Chinese economic policy makers are attempting a delicate balancing act – one foot on the throttle of credit creation and the other on the brake dismantling shadow banking – that has profound implications for Canadian investors. That's right, Canadian investors.

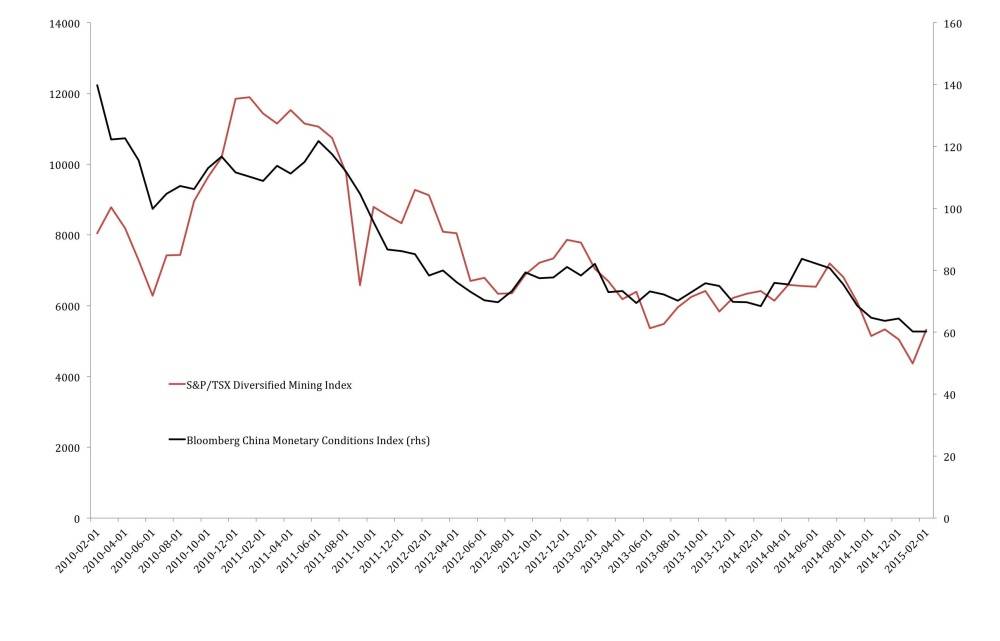

A comparison between the performance of Canadian mining stocks and money supply growth in China underscores the importance of China's economy to domestic investors. The accompanying chart shows that Bloomberg's China monetary conditions index – a weighted average of loan growth, real interest rates and the currency exchange rate – have tracked extremely closely with domestic mining equities.

Why would this be the case? China's incredible 30-year economic growth story is based on credit-driven infrastructure and real estate growth using borrowed funds. The country's economic growth, and by extension their demand for commodities, has been dependent on loan growth.

Rather than use direct government stimulus, China's leadership encouraged the country's banks to lend funds to real estate developers and state-owned enterprises like the Ministry of Railways to facilitate construction on a massive scale. In addition, corporate lending to steel makers, cement companies and miners – industries directly involved with construction – stoked the economy further.

As a result of this growth strategy, China is the largest consumer of almost every commodity on the planet. Canadian mining companies, even those with no revenue coming directly from the mainland, benefited from the higher commodity prices caused by China's appetite.

It's no surprise, then, that a steady decline in loan growth and monetary conditions in China has accompanied the difficult conditions in the Canadian mining sector.

In a speech Thursday, Chinese Premier Li Keqiang was uncharacteristically blunt about the country's 2015 economic prospects according to Reuters. "The downward pressure on China's economy is intensifying… . Deep-seated problems in the country's economic development are becoming more obvious," he said. "The difficulties we are facing this year could be bigger than last year."

Immediately following the Premier's remarks, iron ore spot prices in China fell to a six-year low and Canadian iron producers like Labrador Iron Ore Royalty Corp. endured another difficult market session.

Canadian investors are growing more comfortable with the notion of slowing Chinese growth but that doesn't mean they should stop following events closely. The strong connection between China's economy and domestic equities remains, and changes in Chinese economic activity still have the capacity to both blindside and benefit domestic portfolios.

Follow Scott Barlow on Twitter @SBarlow_ROB.