U.S. investors are fleeing emerging markets and this is not good news for Canadian investors.

Pavilion Corp.'s Pierre Lapointe, the company's head of global strategy and research, published a report Wednesday noting that, after a five-year period when emerging markets underperformed developed equities, investors have had enough: "In January, EM funds available to U.S. investors registered outflows of $3.3-billion. This is the largest monthly outflow since the Lehman crisis in 2008."

Canada possesses a developed economy in every regard but that doesn't mean investors can ignore emerging markets. The weighting of resource-related companies in the S&P/TSX composite remains much higher than their contribution to gross domestic product despite recent market weakness. Materials and energy accounted for 8.4 per cent of Canada's economy according to Statistics Canada's latest figures. At the same time, these resource sectors comprise 32 per cent of the S&P/TSX composite.

Developing world countries use far more commodities for every unit of economic growth – China's reliance on infrastructure construction is the best example – and the result is that the Canadian equity market is closely connected to emerging markets.

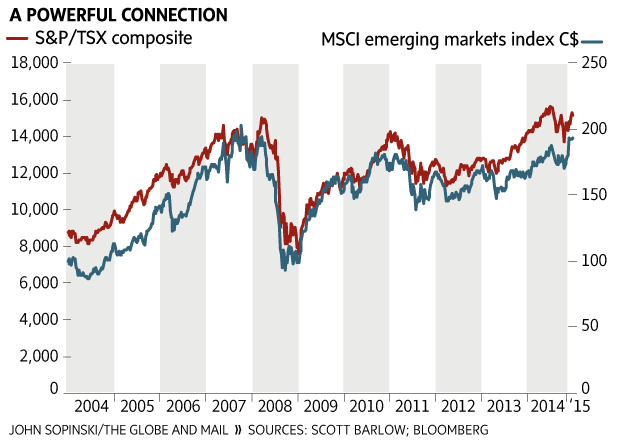

The accompanying chart shows just how ridiculously closely domestic equities have tracked the MSCI emerging markets index over the past 10 years. Once the emerging markets index is adjusted for the Canadian dollar, the two lines are almost identical.

The U.S. investor exodus from emerging markets equities and bonds is an unqualified negative for regional markets. Every sale of an emerging market ETF or fund means assets must be sold, pushing prices lower. As the chart shows, any move in EM stocks quickly translates to changes in the TSX.

The investment world's favourite legal cliché – "past performance does not guarantee future results" – carries positive implications for Canadian investors where emerging markets are concerned. Recent signs of economic life in India, and the surprising strength in Russian equity markets could signal a recovery in emerging market performance.

It's also true that S&P/TSX composite returns weren't always lashed to the developing world and their close association may have run its course. The steady if unspectacular U.S. economic recovery is providing the opportunity for new leadership in the Canadian market, notably from exporters.

But Canadian investors, especially those with commodity-heavy portfolios, should pay close attention to emerging market performance until this new leadership becomes clear. The domestic market's powerful connection to developing world growth is unlikely to disappear overnight.

Scott Barlow, Globe Investor's in-house market strategist, writes exclusively for our subscribers at ROB Insight and Inside the Market online. Subscribe to Globe Unlimited at globeandmail.com/globeunlimited.