The WTO ruled both Airbus and its U.S. rival Boeing received billions of dollars in illegal subsidies, in a pair of cases dating back to 2004.Regis Duvignau/Reuters

The United States on Wednesday said it would enact 10-per-cent tariffs on European-made Airbus planes and 25-per-cent duties on French wine, Scotch and Irish whiskies and cheese from across the continent as punishment for illegal EU aircraft subsidies.

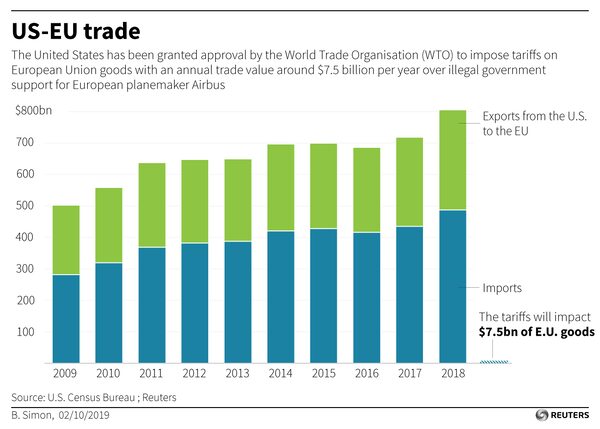

The announcement came after the World Trade Organization gave Washington a green light to impose tariffs on US$7.5-billion worth of EU goods annually in the long-running case, a move that could ignite a tit-for-tat transatlantic trade war.

The U.S. Trade Representative’s target list for EU tariffs, set to take effect on Oct. 18, includes large Airbus SE planes made in France, Britain, Germany and Spain for 10-per-cent tariffs.

But no tariffs will be imposed on EU-made aircraft parts used in Airbus’s Alabama assembly operations nor those used by rival U.S. plane maker Boeing Co., safeguarding U.S. manufacturing jobs.

Reuters

Instead, the list heavily targets the four Airbus consortium countries with tariffs, including French wine, Spanish olives, British whisky, sweaters and woollens and German tools and coffee.

Cheese from nearly every EU country will be hit with the 25-per-cent tariffs, but Italian wine and olive oil was spared, along with European chocolate.

“Finally, after 15 years of litigation, the WTO has confirmed that the United States is entitled to impose countermeasures in response to the EU’s illegal subsidies,” U.S. Trade Representative Robert Lighthizer said in a statement.

“We expect to enter into negotiations with the European Union aimed at resolving this issue in a way that will benefit American workers,” Mr. Lighthizer added.

WTO arbitrators said Boeing had lost the equivalent to US$7.5-billion a year in sales and disruption to deliveries of some of its largest aircraft because of cheap European government loans to Airbus.

The decision, confirming a figure reported by Reuters last week, allows Washington to target the same value of EU goods, but bars any retaliation against European financial services.

It is part of a two-way dispute that diplomats and trade experts expect to lead to tit-for-tat European import tariffs against U.S. goods next year over state subsidies for Boeing.

The Trump administration asked the WTO for an emergency meeting to give the formal ratification needed for tariffs in mid-October.

Earlier this year, U.S. trade officials floated a US$25-billion list of European targets from planes to helicopters, wine, cheese, spirits and luxury goods. Goods from EU countries that are not part of the Airbus consortium – such as Italy – would still be targeted, a USTR official said, because European Union countries all bear responsibility for the situation.

Broad selling amid worries over slowing global growth that had punished European stocks earlier on Wednesday accelerated as the ruling revived worries about damage to the already-ailing regional economy. The pan European STOXX 600 index finished down 2.7 per cent, its worst day since December 2018.

Airbus shares closed down 2 per cent.

Wall Street’s main indexes suffered their sharpest one-day declines in nearly six weeks on Wednesday after employment and manufacturing data suggested the U.S.-China trade war is taking an increasing toll on the U.S. economy.

WAR OF ATTRITION

The world’s two largest plane makers have waged a war of attrition over subsidies at the WTO since 2004 in a dispute that has tested the trade policeman’s influence and is expected to set the tone for competition from would-be rivals from China.

The WTO had already found that both Europe’s Airbus and its U.S. rival Boeing received billions of dollars of illegal subsidies in the world’s largest corporate trade dispute.

The global trade body is set to decide early next year on the level of annual tariffs the EU can impose on U.S. imports.

German Chancellor Angela Merkel said the decision would weigh on the European plane maker, which is one of Germany’s largest industrial employers and is headquartered in France.

Before any tariffs can be imposed, the WTO’s Dispute Settlement Body must formally adopt the arbiters’ report in a process expected to take between 10 days and four weeks.

Its next scheduled meeting is on Oct. 28, but Washington’s request could bring that forward to Oct. 14.

’LOSE-LOSE’ TRADE WAR

While the level of tariffs amounts to less than three days’ worth of trade between Europe and the United States, importers led by U.S. airlines that buy Airbus jets have urged Washington to be selective when choosing industries to hit in order to avoid causing collateral damage to the U.S. economy.

EU manufacturers are already facing U.S. tariffs on steel and aluminum and a threat from U.S. President Donald Trump to penalize EU cars and car parts. The EU has in turn retaliated.

The Trump administration believes tariffs were effective in bringing China to the negotiating table over trade, and in convincing Japan to open its agricultural market to U.S. products.

Airbus has said this would lead to a “lose-lose” trade war and has published a video stressing its contribution to the U.S. industry through local assembly plants and 4,000 direct jobs.

Not all analysts see the WTO’s aircraft subsidy row – with its thousands of pages of legal and aeronautical jargon – inflaming broader international trade tensions.

“In some ways, it is a distinct issue from the rest of the Trump trade wars,” said Constantine Fraser of British research firm TS Lombard.

“I think the White House is going to be aggressive in pursuing this, but I don’t think there is necessarily any kind of read-through from this to the prospect of tariffs on cars.”

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.