The U.S. Thanksgiving holiday offers unique investment opportunities for Canadian and U.S. investors.

Two of the strongest days of the year for U.S. equity markets are the day before and the day after Thanksgiving.

For Thanksgiving week since 1950, the S&P 500 index has moved higher 68.18 per cent of the time, averaging a gain of 0.71 per cent. The bulk of the gains came during the two days that bookended the holiday Thursday. Advances on the Wednesday and Friday were recorded 77.3 per cent and 72.7 per cent of the time, respectively, averaging gains each day around 0.35 per cent. Happy Thanksgiving indeed!

From the archives: Black Friday balancing act: How deep discounts pay off

Performance of the S&P/TSX Composite Index during the U.S. Thanksgiving rally period also has been positive. The TSX Composite Index, since its re-launch in March 2000, has advanced in 10 of the past 15 years during the Wednesday to Friday period.

Strength during the period is influenced by a difference in sentiment between institutional and individual investors.

Most institutional investors and market makers have a diminished impact on equity markets because they close their books at midday on Wednesday, the day before Thanksgiving. They take an extended long weekend, including a holiday on Friday, the day after Thanksgiving.

Individual investors have a greater impact on equity markets. They are in a buoyant pre-Christmas mood. Thanksgiving Day in the U.S. is the start of the Christmas shopping season. The day after Thanksgiving Day is known as "Black Friday" and traditionally has been the busiest shopping day of the Christmas season. It became known as "Black Friday" because historically that is the date when retailers finally turn a profit for the year. Their profit and loss statement turns from red to black.

What about this year?

Once again, Black Friday and the Thanksgiving weekend will be an important day for retail sales in the United States and Canada.

The U.S. National Retail Federation's October survey predicted that sales during the Black Friday period, excluding auto, gasoline and restaurant sales, will increase 4 per cent over last year to an average of $139.61 per person. Nearly six in 10 Americans, an estimated 137.6 million people, are planning or considering shopping during the Thanksgiving weekend.

For the entire Christmas season, sales are expected to increase 3.6 per cent over last year to $935.58 per person.

E-commerce sales are predicted to continue to grow at a faster rate than "bricks and mortar" store sales representing 36 per cent of holiday sales, up from 34 per cent last year. Canadian retailers also have caught the wave. Many Canadian retailers already are advertising "Black Friday specials" for the U.S. Thanksgiving holiday. A 0.74-cent Canadian dollar relative to the U.S. dollar will prompt Canadian consumers to purchase goods in Canada this U.S. Thanksgiving instead of taking a quick shopping trip to the United States.

Investors can take advantage of the U.S. Thanksgiving holiday phenomenon.

The easiest opportunity is to avoid selling U.S. and Canadian equities and equity Exchange Traded Funds the day before and the day after the U.S. Thanksgiving holiday when prices have a high probability of moving higher.

And now a curiosity! Seasonal studies show that the best day to take seasonal profits in the retail merchandising sector is on Black Friday. Traders take profits on news. Preferred strategy is to hold retail merchandiser stocks and related ETFs for now, but be prepared to take profits on Black Friday.

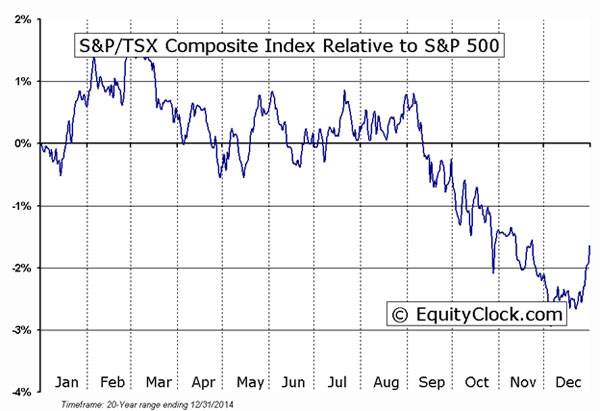

Black Friday also is a special day for Canadian investors. That is the day when Canadian equity indexes and ETFs historically enter into a period of outperformance relative to U.S. equity markets. The period of outperformance is from the first week in December to the first week in March.