I'm not usually prone to biblical references but "pride goeth before the fall" too accurately depicts the mood of dividend investors lately. They're getting cocky at possibly the wrong time.

One of the worst, most punishing sins of investing is recency bias – the belief that what has occurred in the recent past will continue forever while ignoring longer term market history. ("New Paradigm," anyone?)

Psy-Fi blog, a brilliantly useful compendium of research on behavioural economics, writes that recency bias turns investors into "a sort of living incarnation of a goldfish, forever surprised by the same piece of seaweed."

Dividends, which put cash directly in the hands of investors, are great, no doubt. But the strong post-crisis performance of yield-heavy market sectors like high-yield bonds, REITs and utilities was driven by a slow growth, low government bond yield environment that might as well have been designed for them.

There are two major threats to this dividend utopia – higher bond yields and acceleration in U.S. economic growth.

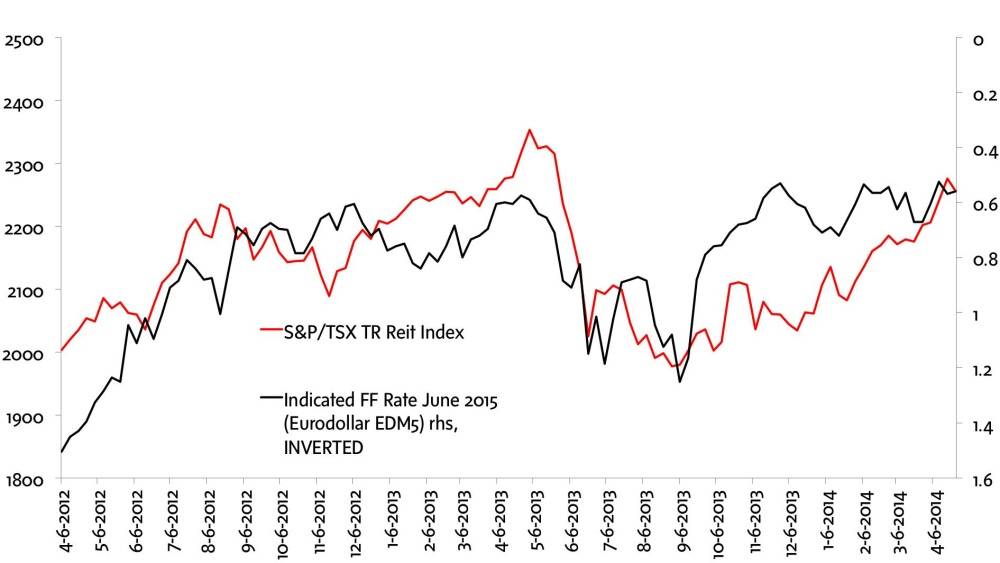

The Eurodollar futures market represents the smartest of the smart money – global investment banks predicting future rates and hedging the giant interest rate exposure inherent in their businesses. (Click here for a more detailed discussion on Eurodollars).

Eurodollars predict that by June 2015, the Fed Funds rate will more than double to 57 basis points. Dividend sectors do not perform well in a rising rate environment – as REIT investors learned in 2013. The S&P/TSX REIT Index dropped almost 14 per cent as taper fears sent ten-year U.S. Treasury bond yields higher by 100 basis points.

An accelerating U.S. economy would be great news for global markets as a whole, but not for dividend investors. Investment assets would be attractive to economically-sensitive stocks in the industrial, manufacturing and energy sectors while slower-growing high yield stocks would lag behind.

Investors know that market leadership changes at different points in the in cycle and yet somehow always seem surprised when the strategy that outperformed for the previous five years starts to lag.

Raymond James analyst Ken Avalos recently advised institutional clients to underweight the REIT sector and BMO strategist Brian Belski is underweight the utility sector – another dividend investor favorite.

Investors that are overweight dividend sectors should view the upheaval seen from April to September 2013 as a warning shot, and begin to reduce their holdings. It might happen next month or next year, but the odds point to a rising rate interest environment that will severely crimp performance in income-generating investment sectors.

Follow Scott Barlow on Twitter at @SBarlow_ROB.