Christie Vuong/The Globe and Mail

Richelieu Hardware Ltd. (Montreal)

Revenue (2021): $1.4 billion

Profit (2021): $142.3 million

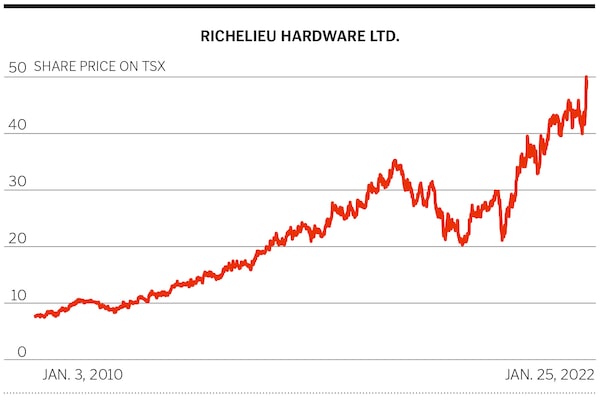

Three-year share price gain: 119%

P/E ratio (trailing): 19.8

The word “entrepreneur” sometimes scares seasoned investors. It calls to mind young CEOs hell-bent on growth at any cost, who load up their companies with debt and often flame out within a few years.

That’s not Richelieu CEO Richard Lord’s M.O. “My soul is to be an entrepreneur,” he says—not just one who makes a lot of money but who also contributes something lasting to society. As for the young part, the grey-haired CPA, who has a quick and infectious laugh, politely declines to tell me his age. But he’s been in charge of the importer, manufacturer and distributor of specialty hardware since 1988, and few CEOs have a stronger record of long-term growth and share-price appreciation.

When Lord joined the company, it had just $13 million in annual sales. “Now, it’s a $1.4-billion company, and very profitable,” he says. Richelieu has 49 distribution centres in Canada and 57 in the United States—with the U.S. picking up—and offers more than 130,000 products. Many of them are components and finishings for kitchen cabinets, closets, and other types of storage and furniture.

The Globe and Mail

In some ways, it helps to describe what Richelieu is not. Even 15 years ago, Lord says, some investors would ask, “Do you compete against Home Depot?” In fact, Richelieu is a specialty distributor. Only about 20% of its sales go to retailers—and Richelieu sells to all the big-box chains, including Home Depot, Lowe’s, Rona, Home Hardware and others. The lion’s share goes to manufacturers and installers, and that’s still a fragmented and very promising market.

As it was in 1988, Lord’s strategy is growth. He’s made 79 acquisitions over the years, including five in fiscal 2021 (which ended on Nov. 30) and three since then. Yet Richelieu has never carried any significant long-term debt. “We produce more cash flow than the acquisitions we make,” says Lord.

Richelieu went public on the TSX in 1993, and after expanding across Canada, it entered the U.S. in 1999. The company hasn’t suffered any long-lasting downturns, though Lord says there was a fright during the first two months of the pandemic, when sales plunged 45%. But now they’re back on track and growing. “You can easily imagine $2 billion is not very far,” says Lord, who owns about 8% of the company. As for succession, “I am surrounded by a fantastic team,” he says. But he’s not stepping down any time soon. “I think I am okay for the time being.”

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

John Daly

John Daly