversed if the virus is not tamed soon.

“Unfortunately, my base case scenario is that we will see a second wave of the virus across the U.S., probably this fall,” Kashkari said during a Twitter chat moderated by CBS News. “If there is a second wave, I would expect the unemployment rate to climb again.”

LONG AND SLOW

Earlier this week, in two separate appearances before lawmakers in the U.S. Congress, Fed Chair Jerome Powell warned millions of people will likely still be unemployed even as the economy is on the path of recovery.

Powell, Rosengren and others have all said more fiscal and monetary policy support is likely needed to help them. Fed Vice Chair Richard Clarida told Fox Business Network on Friday “there’s more that we can do, I think there’s more that we will do.”

Clarida added there is no limit to the Fed’s potential purchases of Treasury securities or mortgage-backed securities.

Congress has allocated nearly $3 trillion for coronavirus-related economic aid and the Fed has pumped trillions of dollars of credit into the economy to cushion it from the fallout from the epidemic.

But some Republicans have been resistant to doing more quickly, especially given recent positive economic data.

Powell, in a separate appearance on Friday, reiterated that the U.S. economic recovery will not be quick or smooth.

“We will make our way back from this, but it will take time and work ... The path ahead is likely to be challenging,” Powell said during a webcast discussion with local business and community leaders in Youngstown, Ohio, on building a resilient workforce.

“Lives and livelihoods have been lost, and uncertainty looms large,” he said.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.