Some investors want to reduce the level of risk in their portfolios as they age, even if that means sacrificing some return. In September 2011, I set up a model portfolio for this purpose. The objective was to preserve capital while earning a target return of two percentage points more than the yield on a five-year GIC from the major banks. The current RBC rate is 1.6 per cent, so, at present, we are aiming for 3.6 per cent per year.

Here is a look at the securities we hold with some comments on how they performed since my last update in mid-September. Prices are as of the mid-day on April 19, except for the PIMCO fund, which is at the close of trading on April 18.

iShares 1-5 Year Laddered Corporate Bond Fund (CBO-T). This short-term corporate bond ETF was chosen because of its low-risk profile and regular monthly cash flow. Because of the low-risk nature of the fund, we don't expect much of a return. However, we should be doing better than the 0.03 per cent cumulative return to date so a change is needed here.

iShares DEX Short Term Corporate Universe + Maple Bond Index Fund (XSH-T). This is another short-term ETF. It was added to the portfolio in the fall of 2013 to provide some exposure to Maple Bonds, which are Canadian-dollar bonds from foreign issuers such as Bank of America, JPMorgan Chase, and Goldman Sachs. The unit price is down 8 cents since the last review in September, but we received monthly distributions totalling just about 31 cents during the period so we came out slightly ahead.

iShares Canadian Universe Bond Index ETF (XBB-T). We added this ETF to the portfolio last September when it was trading at $31.37. As of mid-day on April 19, they were up to $13.72 plus we had received distributions of 44.91 cents per unit for a gain of 2.6 per cent during the period.

PIMCO Monthly Income Fund (PMO005). We added this global fixed-income mutual fund in October 2013. It offers monthly cash flow and places a strong emphasis on capital preservation. Since the last review, the unit value has lost 40 cents, but that was more than made up for by distributions totalling about 54 cents per unit. We have a total return of 12.1 per cent so far on this one.

BCE Inc. (BCE-T, BCE-N). BCE continues to be a strong performer for us. The stock has gained $5.64 since the last review and the company increased its quarterly dividend by 5 per cent to 68.25 cents, effective with the March payment.

Enbridge Inc. (ENB-T, ENB-N). After being battered last summer, Enbridge shares staged a modest recovery in the latest period, adding $1.28. The big news for income-oriented investors was a dividend increase of about 14 per cent to 52.99 cents per quarter.

Brookfield Infrastructure Limited Partnership (BIP.UN-T, BIP-N). This Bermuda-based limited partnership invests in infrastructure projects in stable countries around the globe, including Australia, Chile, Great Britain, and the U.S. It lost some ground last summer but bounced back to gain almost $3 per share in the latest period. The quarterly dividend has been increased by 7.5 per cent to 57 cents (U.S.).

We also received interest of $2.97 on the cash in the high-interest savings account.

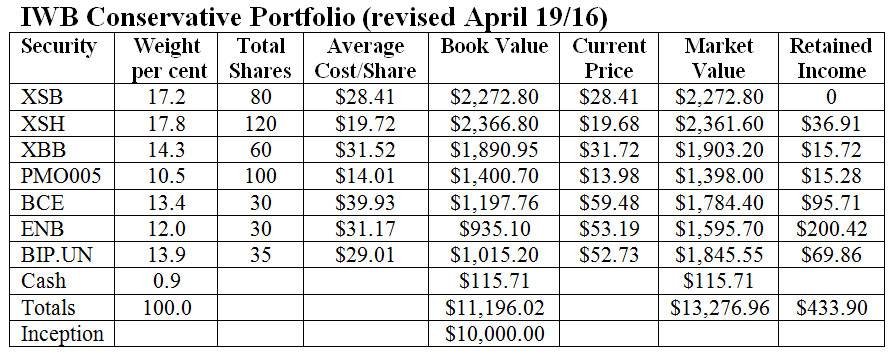

Following is a summary of where we stood at mid-day on April 19. The initial book value was $10,000. At the time of my last review the value of the portfolio, including dividends/distributions, was $13,193.73. Brokerage commissions are not factored in and the Canadian and U.S. dollars are treated as being at par (which, obviously, they are not but we do this to remove exchange rates from the performance data).

Comments: The portfolio is up 3.9 per cent since the last review, which is a respectable return given the high fixed-income component of almost 60 per cent. Since inception, we have a gain of 37.1 per cent, which works out to an average annual compound rate of return of 7.13 per cent. That is almost double our target.

Changes: As mentioned, I am not happy with the performance of CBO. We want to keep the risk in this portfolio to a minimum but we should be earning more than a flat return, especially from our largest holding. Therefore, we will sell our entire position, which is worth $3,134.24 with retained distributions.

We will use $793 of that to buy an additional 25 units of XBB. This will bring our total position to 60.

The rest will be invested in the iShares Canadian Short Term Bond Index ETF (XSB-T). The units were priced at $28.41 at the time of writing so we will buy 80 of them at a cost of $2,272.80. The balance of $68.44 will be added to our general cash reserve.

We will also make a few other small changes.

PMO005 – We will buy 10 units for $139.80. This will bring our total to 100 and reduce the retained income to $15.28.

BCE – We will buy one share at $59.48, which will bring our total to 30 and reduce retained income to $95.71.

BIP.UN – We'll add one share at $52.73 to bring our position to 35. We will be left with cash of $69.86.

Cash – We will move our cash position of $549.61 to an on-line savings account with EQ Bank that currently pays 2.25 per cent.

Here is the revised portfolio. I will revisit it in September on its fifth anniversary.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters. Follow him on twitter @GPUpdates and on Facebook.